Form 8949 Statements

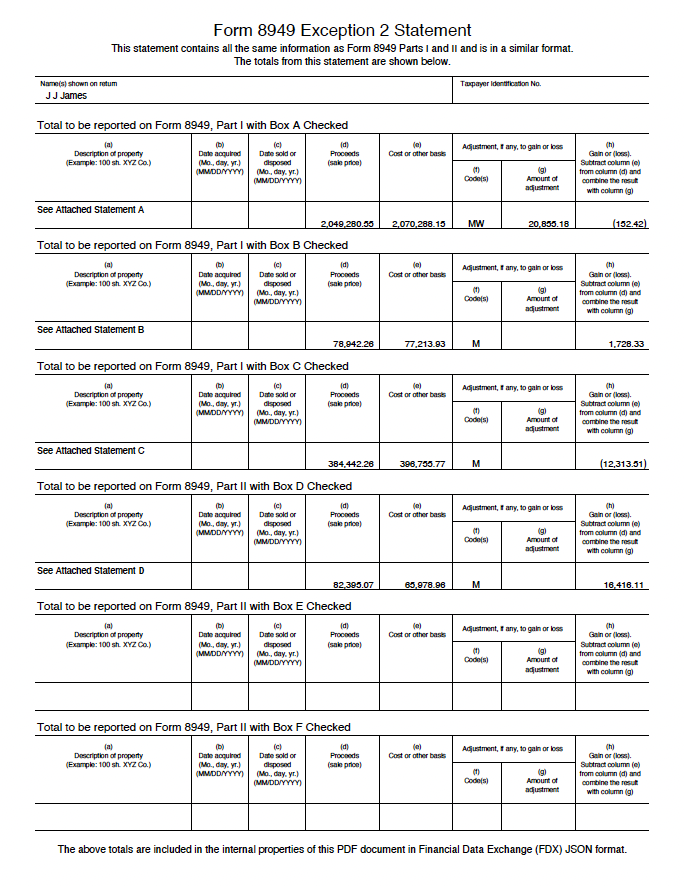

Also known as Form 8949 Exception 2 Statements

Form 8949 Statements are statements prepared outside your tax software.

They are uploaded to your tax software for attachment to your income tax return.

See the excerpts from IRS instructions and information shown below.

Below are excerpts from the IRS Instructions for Form 8949 (emphasis and bullets added).

There are exceptions to the rule that you must report each of your transactions on a separate row of Part I or Part II. Any taxpayer who qualifies can use Exception 1 or Exception 2.

Exception 2.

Instead of reporting each of your transactions on a separate row of Part I or II, you can report them on an attached statement containing all the same information as Parts I and II and in a similar format.

The IRS instructions explain further:

Instead of reporting each of your transactions on a separate row of Part I or II, you can report them on an attached statement containing all the same information as Parts I and II and in a similar format, that is

