As a tax software product manager or developer,

your tax software application

can greatly simplify and streamline

the tax prep experience

of

investors and traders

by integrating

the features and services of

Form8949.com with your software

There are 4 options for integration

1. One Step "Intelligent Form 8949 Statement" Import

2. One Step Application Program Interface (API)

3. User Referral

4. One Step QR Code

One Step "Intelligent Form 8949 Statement" Import

At Form8949.com, we are implementing Intelligent Tax Document™ technology, a technology that can make tax prep...

The "What"

Users take the Form 8949 Statement generated by our app and, in ONE STEP, import into your tax software.

Your tax software:

- Accepts the PDF for attachment to the return AND

- Reads and imports the summary total amounts to be shown on Form 8949

No data entry tedium

No data entry confusion

No OCR errors

No rounding issues

One step and done

The "How"

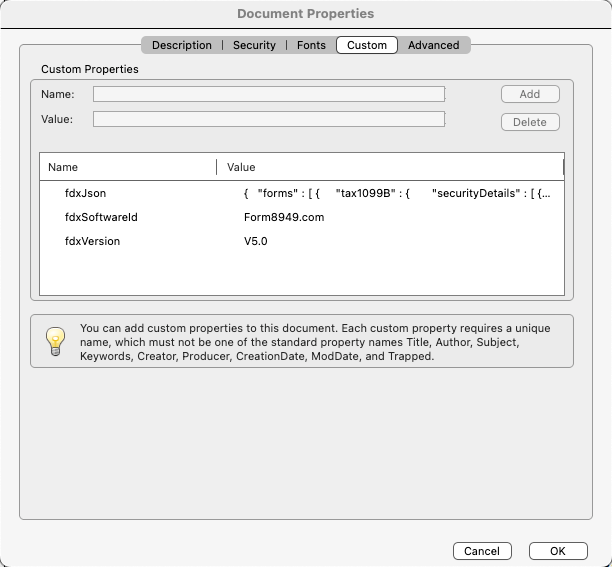

The Form 8949 Statement PDF file includes the total amounts reportable on Form 8949 in the PDF internal document properties.

For complete implementation information, see How to Import Intelligent Form 8949 Statements into Tax Software.

One Step API

- Users of your software upload their broker 1099-B data file for processing

- See the list of broker 1099-B files that we can process.

- Behind the scenes your software submits the data to our API server for parsing

- Our server returns the parsed data in industry-standard format (FDX JSON) for import into Form 8949

- SECURE: Our API server processes broker data files in memory. The uploaded broker file is read into memory, processed, and the resulting FDX JSON is returned to your program. After the response is returned, memory is cleared. We never see the data.

- DOCKER ALTERNATIVE: If sending user data to an outside API is out of the question, the same functionality can be made available in a Docker image for deployment on your server(s).

- API BILLING: After agreeing to a per-file processing fee, you deposit an amount to cover processing for an agreed-upon number of files. When the deposit is exhausted, an invoice for a new deposit is issued.

To discuss, get API documentation (Swagger) and an API key, contact us at integration@form8949.com.

User Referral

- We refer Form8949.com users to your tax software application.

- You work with us to educate users about how to import and/or input Form 8949 information into your tax software application.

- We publish this information on our website including links referring to your website.

The information we currently have is linked below. If your tax software is not listed or, if the information we have is incomplete, please contact us at support@form8949.com

