TaxAct Active Traders

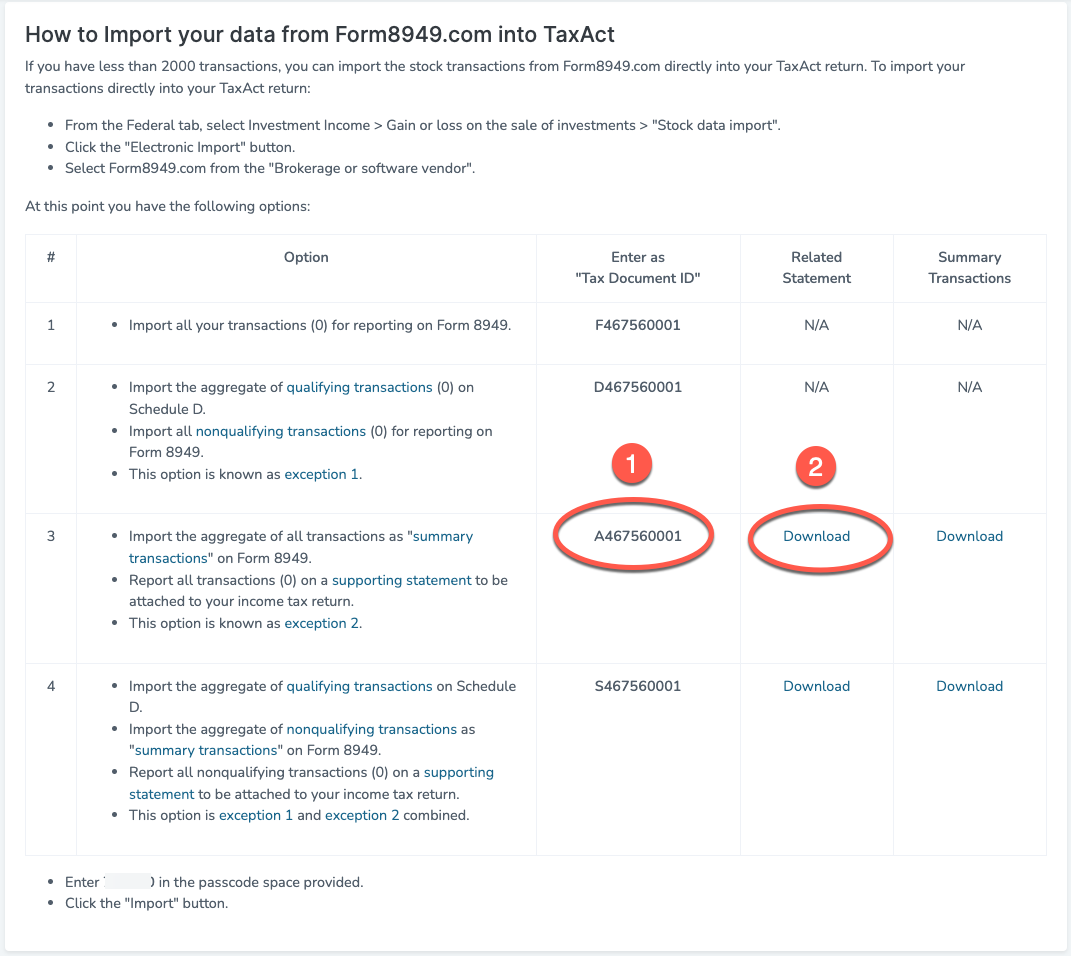

TaxAct has an import limit of 2,000 transactions. If you have more than 2,000 broker transactions, instead of importing your transactions, you can use the Form8949.com app to generate (1) "summary transactions" for import and (2) a PDF statement for attachment to your TaxAct-generated tax return.

In the Form8949.com app, you are provided with (1) import codes and instructions and (2) a link to download the PDF file.

You may either import or enter "summary totals" into the TaxAct program.

