FreeTaxUSA Integration

Website: https://www.freetaxusa.com

YouTube Channel: https://www.youtube.com/@freetaxusa

Users of Form8949.com who use FreeTaxUSA for tax prep have the following integration options:

- Enter Detail Transactions

- Enter Summary Transactions

- Import Detail Transactions

- Import Summary Transactions

- Attach Form 8949 Statement

Enter Detail Transactions

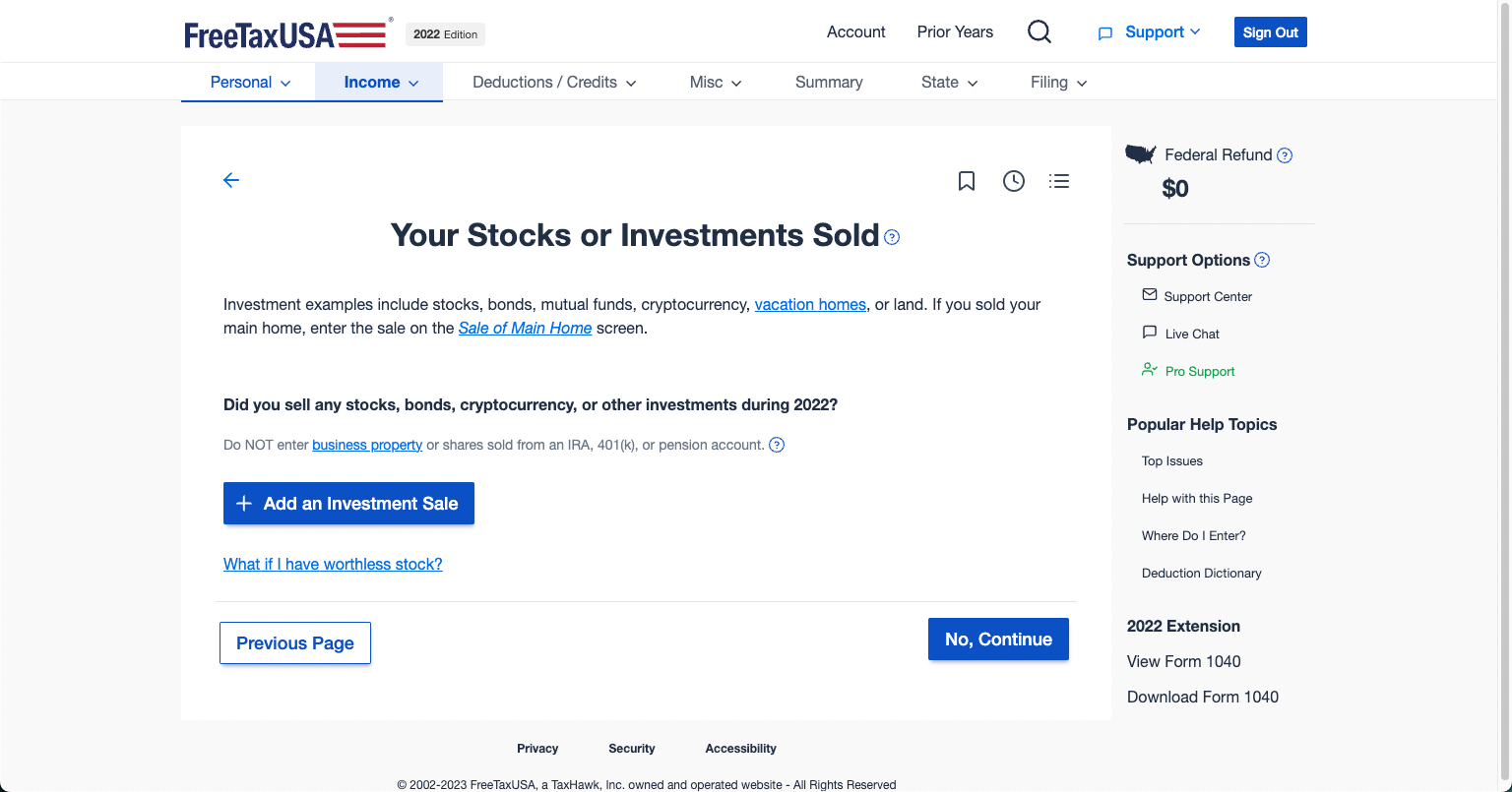

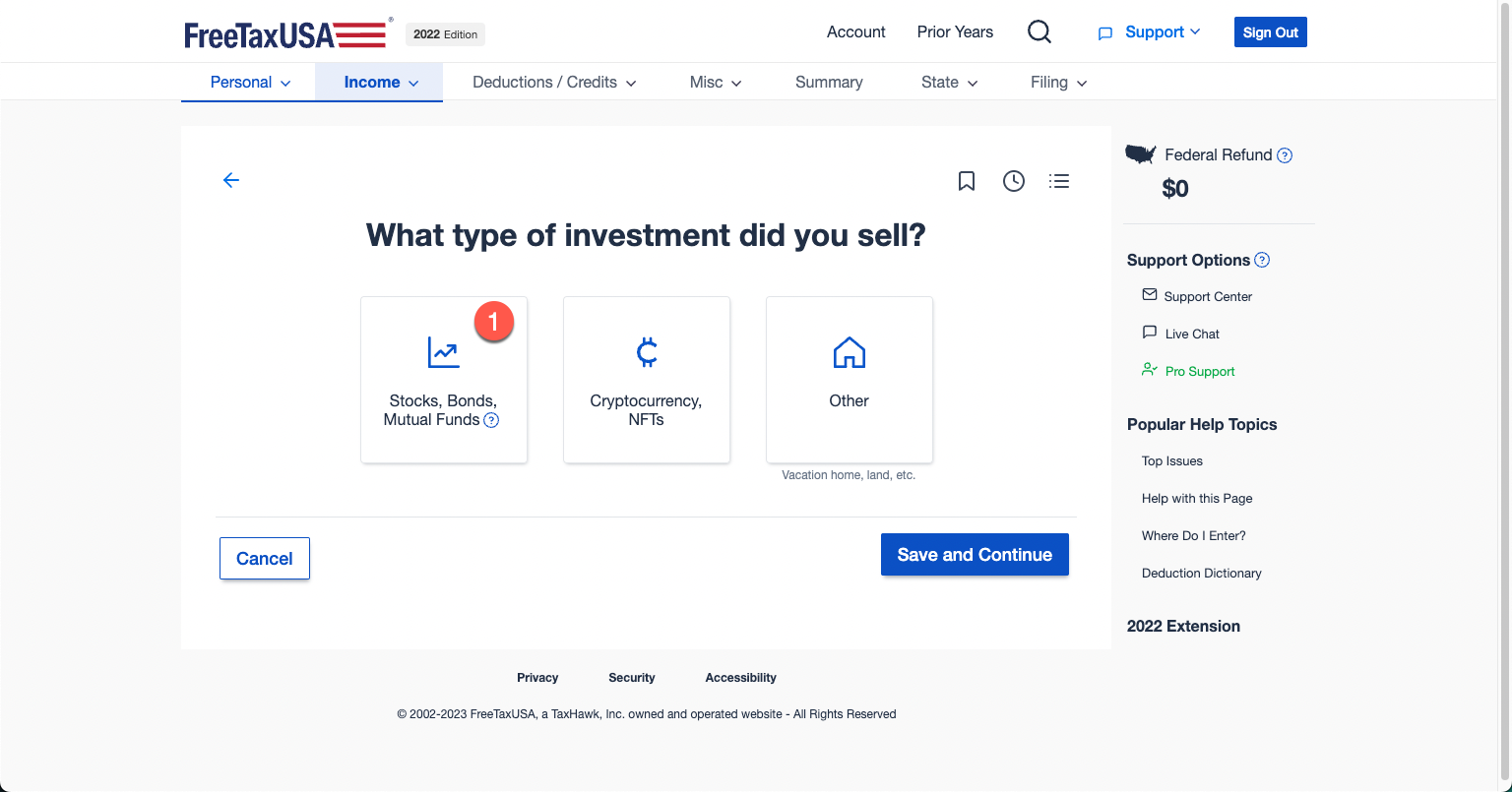

Go to the 'Income' > 'Your Stocks or Investments Sold' screen in the program.

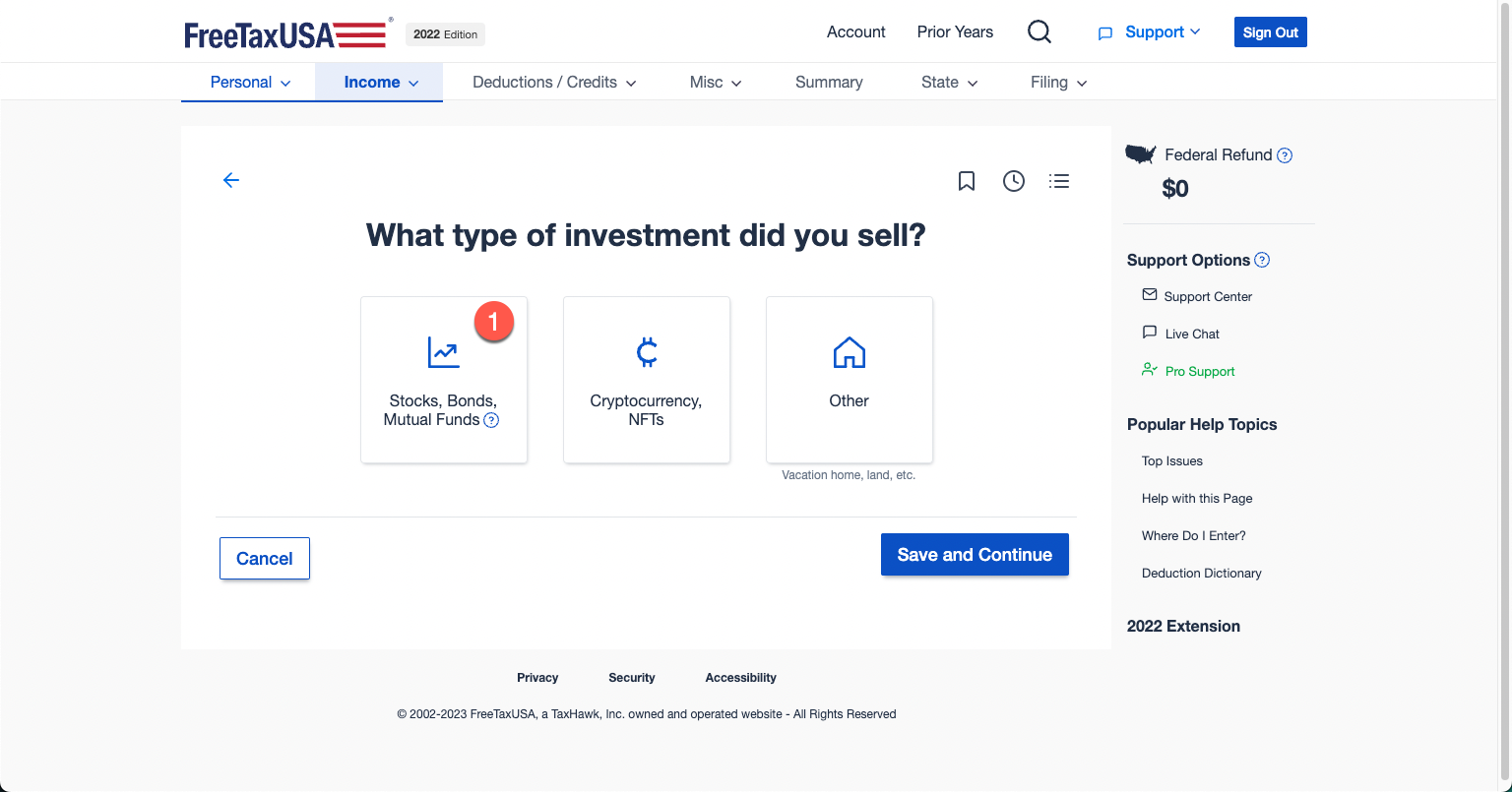

Select 'Stocks, Bonds, Mutual Funds', 'Save and Continue'.

