TaxAct Integration

Users of Form8949.com who use TaxAct for tax prep have the following integration options:

- Enter Detail Transactions

- Enter Summary Transactions

- Import Detail Transactions

- Import Summary Transactions

- Attach Form 8949 Statement

Enter Detail Transactions

To avoid the tedium of manually entering your detail data, use the 'Import Detail Transactions' option described below.

Enter Summary Transactions

You may use the Import Summary Transactions option below or enter your summary transactions as described here.

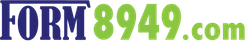

1. Select Federal > Investment Income > Gain or loss on the sale of investments > "Enter totals from a statement of transactions you will attach to your return".

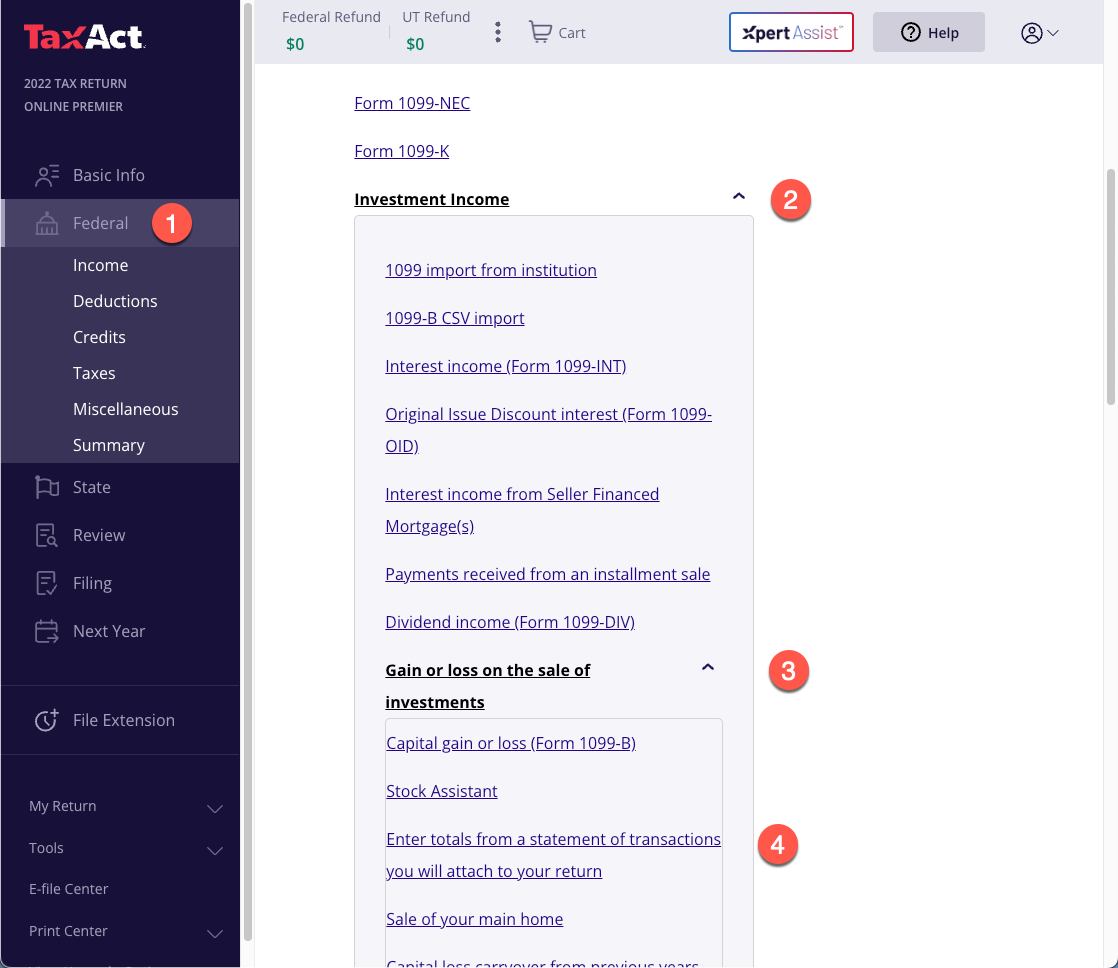

2. Click 'Add a New Provider'.

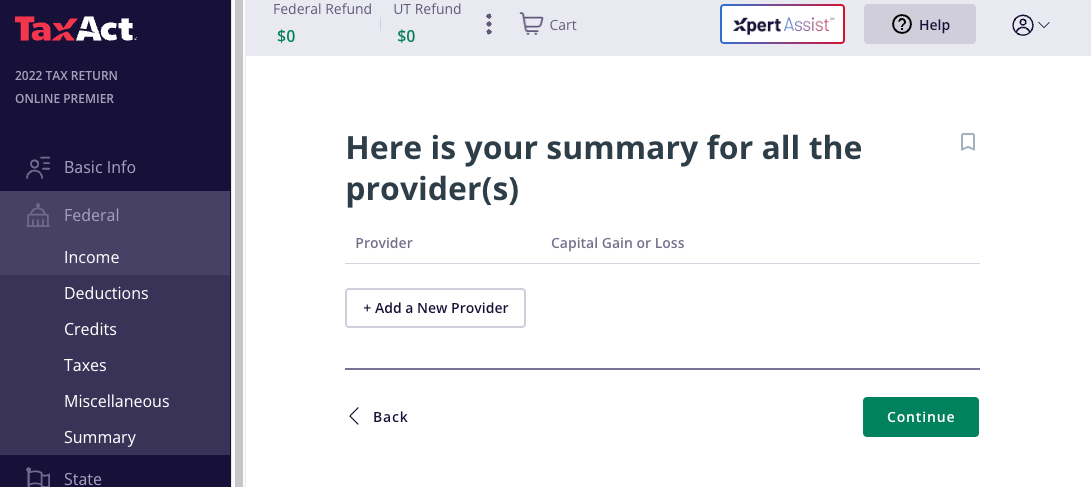

3. Enter a Broker name.

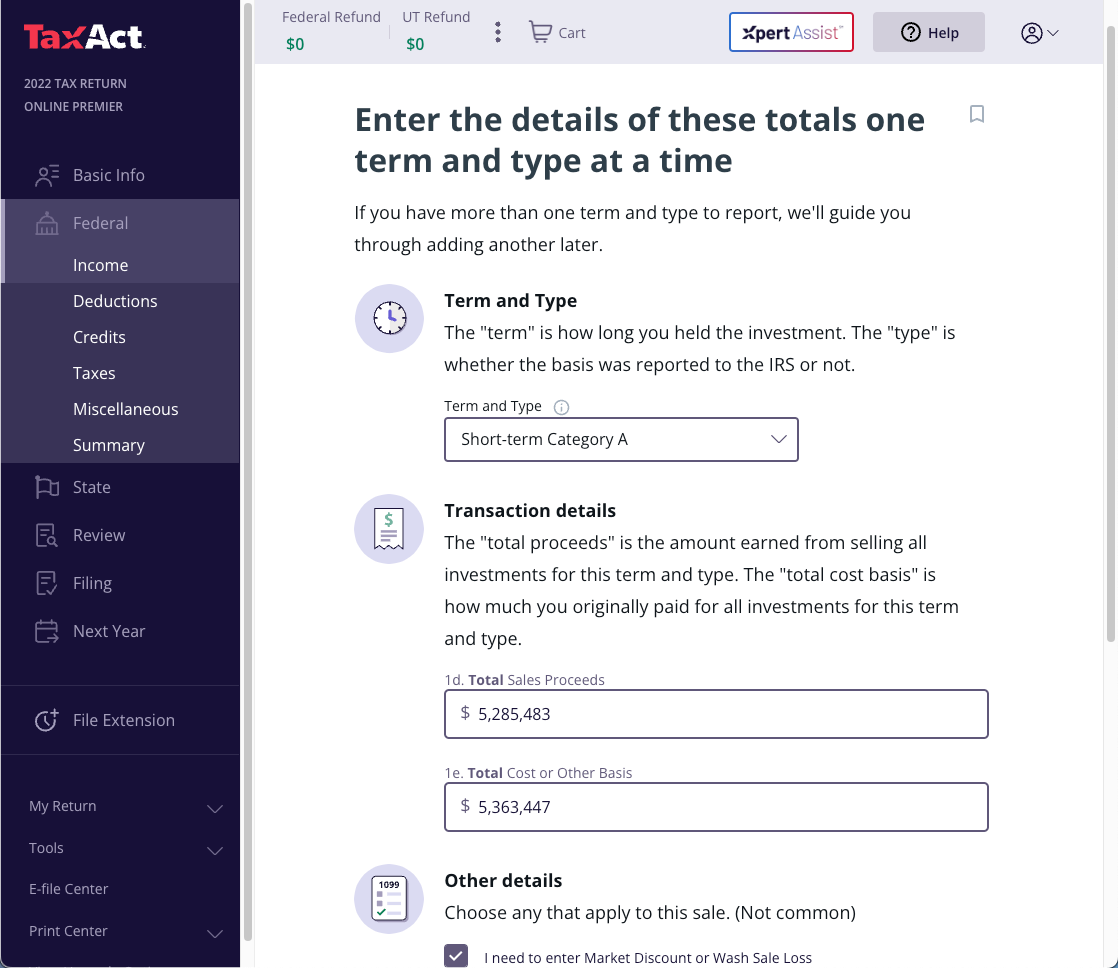

4. For each summary transaction, complete this screen.