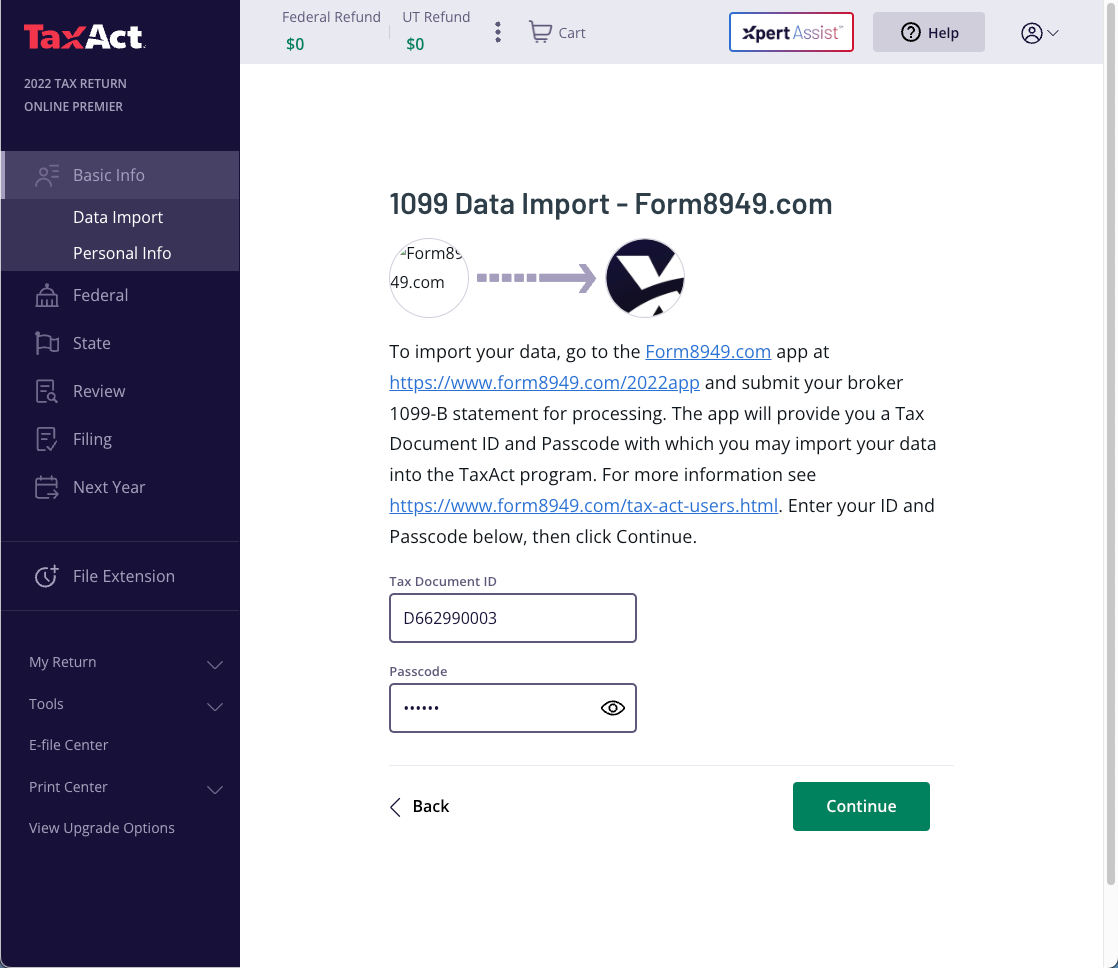

IMPORT SUMMARY TOTALS

In TaxAct, navigate to the import screen and enter the Tax Document ID and passcode provided by Form8949.com.