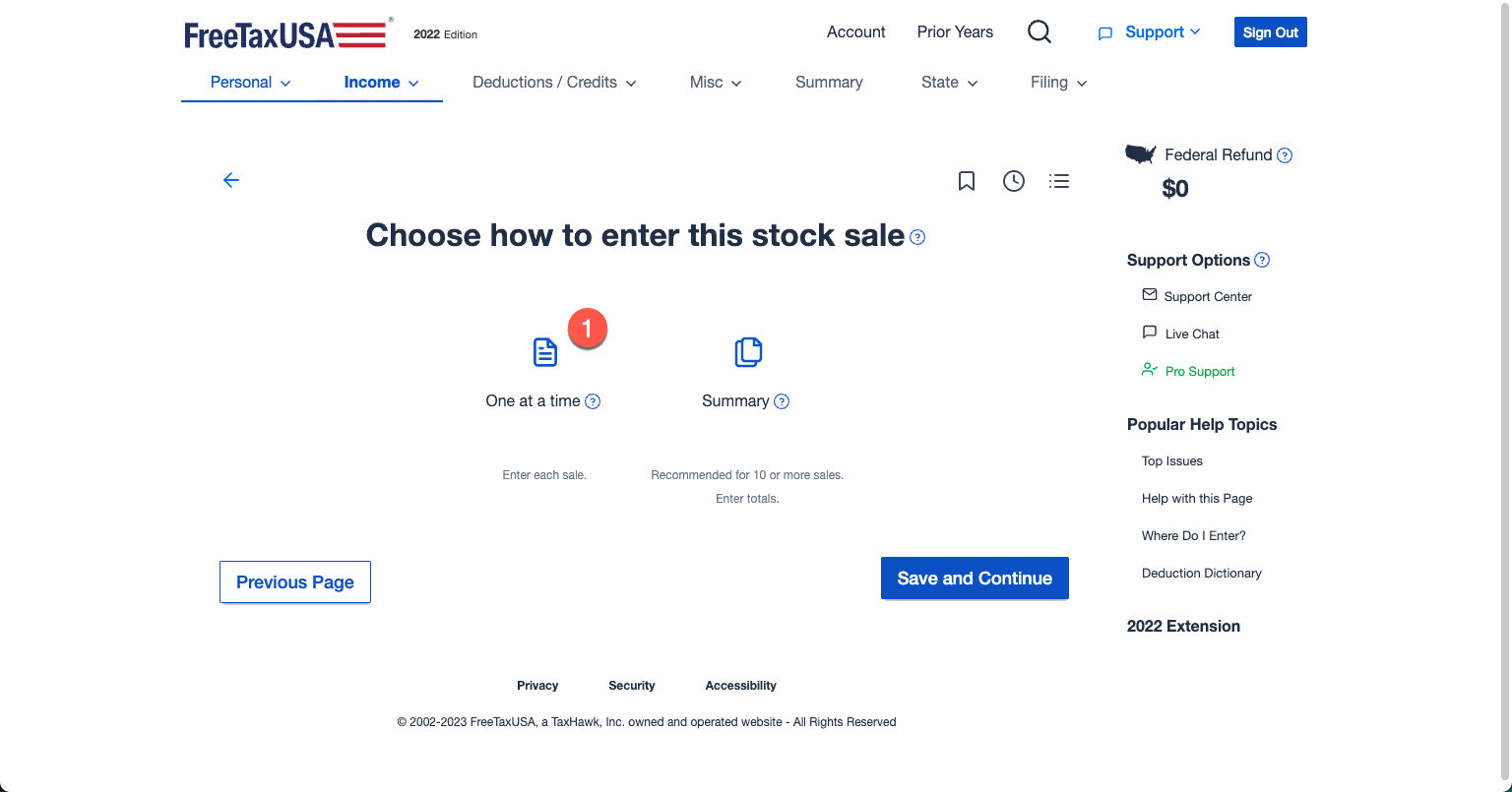

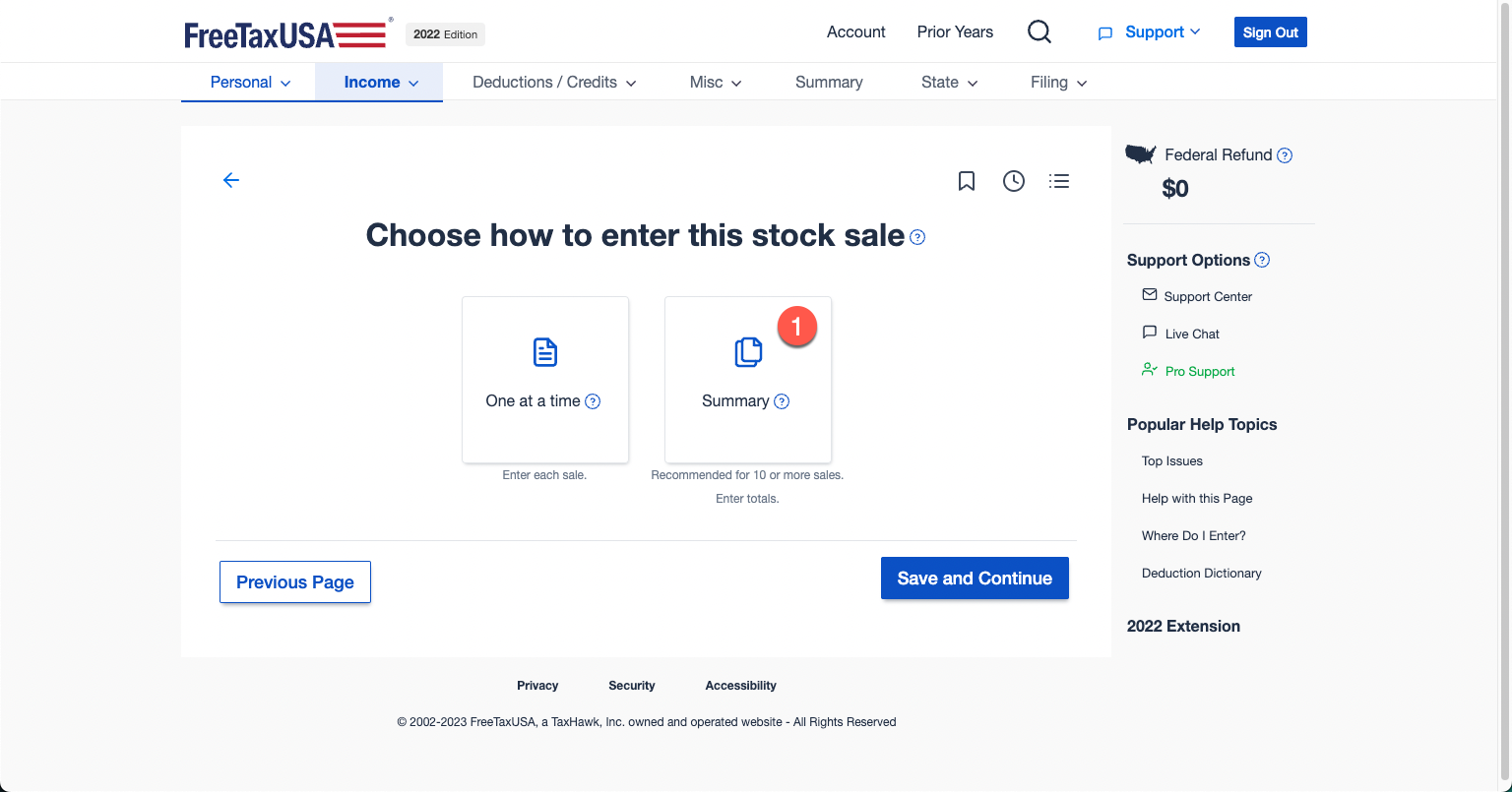

Select 'One at a time', 'Save and Continue'. Follow the subsequent prompts.

Enter Summary Transactions

Go to the 'Income' > 'Your Stocks or Investments Sold' screen in the program.

Select 'Stocks, Bonds, Mutual Funds', 'Save and Continue'.

Select 'Summary', 'Save and Continue'.