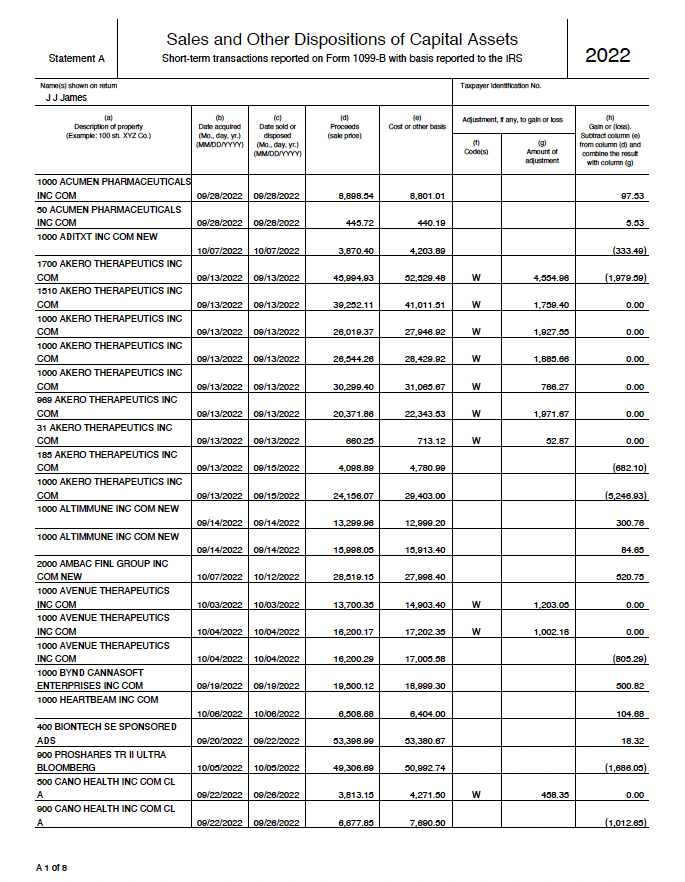

- description of property

- dates of acquisition and disposition

- proceeds

- basis

- adjustment

- code(s)

- gain or (loss)

Use as many attached statements as you need.

- Enter the combined totals from all your attached statements on Parts I and II with the appropriate box checked.

- For example, report on Part I with box B checked all short-term gains and losses from transactions your broker reported to you on a statement showing basis wasn't reported to the IRS.

- Enter the name of the broker followed by the words "see attached statement" in column (a).

- Leave columns (b) and (c) blank.

- Enter "M" in column (f).

- If other codes also apply, enter all of them in column (f).

- Enter the totals that apply in columns (d), (e), (g), and (h).

- If you have statements from more than one broker, report the totals from each broker on a separate row.

Don't enter "Available upon request" and summary totals in lieu of reporting the details of each transaction on Part I or II or attached statements.

