How to Use the Form 8949.com Web Application

Additional How to Use Information

What to do if your broker PDF data file has over 1,000 pages

What to do when your broker 1099-B has incomplete information

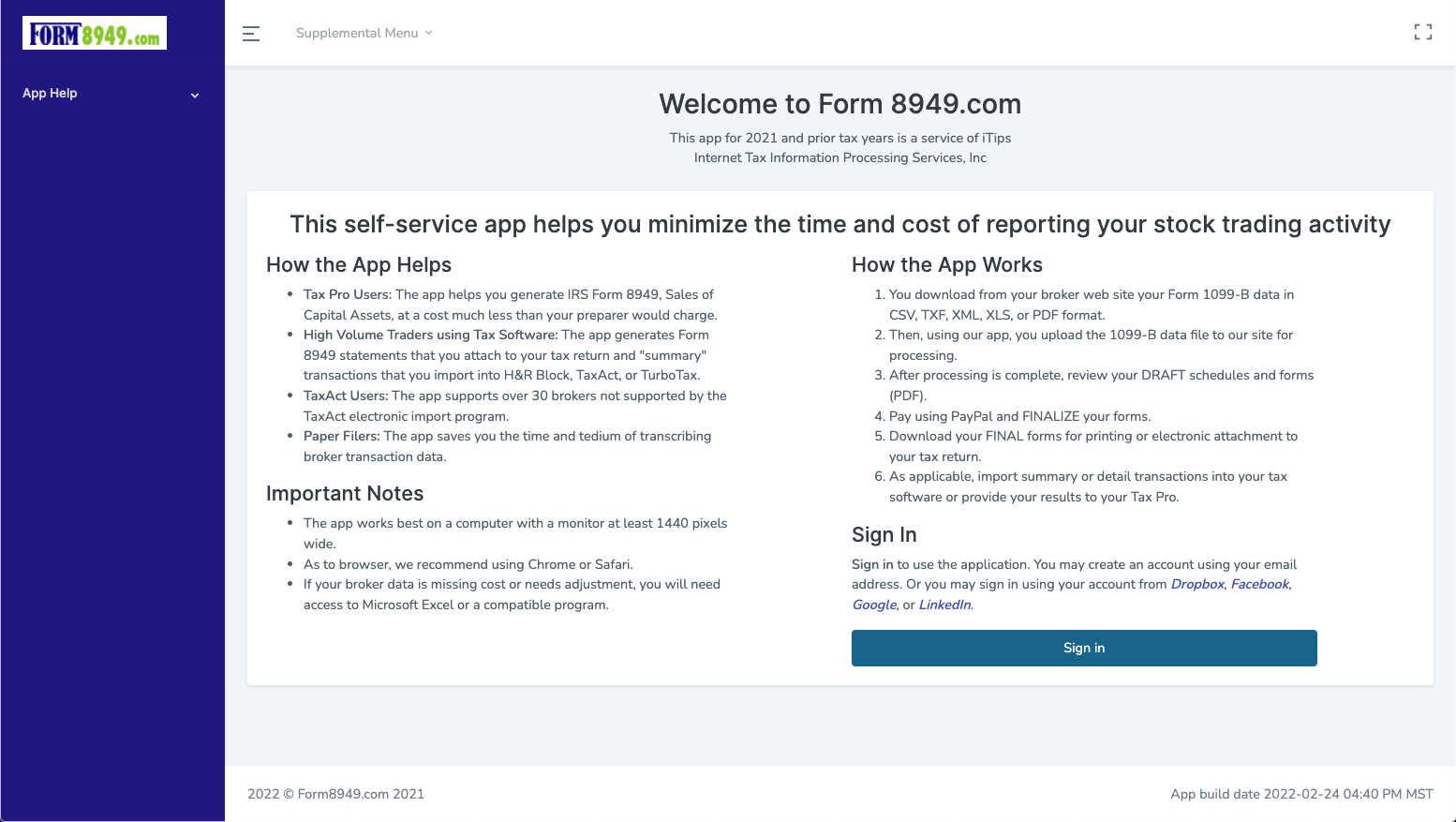

1. At the Welcome Page, click the 'Sign in' button

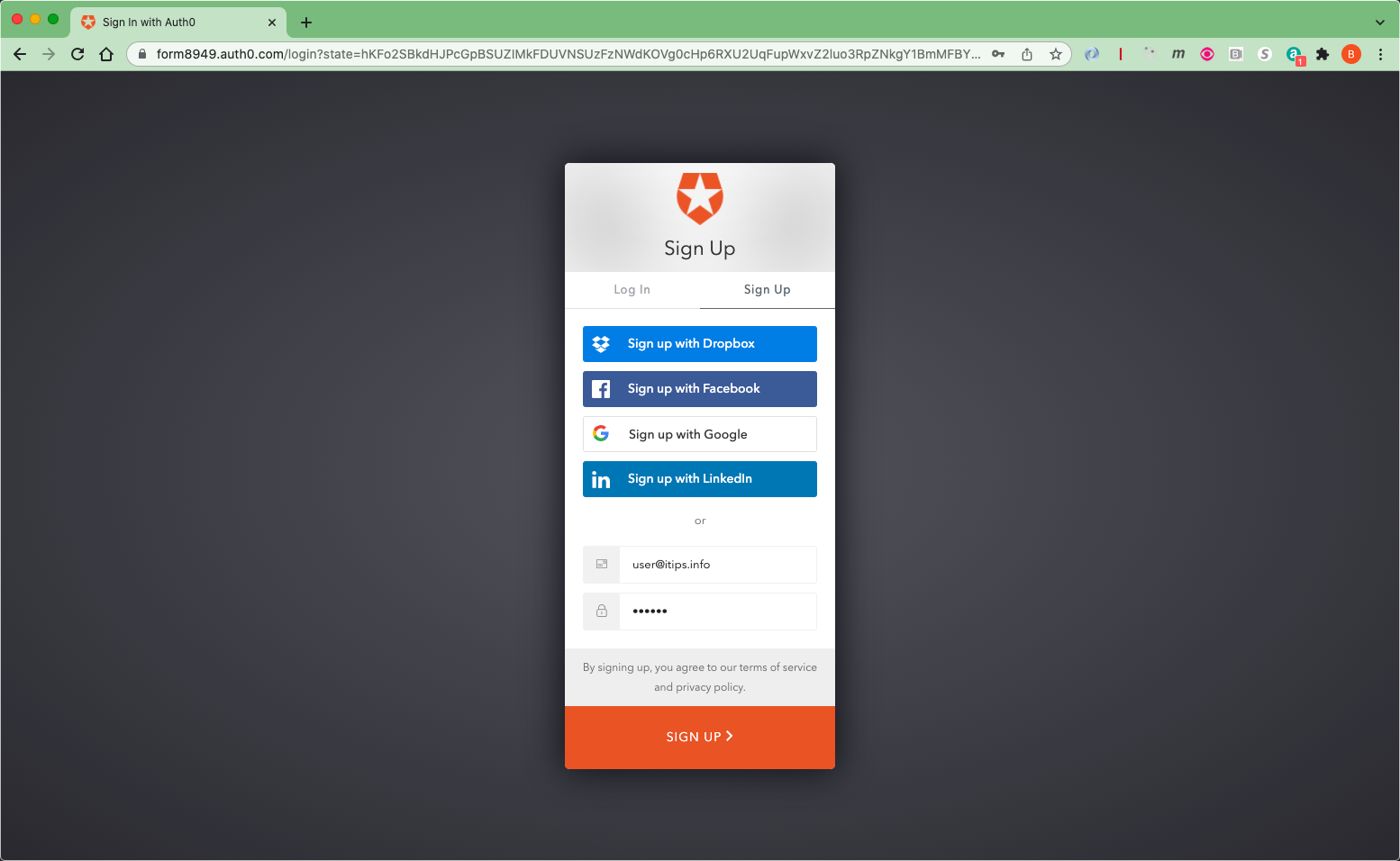

2. You may sign in using your account from DropBox, Facebook, Google, or LinkedIn.

Alternatively, you may create an account by entering your email and choosing a password.