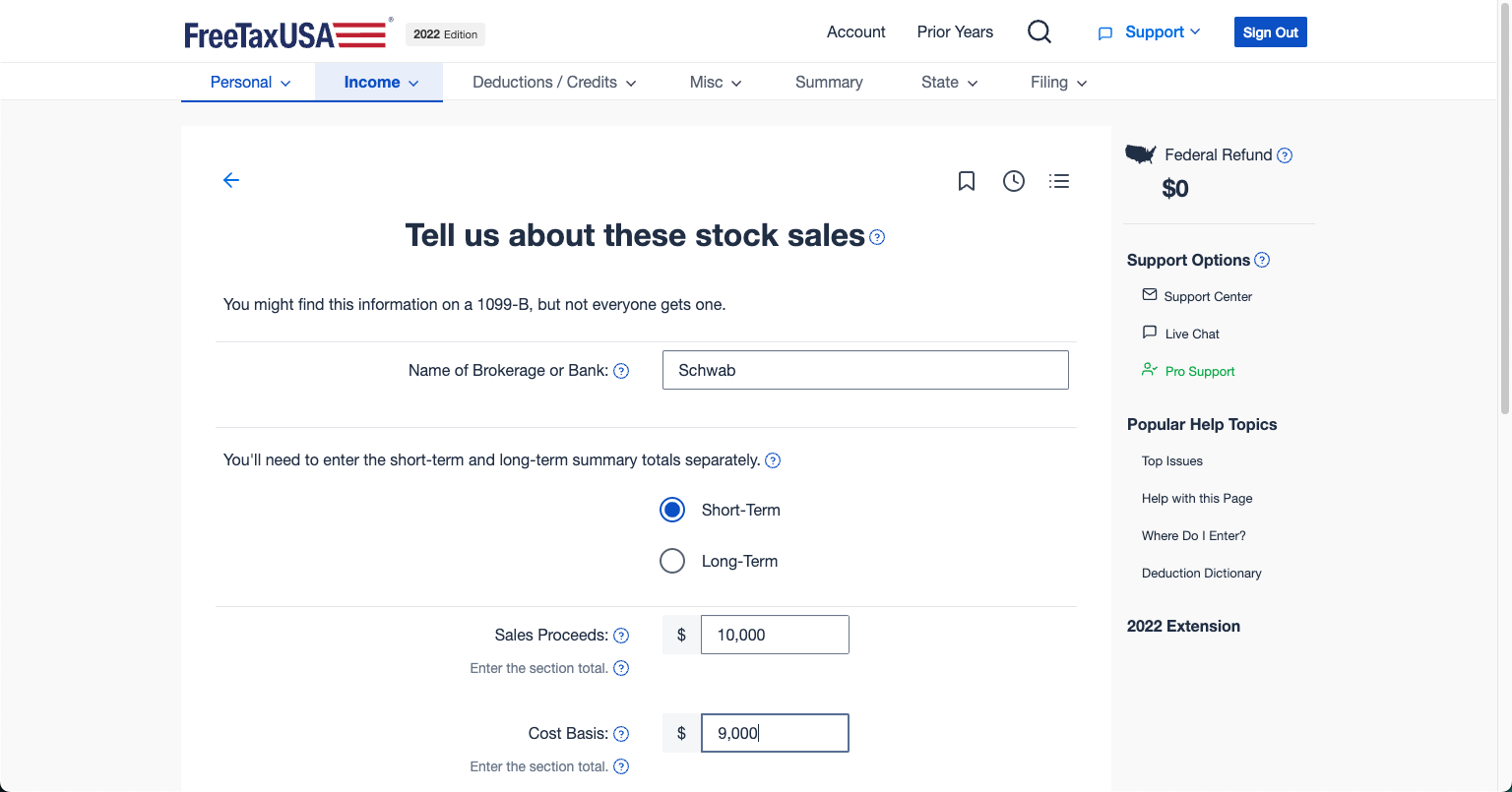

For each of your summary entries, complete the next 4 screens.

Enter the name of the 'Brokerage', 'Term', 'Proceeds', 'Cost'.

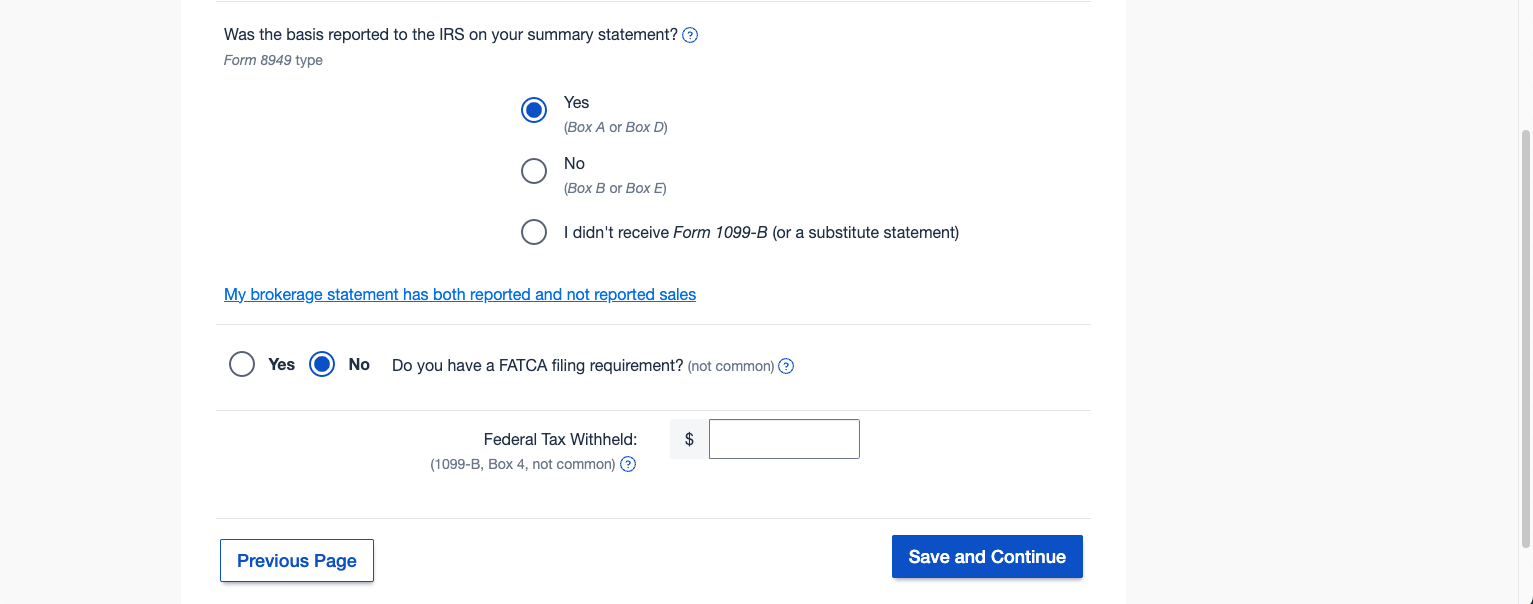

For 'Was the basis reported to the IRS', select the applicable value of: 'Yes', 'No', or 'I didn't receive Form 1099-B'