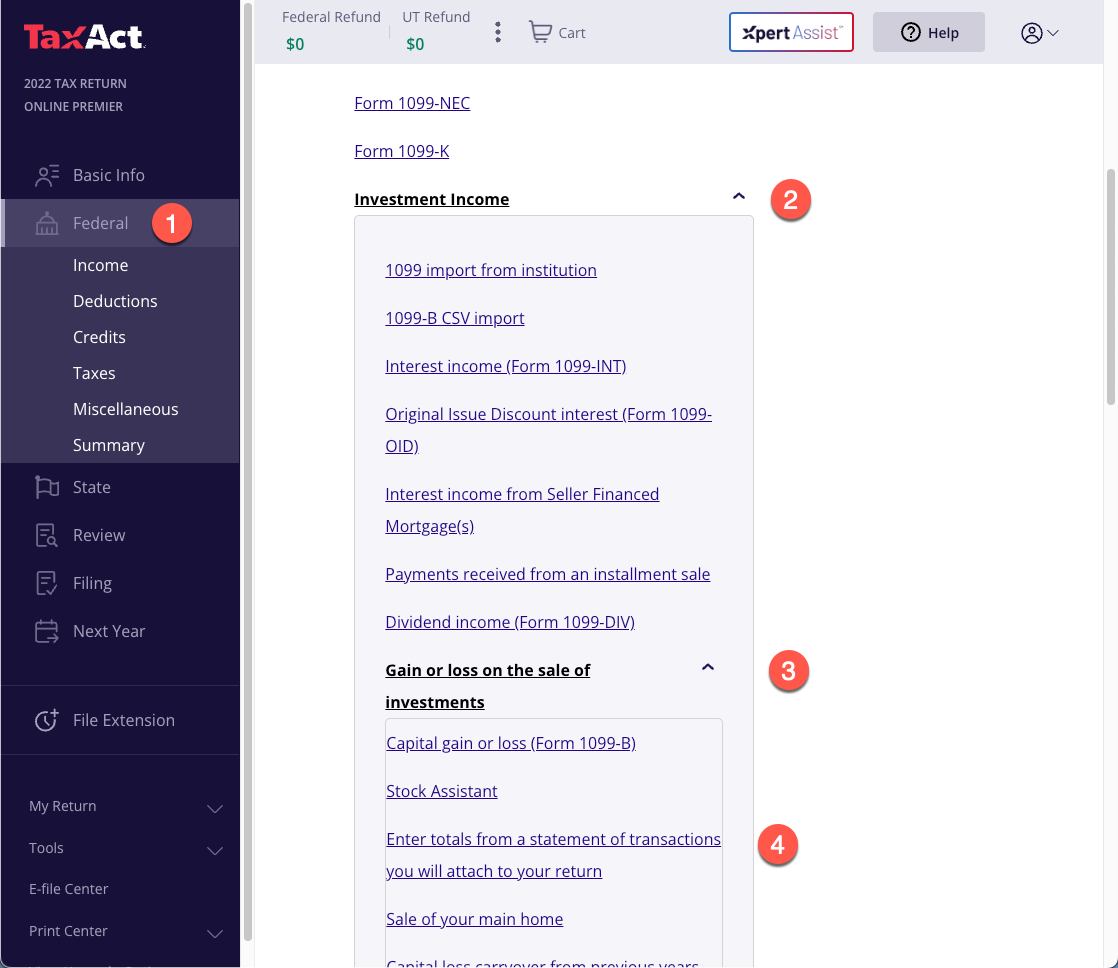

ENTER SUMMARY TOTALS INSTEAD OF IMPORT

1. Select Federal > Investment Income > Gain or loss on the sale of investments > "Enter totals from a statement of transactions you will attach to your return".