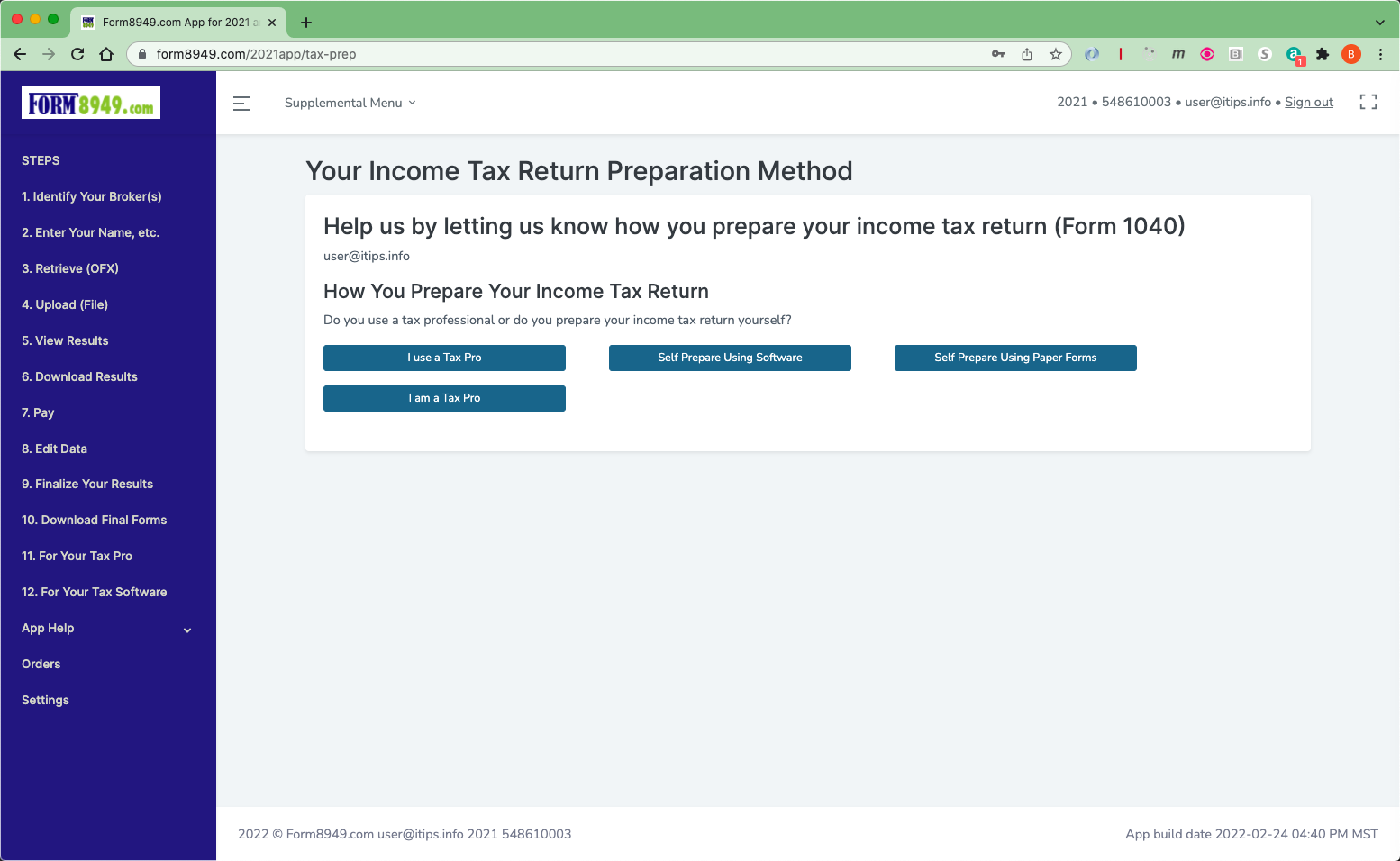

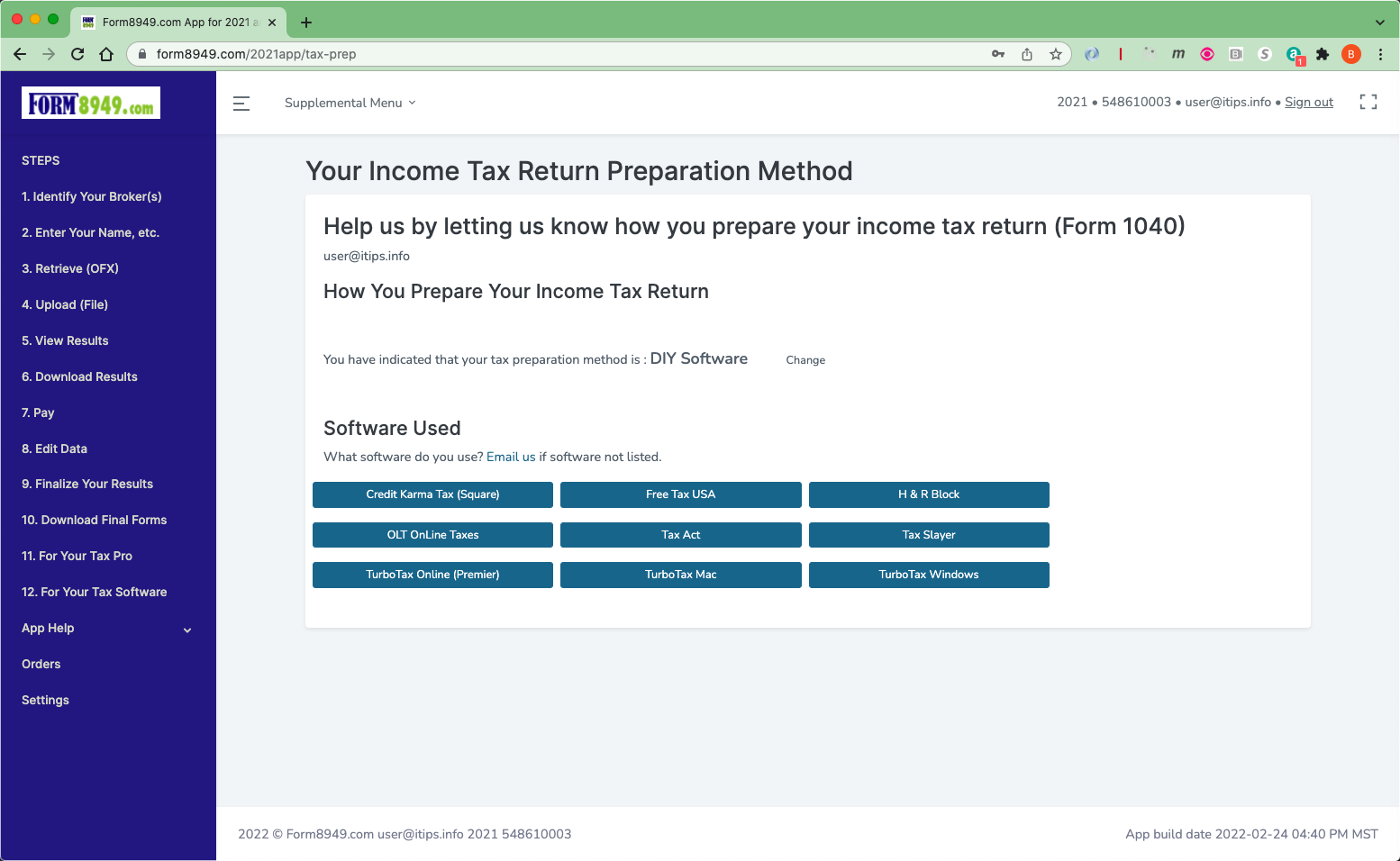

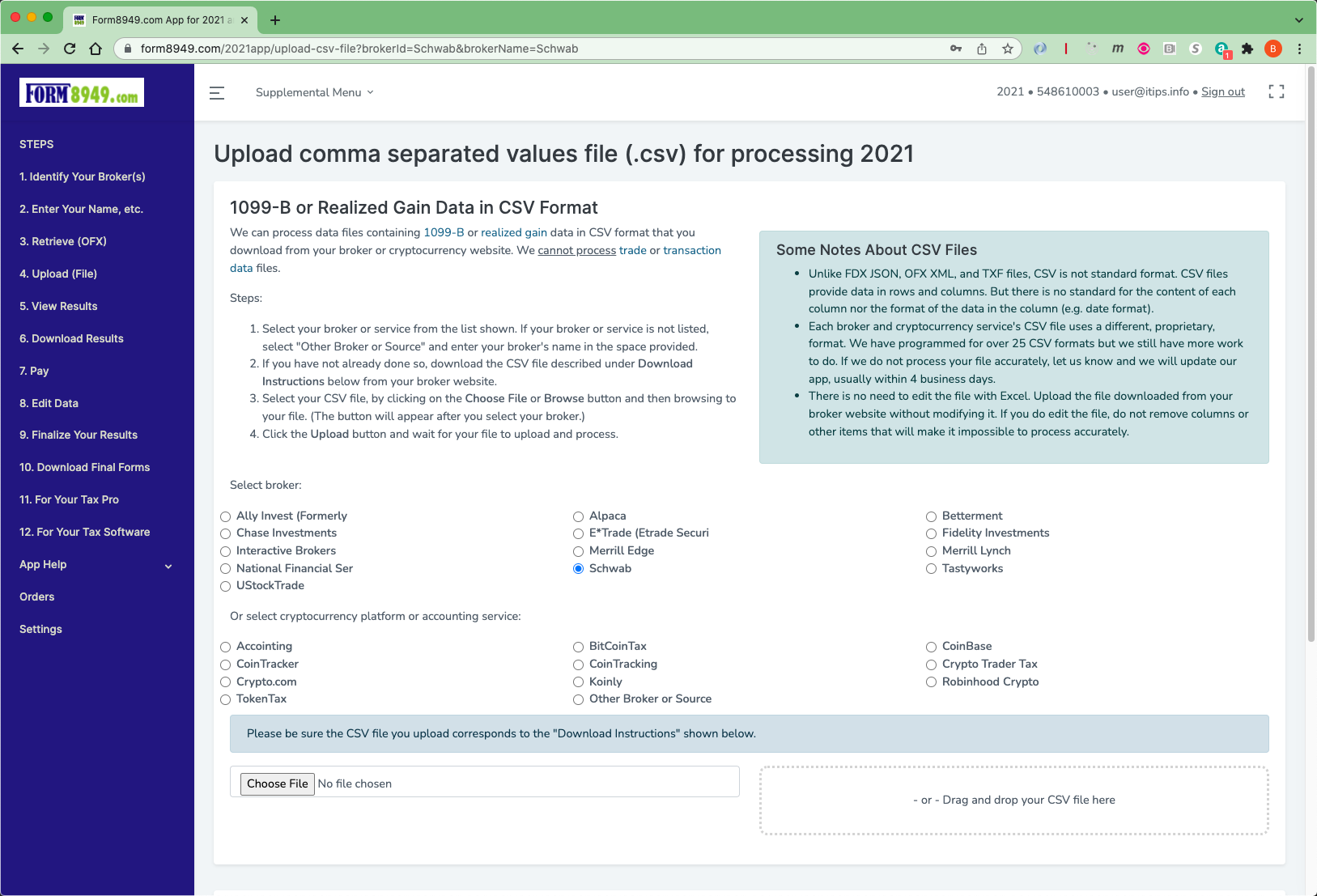

3. You click the button corresponding to your method of