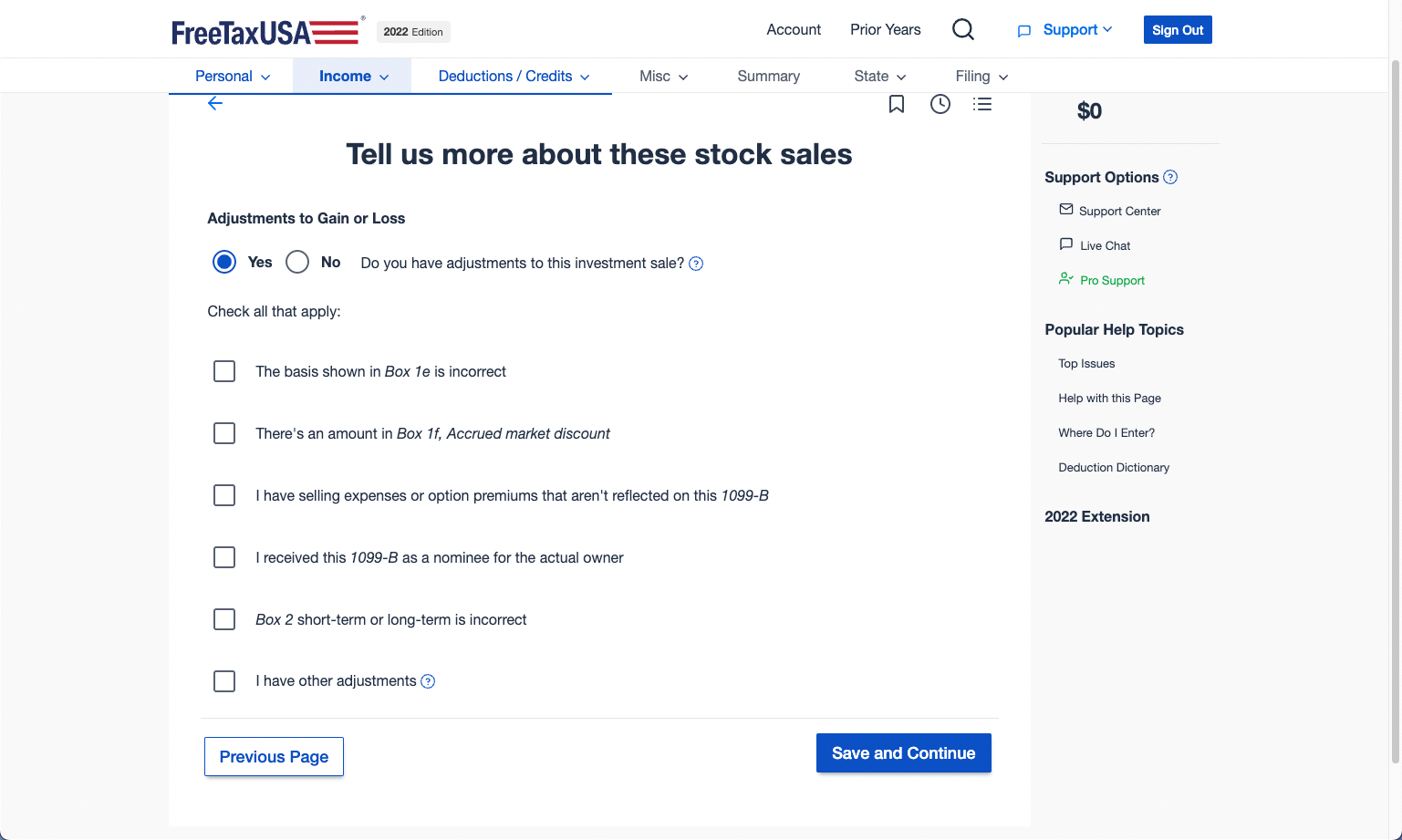

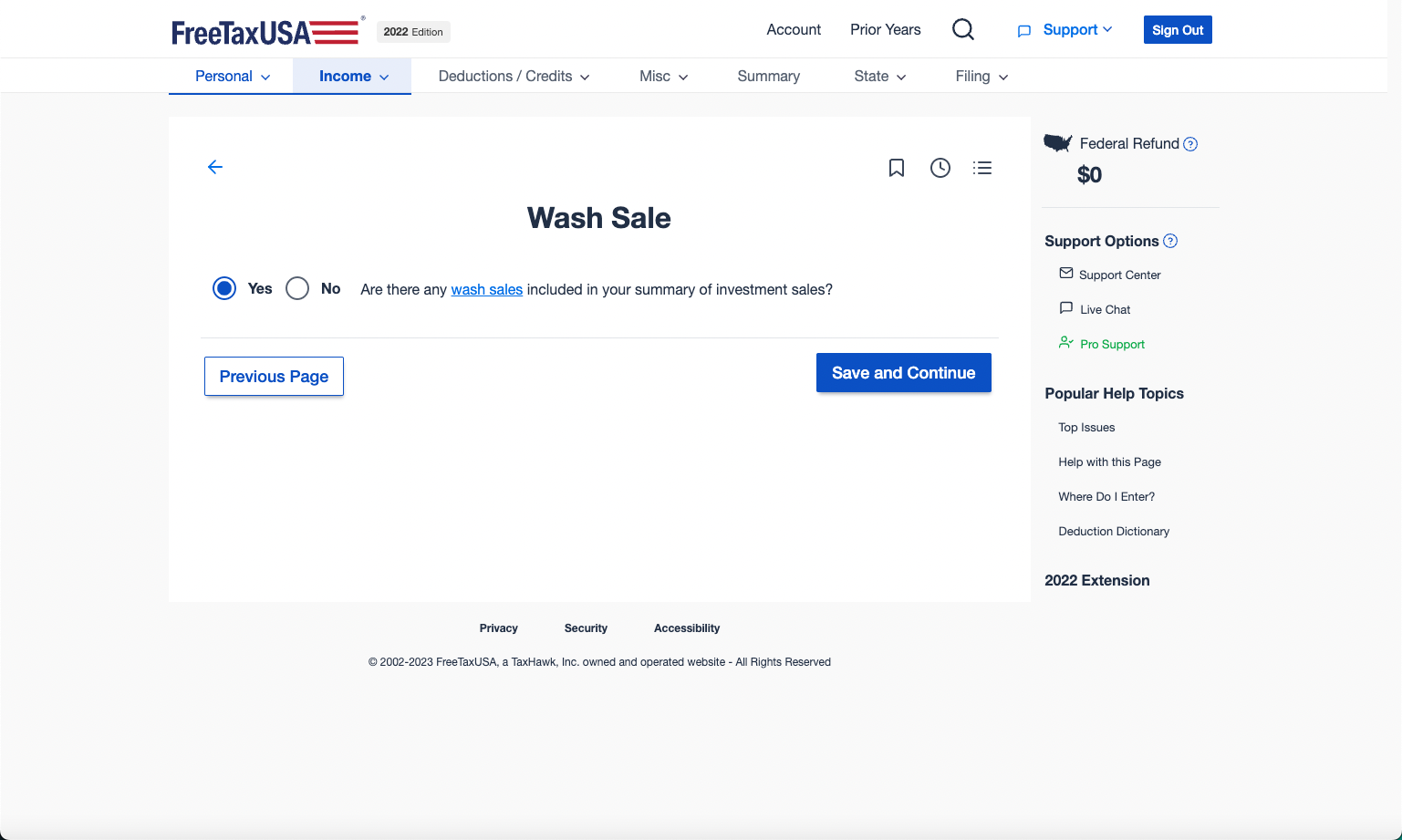

If you have wash sale adjustments, check the 'Yes' box.