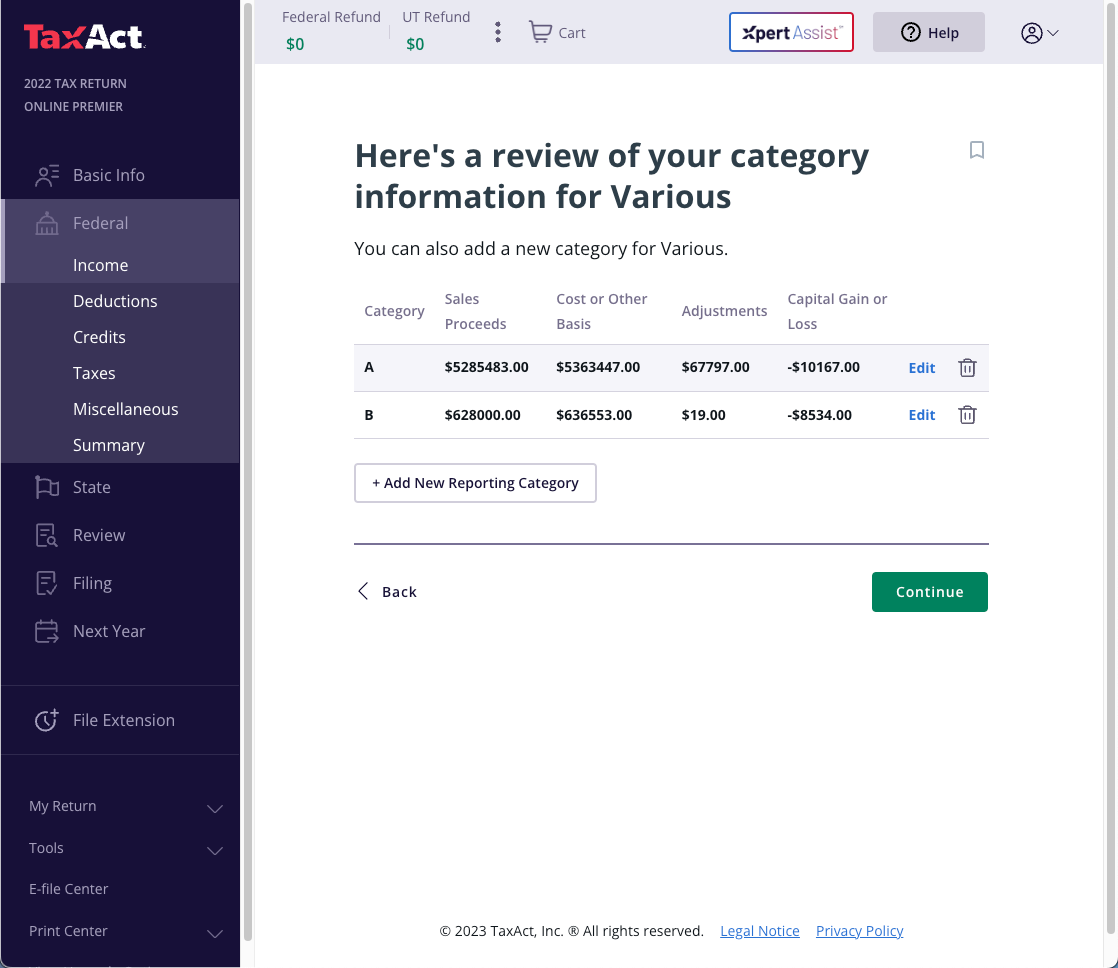

5. Once done, the totals by category will be shown.

6. You will attach your PDF statement during the e-file phase.

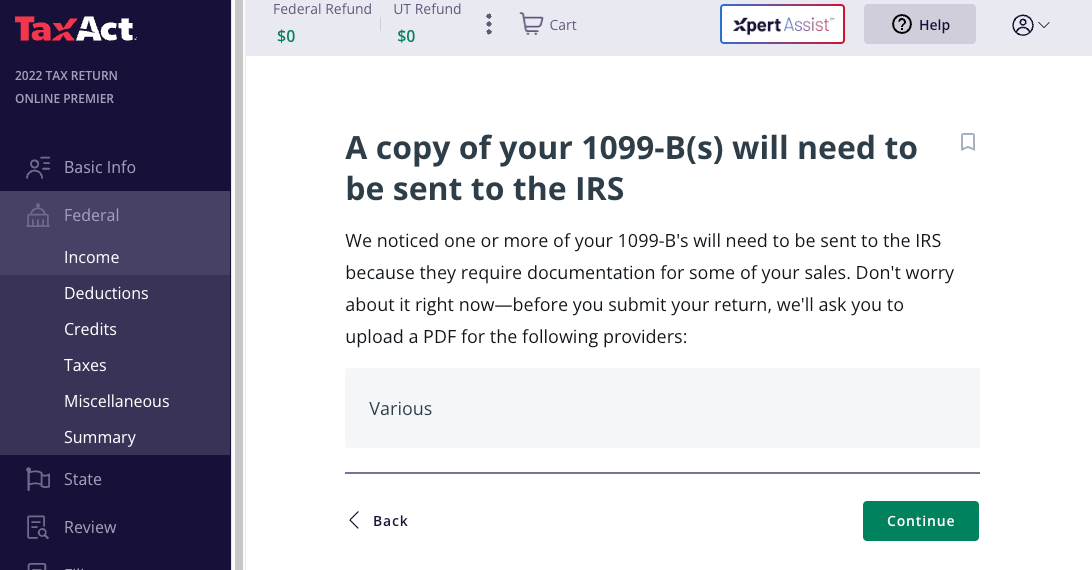

Important note:

The software is saying the IRS requires a copy of your Form 1099-B under these circumstances.

But this is not an accurate statement.