income tax return preparation.

4. You click the button corresponding to your tax software used, if applicable.

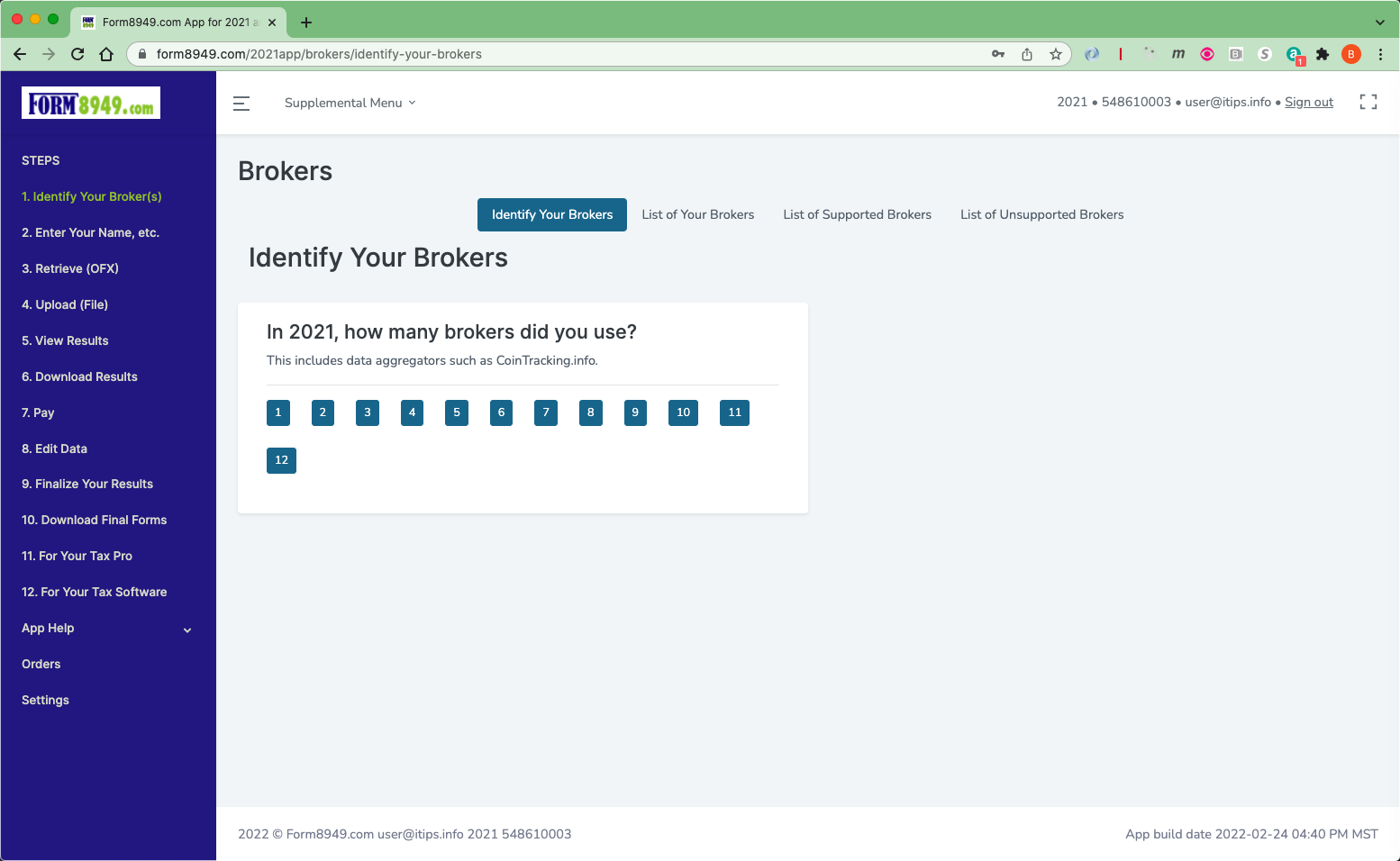

5. Click the button for the