But wash sale adjustments are entered on a subsequent screen

If you have wash sale adjustments, check the 'Yes' box.

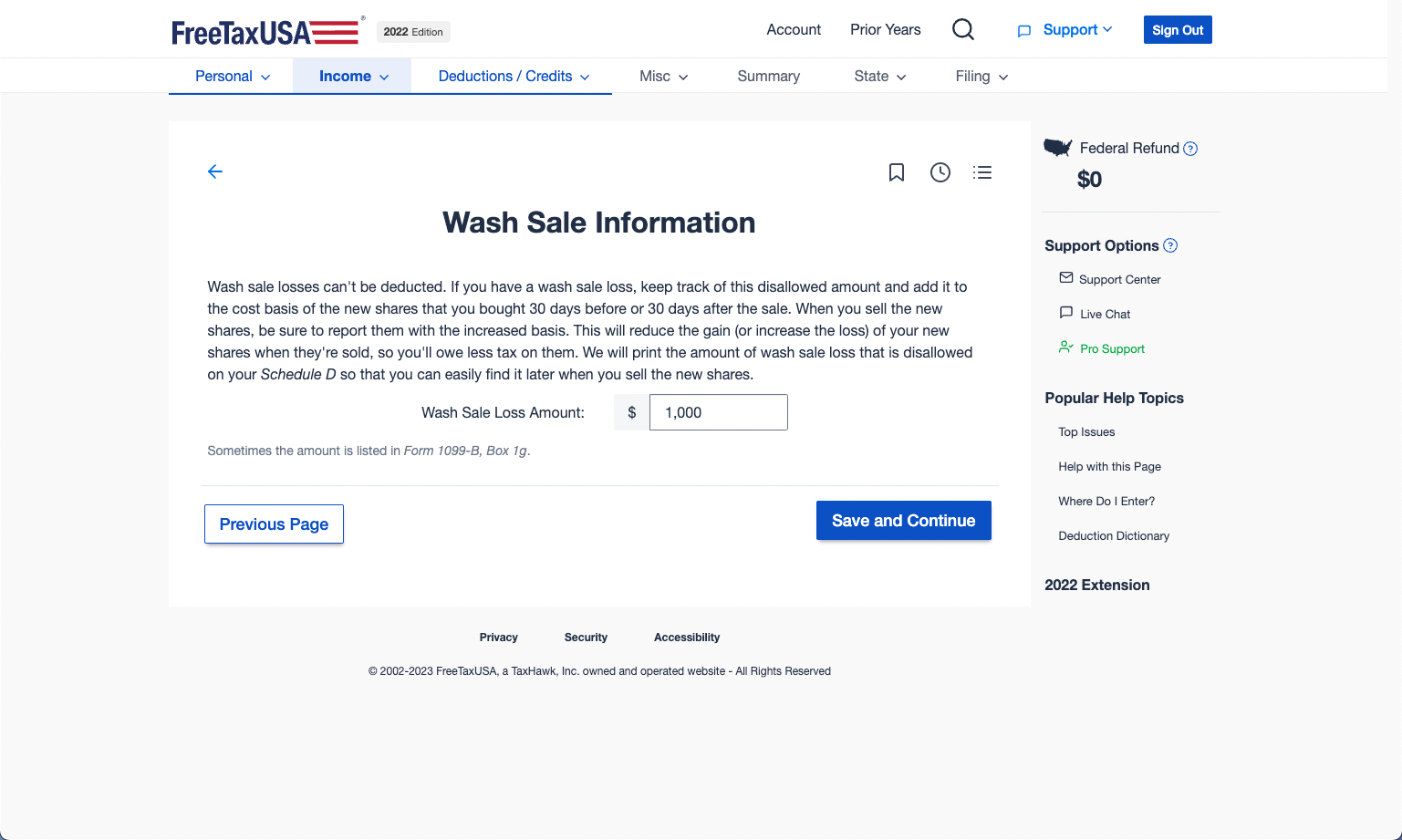

If you have wash sale adjustments, enter the total amount.

Import Detail Transactions

This option is NOT AVAILABLE.

Import Summary Transactions

This option is NOT AVAILABLE.