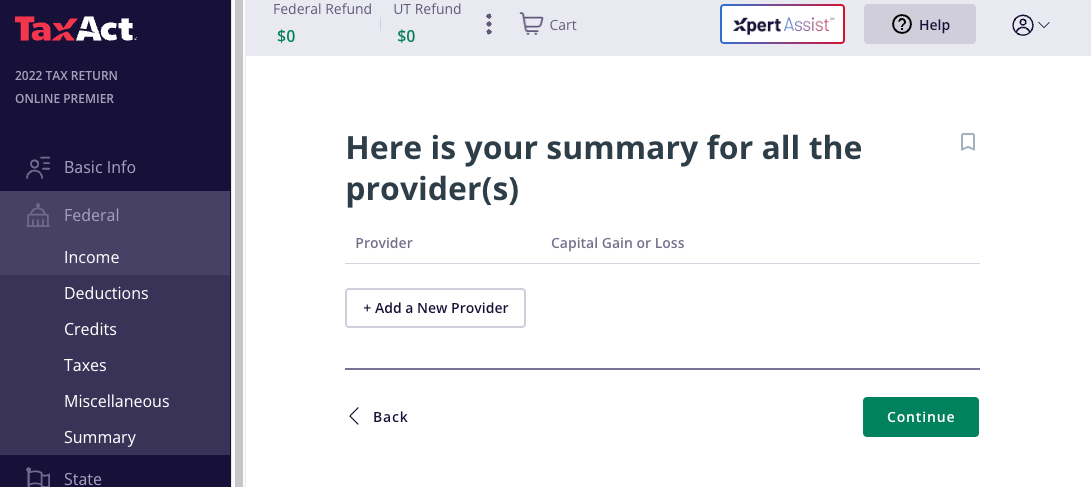

2. Click 'Add a New Provider'.

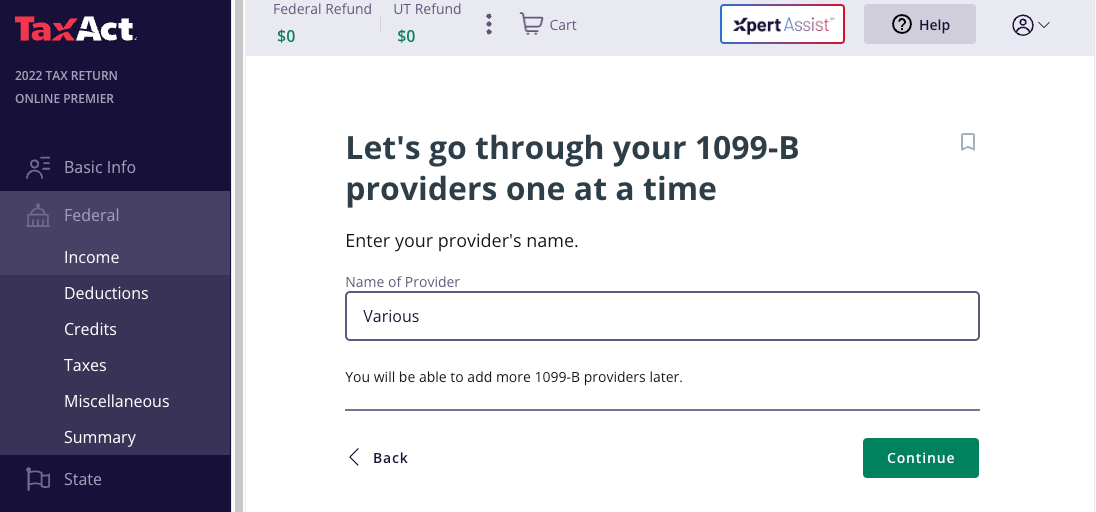

3. Enter a Broker name.

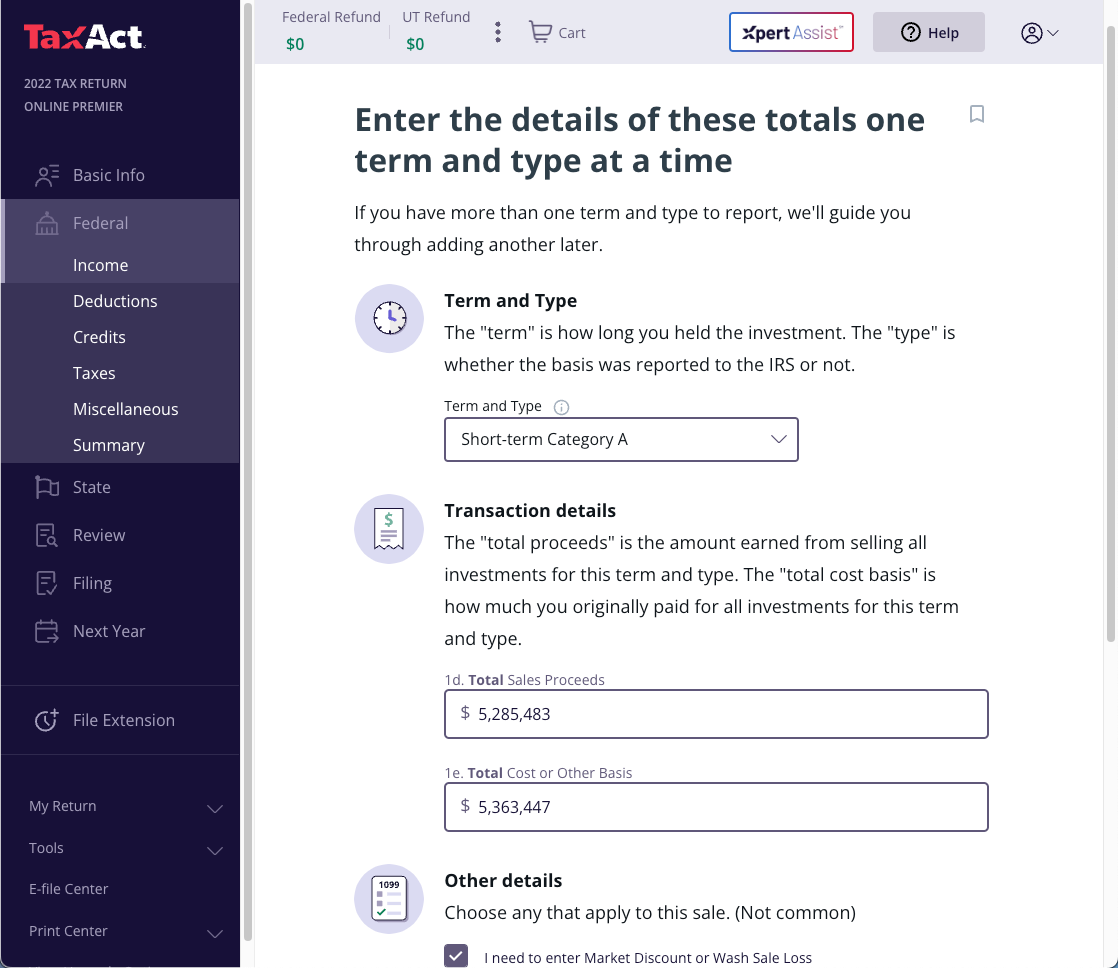

4. For each summary transaction, complete this screen.

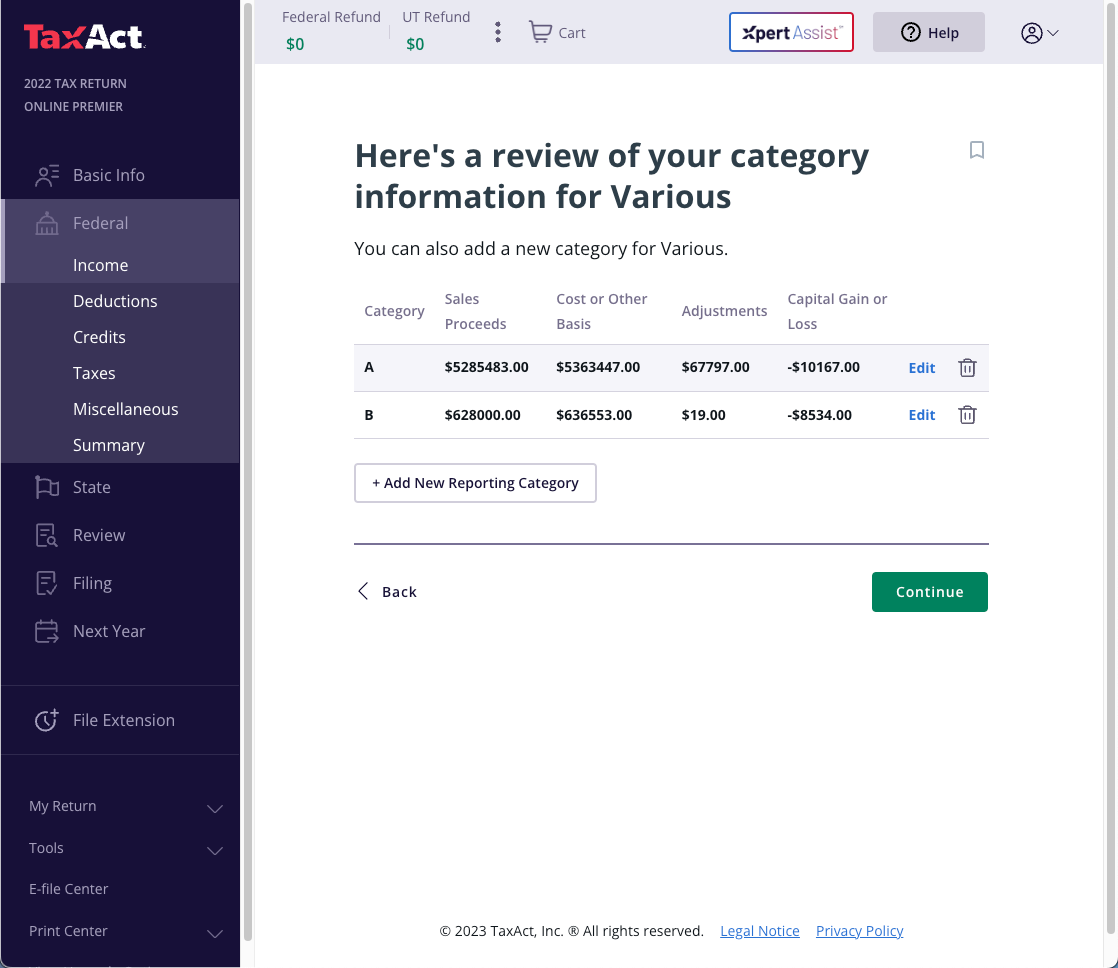

5. Once done, the totals by category will be shown.

6. You will attach your PDF statement during the e-file phase.