number of broker or cryptocurrency service accounts you had for the tax year. For example, if you had 2 accounts at Fidelity and 1 at Schwab you would select 3.

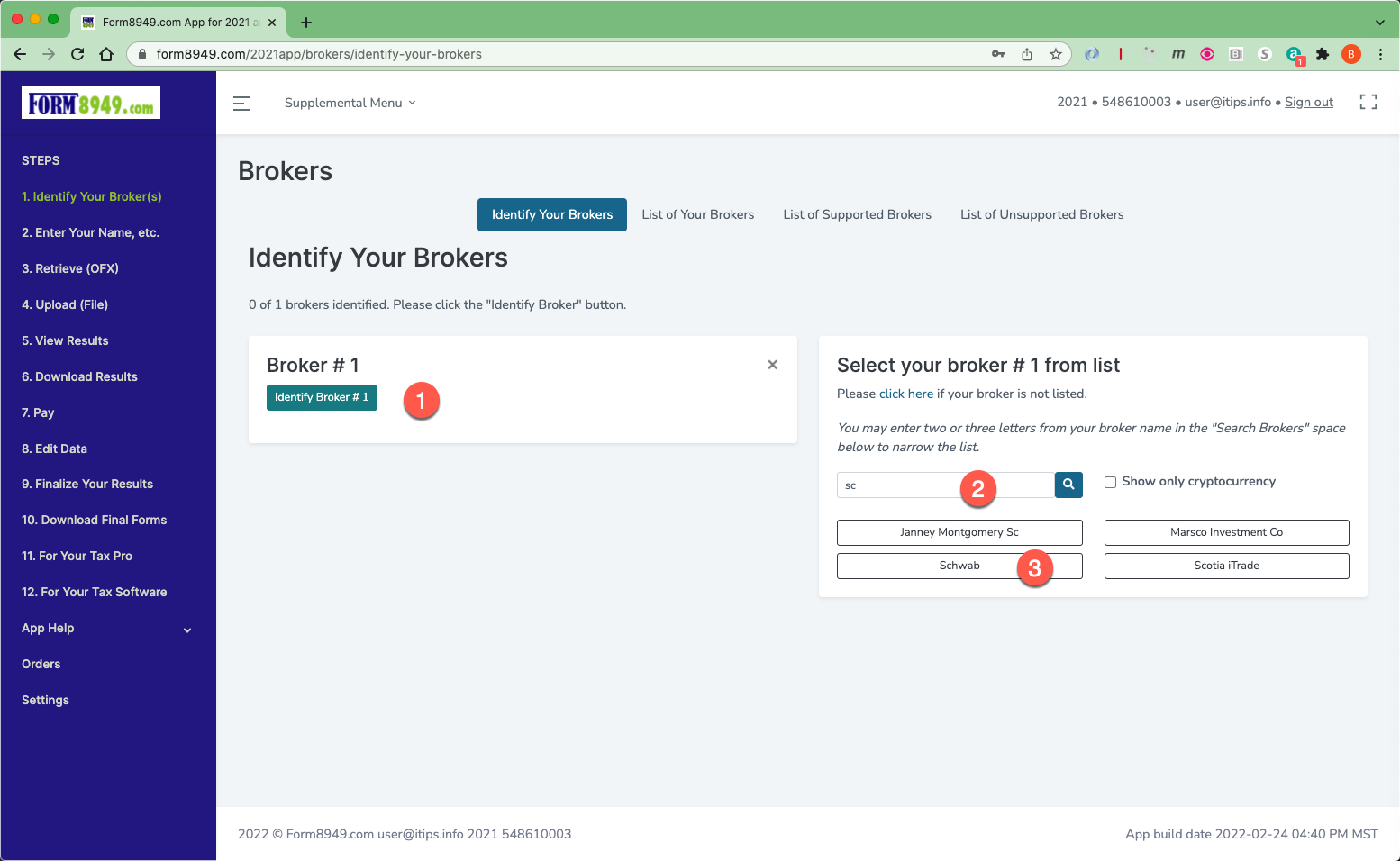

6. For each of your accounts

(1) click the 'Identify Broker' button,

(2) type 2 or 3 letters from the broker name, and

(3) click the button for your broker.