Attach Form 8949 Statement

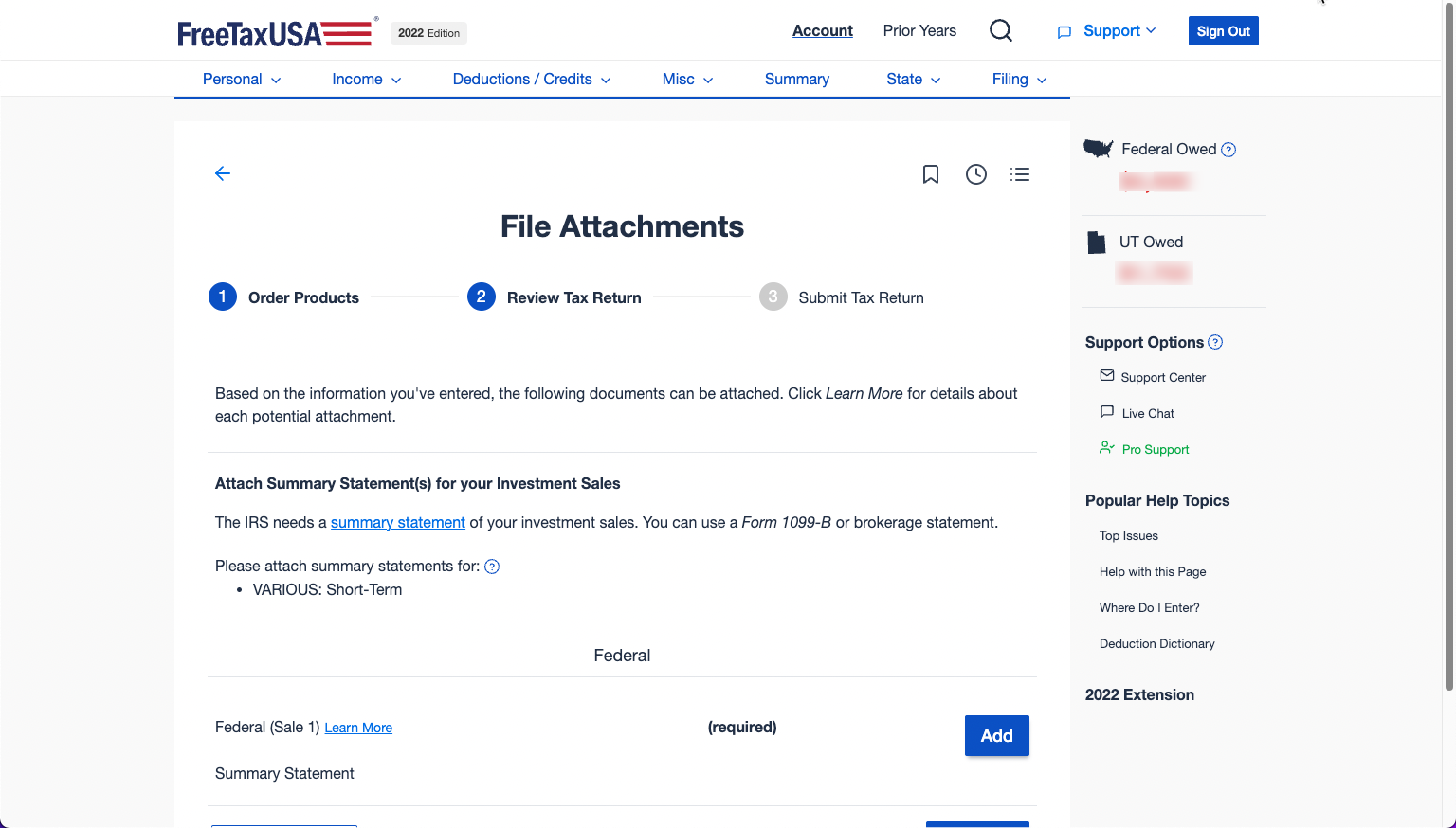

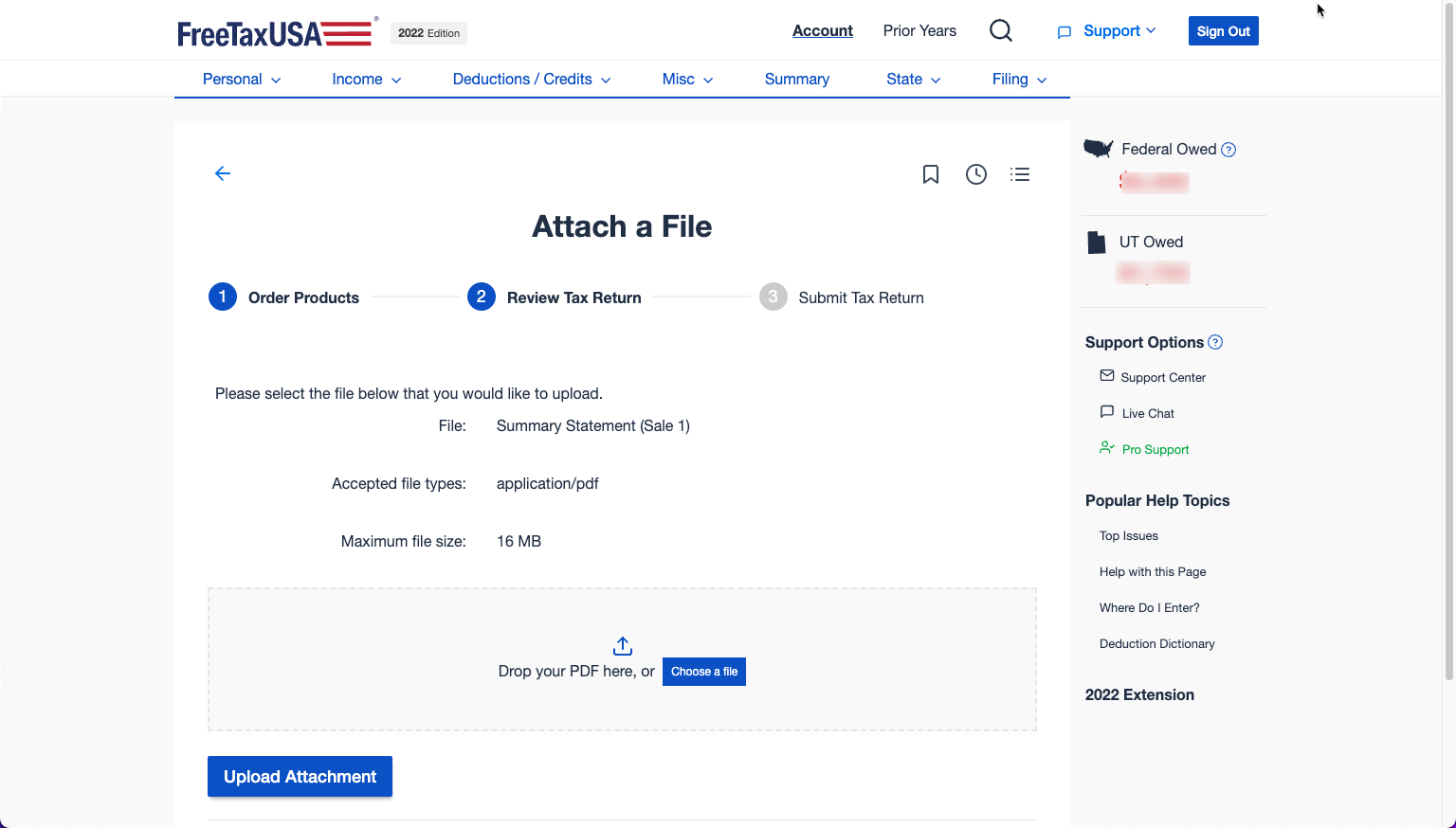

During the e-file step, the FreeTaxUSA program will give you the opportunity to upload your Form 8949 Statement PDF file.

FreeTaxUSA will present you with a 'File Attachments' screen.

Click the 'Add' button.

On the 'Attach A File' screen drag and drop your PDF into the 'Drop your PDF here' area.

Then click the 'Upload Attachment' button.