Important note:

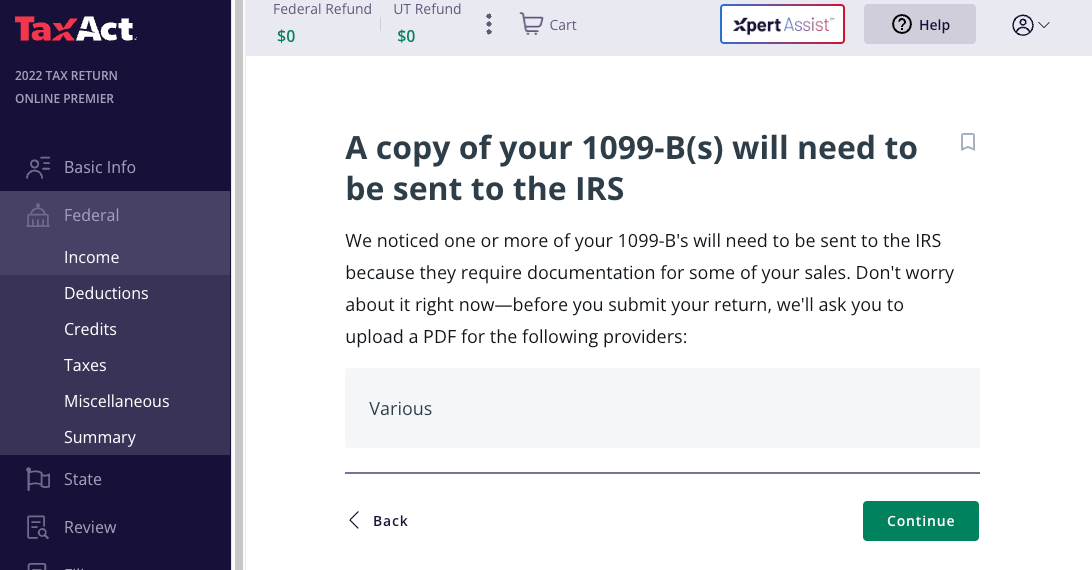

The software is saying the IRS requires a copy of your Form 1099-B under these circumstances.

But this is not an accurate statement.

In the relevant IRS instructions the IRS says:

Instead of reporting each of your transactions on a separate row of Part I or II, you can report them on an attached statement containing all the same information as Parts I and II and in a similar format (that is, description of property, dates of acquisition and disposition, proceeds, basis, adjustment and code(s), and gain or (loss)). Use as many attached statements as you need. Enter the combined totals from all your attached statements on Parts I and II with the appropriate box checked.