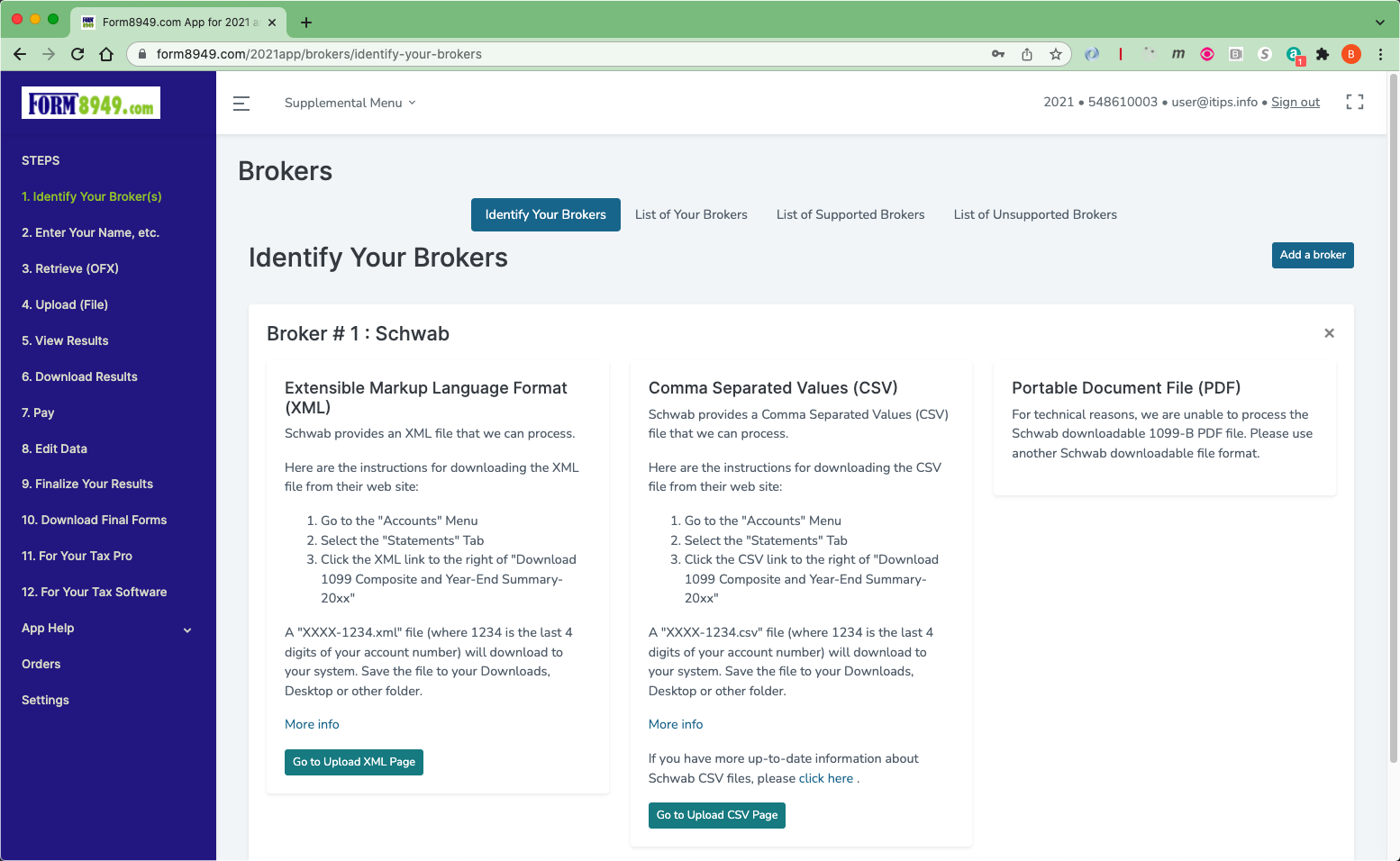

7. The app will present you with the information we know about the data files downloadable from your broker website.

If the information we have is not up-to-date, please email us the updated information.

Download the data file from the broker website.

Then click the applicable 'Go to Upload Page' button.

8. Click the Choose File button ('Browse to File' on some browsers) and

browse to and select your downloaded broker data file.

Then click the 'Upload' button that appears.

Alternatively, drag and drop the file to the drop zone on the right side of the screen.