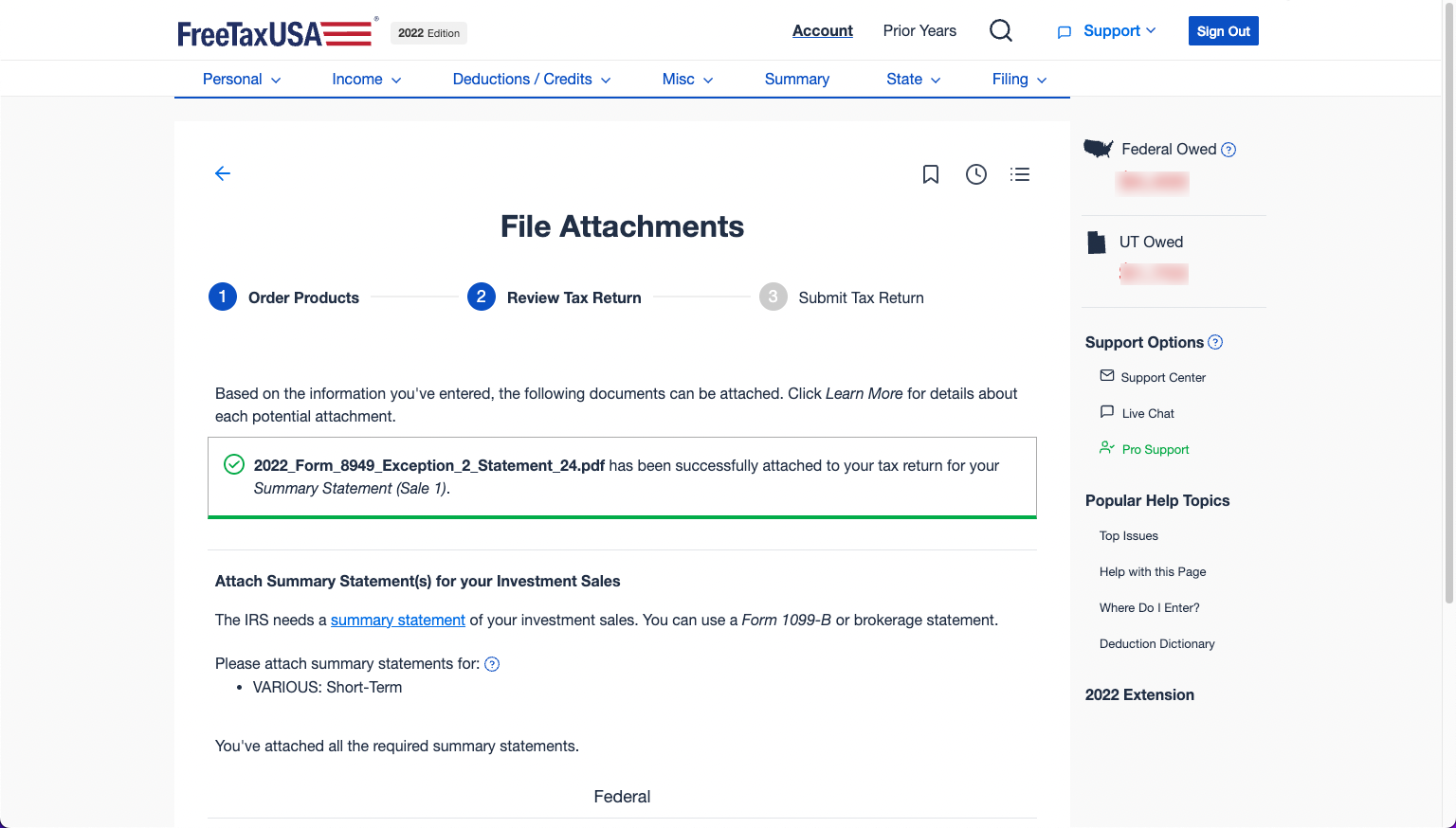

The next screen 'File Attachments' will confirm the upload and attachment of your file.

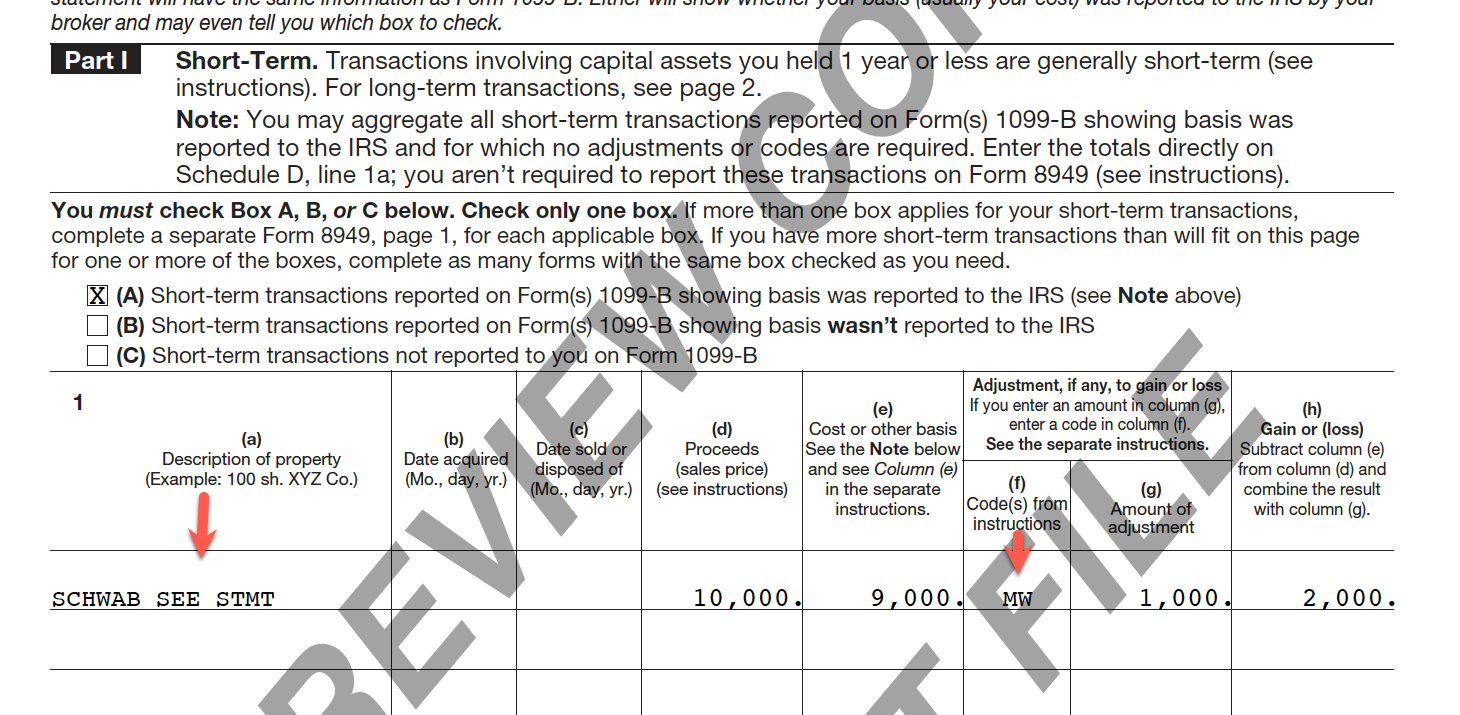

The Form 8949 generated by FreeTaxUSA will reference the statement.

If you have more up-to-date information, please email support@form8949.com.