The statement we provide you conforms to the IRS requirements and should be uploaded for attachment to your return.

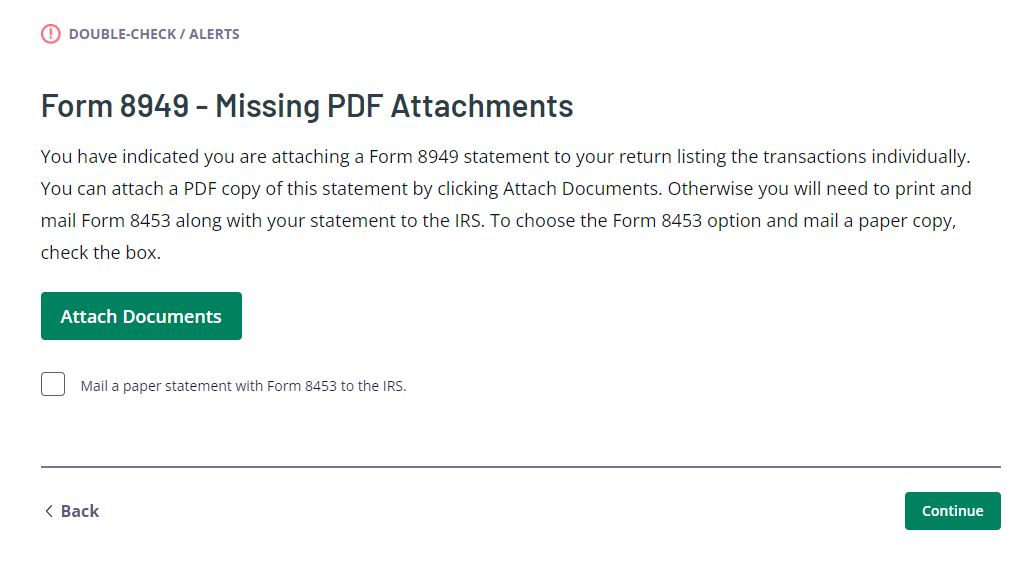

ATTACHING STATEMENT WHEN FILING ELECTRONICALLY

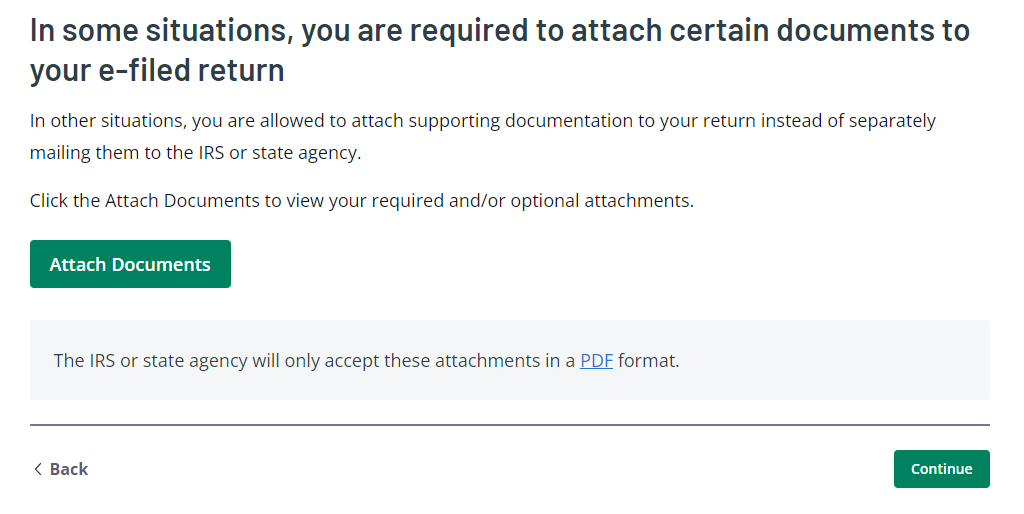

If filing electronically, you will have the option during the e-file steps to attach your Form 8949 statement as a PDF.

Click the 'Attach Documents' button.

Click the 'Attach Documents' button and follow the prompts to upload the Form 8949 Statement PDF.