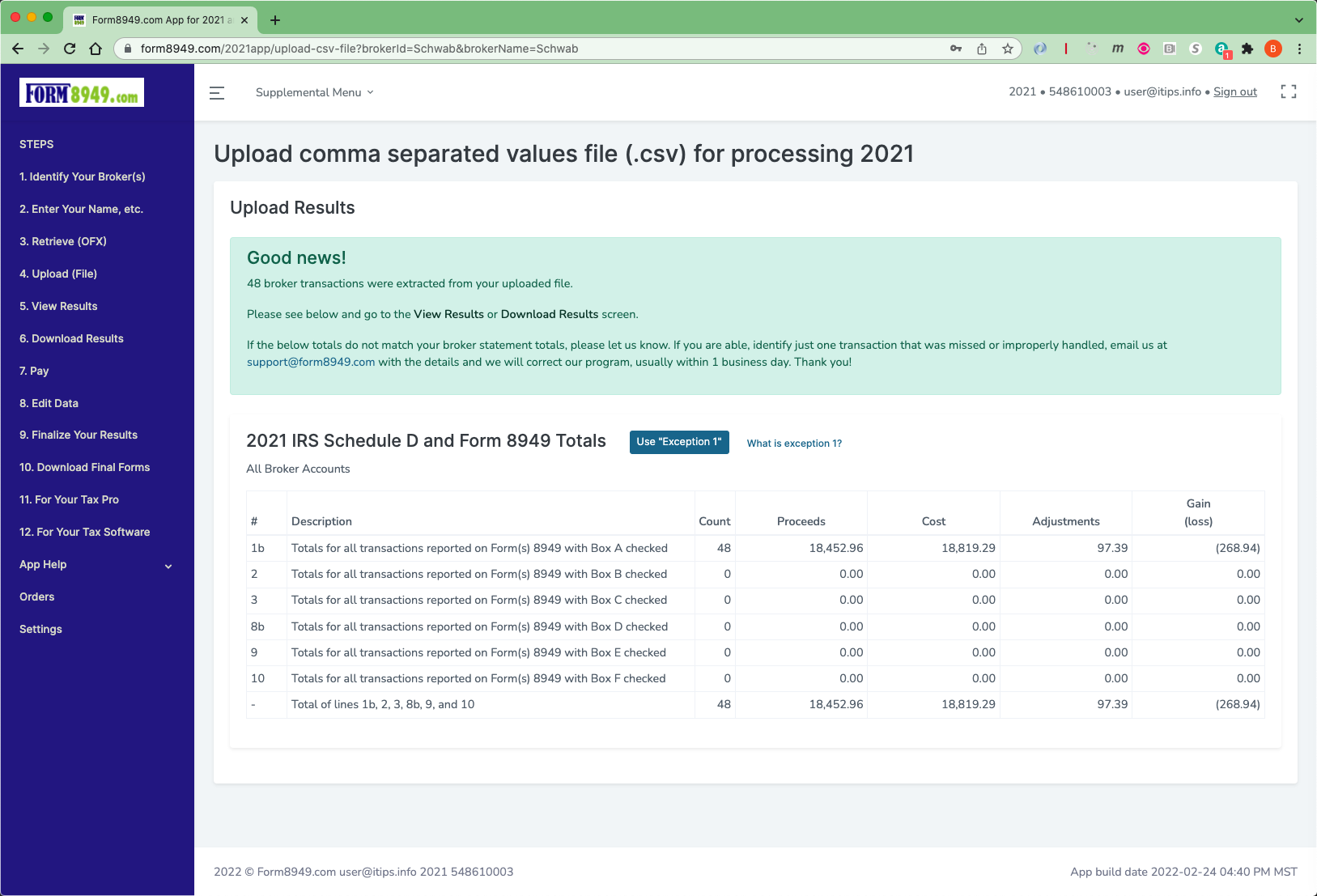

9. The app will present you with a summary of the data extracted from your broker file.

If there are any discrepancies, identify one transaction not properly handled and we will update our app, usually within 1 business day.