How the Form8949.com App Implements Form 8949 Exception 2

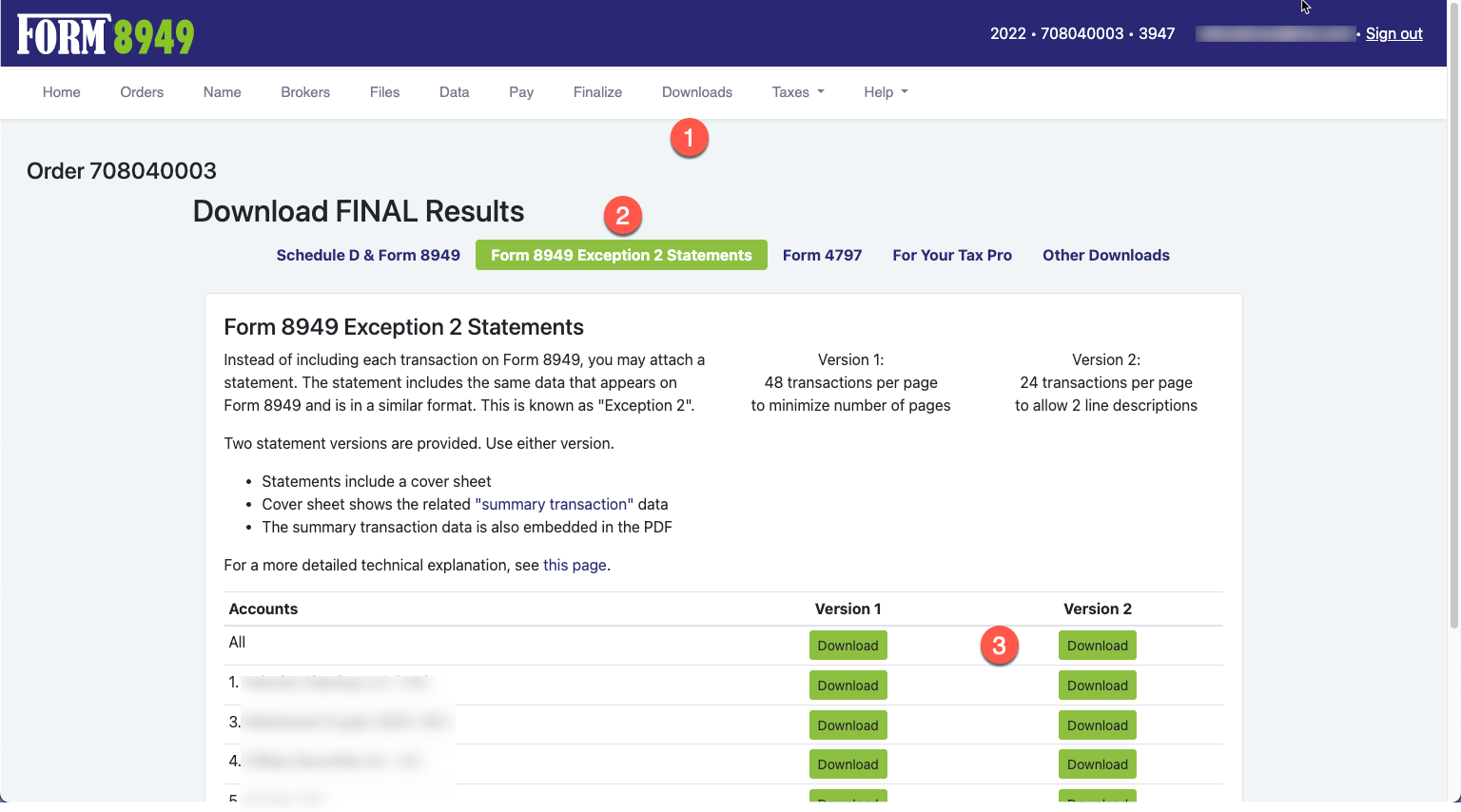

In the app:

- Go to the 'Downloads' screen.

- Select 'Form 8949 Exception 2 Statements'.

- Click the 'Download' button as seen below. Note: If you have more than one broker, you can download one statement of combined transactions or download one statement per broker. Both approaches are acceptable.

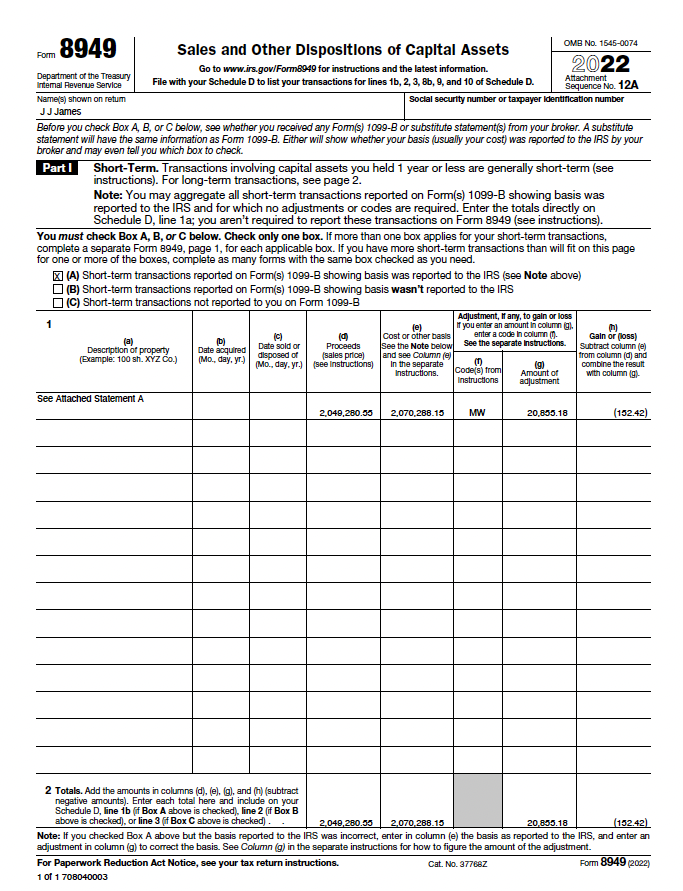

Form 8949

The Form 8949 does not show each transaction. It shows a line that references the attached statement.

Statement

Our statement contains all the same information as Form 8949 and is in a similar format. A cover page is included as seen below.