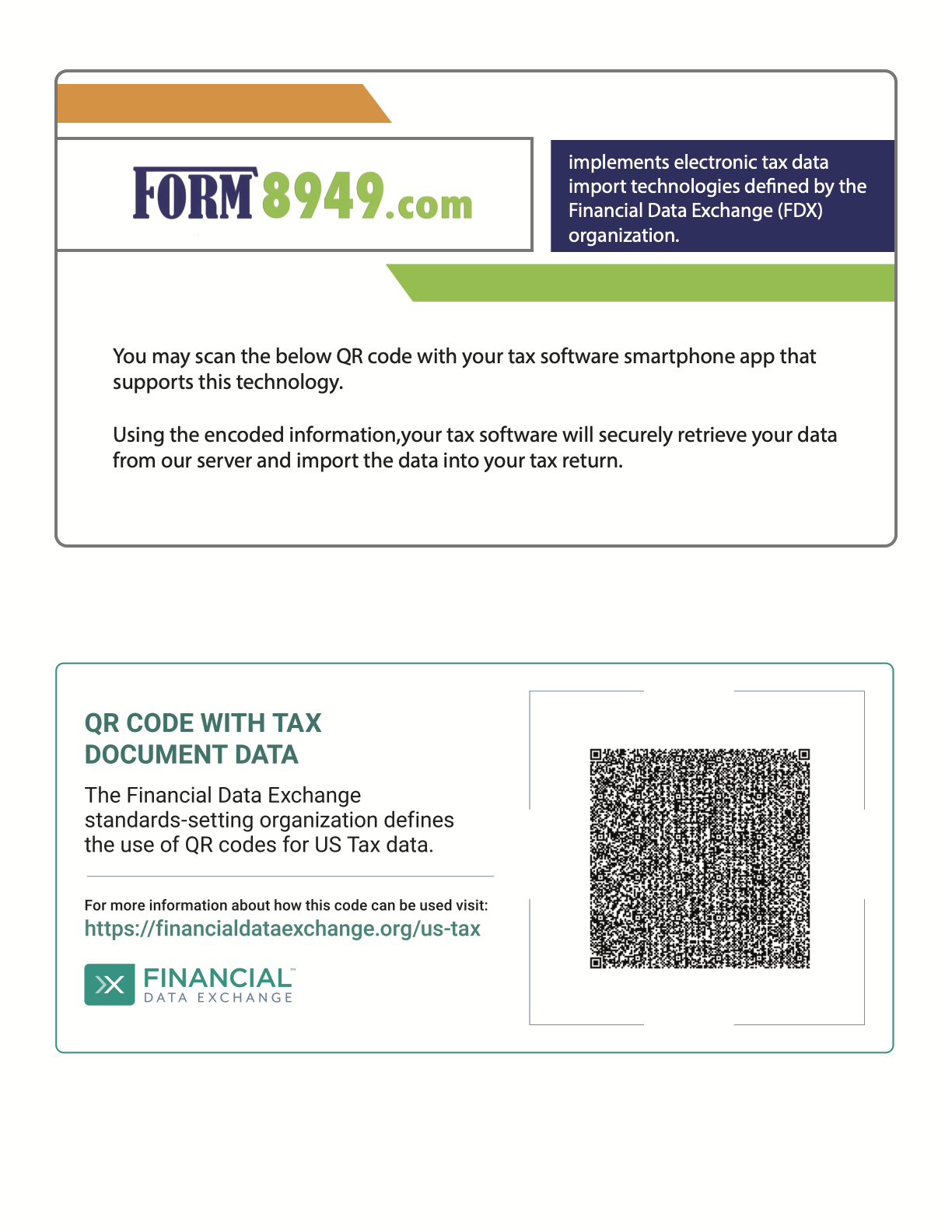

One Step Tax Software Integration via QR Code

Snap a QR code. That's all!

- Users sign in to the smartphone app sponsored by your company and scan the QR code generated by our app as seen below.

- Using the information encoded in the QR code, your software retrieves Form 8949 data from our server and imports it into the users tax return.

The QR Code

The Encoded Data

The QR code contains encoded data that looks like this:

{

"tax1099B": {

"taxFormId": "714870003",

"taxFormType": "Tax1099B",

"attributes": [

{

"name": "BasicAuthPart1",

"value": "714870003"

},

{

"name": "BasicAuthPart2",

"value": "123456"

}

],

"links": [

{

"href": "https://${API_DOMAIN_FORM8949DOTCOM}/form-8949-data",

"action": "GET",

"rel": "Form8949Data",

"types": [

"application/json"

]

},

{

"href": "https://${API_DOMAIN_FORM8949DOTCOM}/form-8949-exception-2-statement",

"action": "GET",

"rel": "Form8949Exception2Statement",

"types": [

"application/pdf"

]

}

],

"securityDetails": [

{

"checkboxOnForm8949": "A",

"saleDescription": "See statement attached to Form 1040 or Form 8453",

"variousDatesAcquired": true,

"dateOfSale": "2022-12-31",

"salesPrice": 331399.32,

"adjustmentCodes": [

{

"code": "M"

}

],

"costBasis": 255774.38,

"washSaleLossDisallowed": 17668.1

},

{

"checkboxOnForm8949": "B",

"saleDescription": "See statement attached to Form 1040 or Form 8453",

"variousDatesAcquired": true,

"dateOfSale": "2022-12-31",

"salesPrice": 64568.23,

"adjustmentCodes": [

{

"code": "M"

}

],

"costBasis": 63109.93

},

{

"checkboxOnForm8949": "D",

"saleDescription": "See statement attached to Form 1040 or Form 8453",

"variousDatesAcquired": true,

"dateOfSale": "2022-12-31",

"salesPrice": 4750.21,

"adjustmentCodes": [

{

"code": "M"

}

],

"costBasis": 15786.21

}

]

},

"version": "V5.0",

"softwareId": "Form8949.com"

}

QR Code Content Explanation

The code contains:

- Summary transaction data. See "securityDetails".

- Import codes. See "attributes".

-

Import links.

See "links".

- The first link is to import detail data.

- The second link is to import a PDF to be attached to the return.

Your Software and Our Server

For tax year 2023 our company, Internet Tax Information Processing Services, Inc (ITIPS), will be operating servers using both Open Financial Exchange (OFX) and Financial Data Exchange (FDX) FDX API technologies.

For more information, see www.taxdochub.com/apis/for-tax-software.html