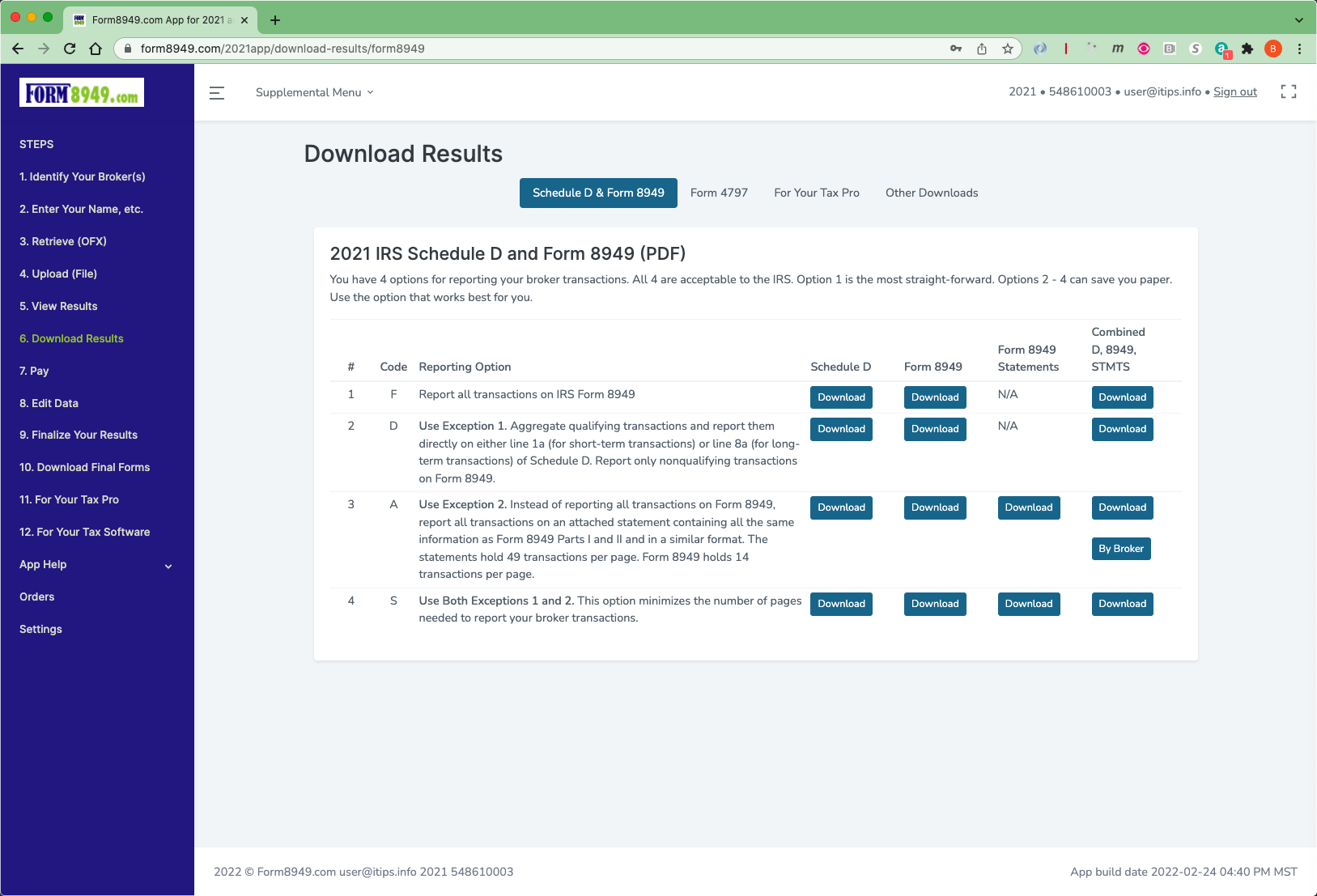

10. Go to the Download Results page and download a 'Draft' copy of your forms, using the reporting option you prefer.

11. Once you review your results:

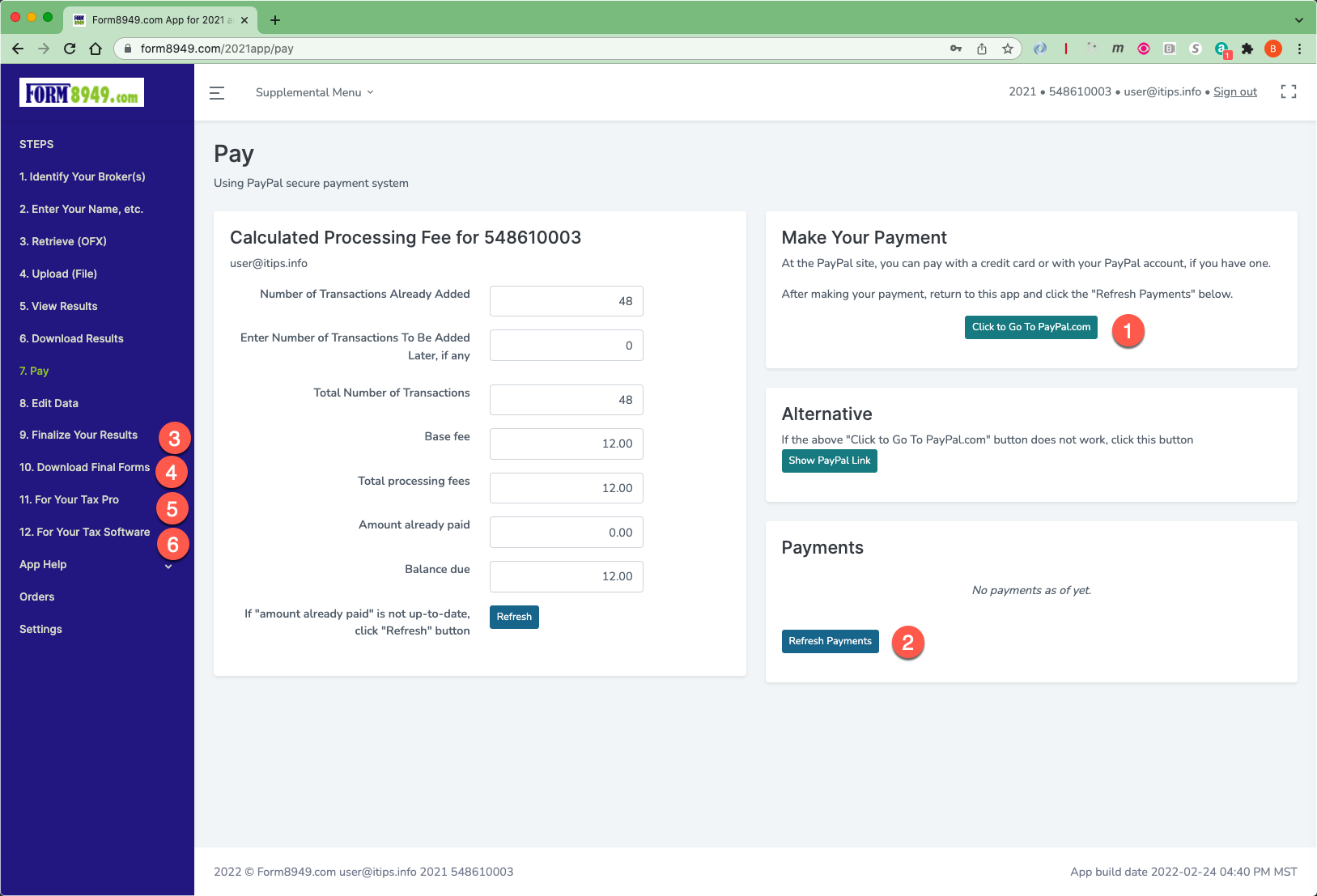

- Go to the 'Pay' screen and click the 'Go To PayPal.com' button. At PayPal, pay with your credit card or PayPal account if you have one.

- Once paid, click the 'Refresh' Payments button.

- Go to the Finalize screen to 'Finalize' your forms

- Then, go to the 'Download Final Forms' screen to download your final forms (with no watermark).

- If you use a tax professional, go to the 'For Your Tax Pro' screen to trigger an email for your Tax Pro

- If you use tax software, go to the 'For Your Tax Software' screen for import and statement attachment (if applicable) instructions.