In the relevant IRS instructions the IRS says:

Instead of reporting each of your transactions on a separate row of Part I or II, you can report them on an attached statement containing all the same information as Parts I and II and in a similar format (that is, description of property, dates of acquisition and disposition, proceeds, basis, adjustment and code(s), and gain or (loss)). Use as many attached statements as you need. Enter the combined totals from all your attached statements on Parts I and II with the appropriate box checked.

The statement we provide you conforms to the IRS requirements and should be uploaded for attachment to your return.

Import Detail Transactions

You can directly import 1099-B/8949 data from FORM8949.COM into TaxAct Online Premier edition.

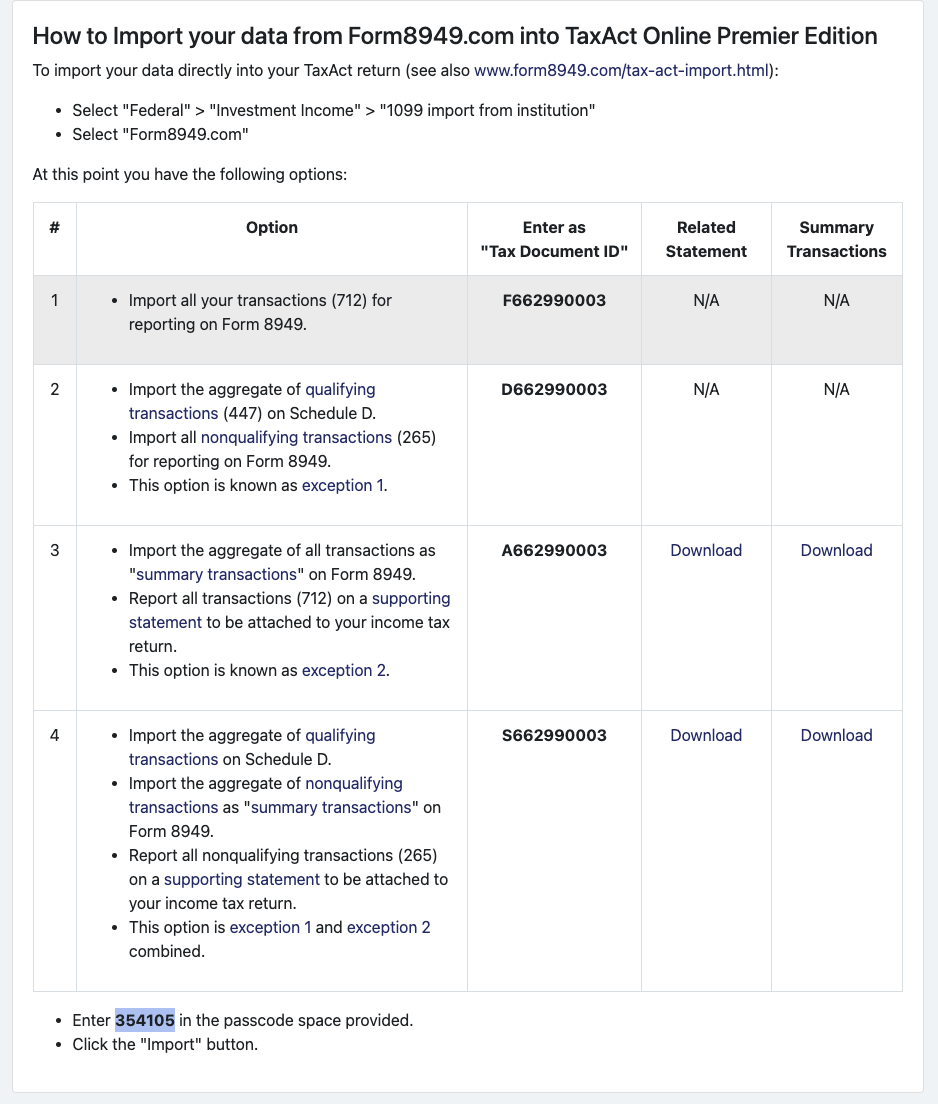

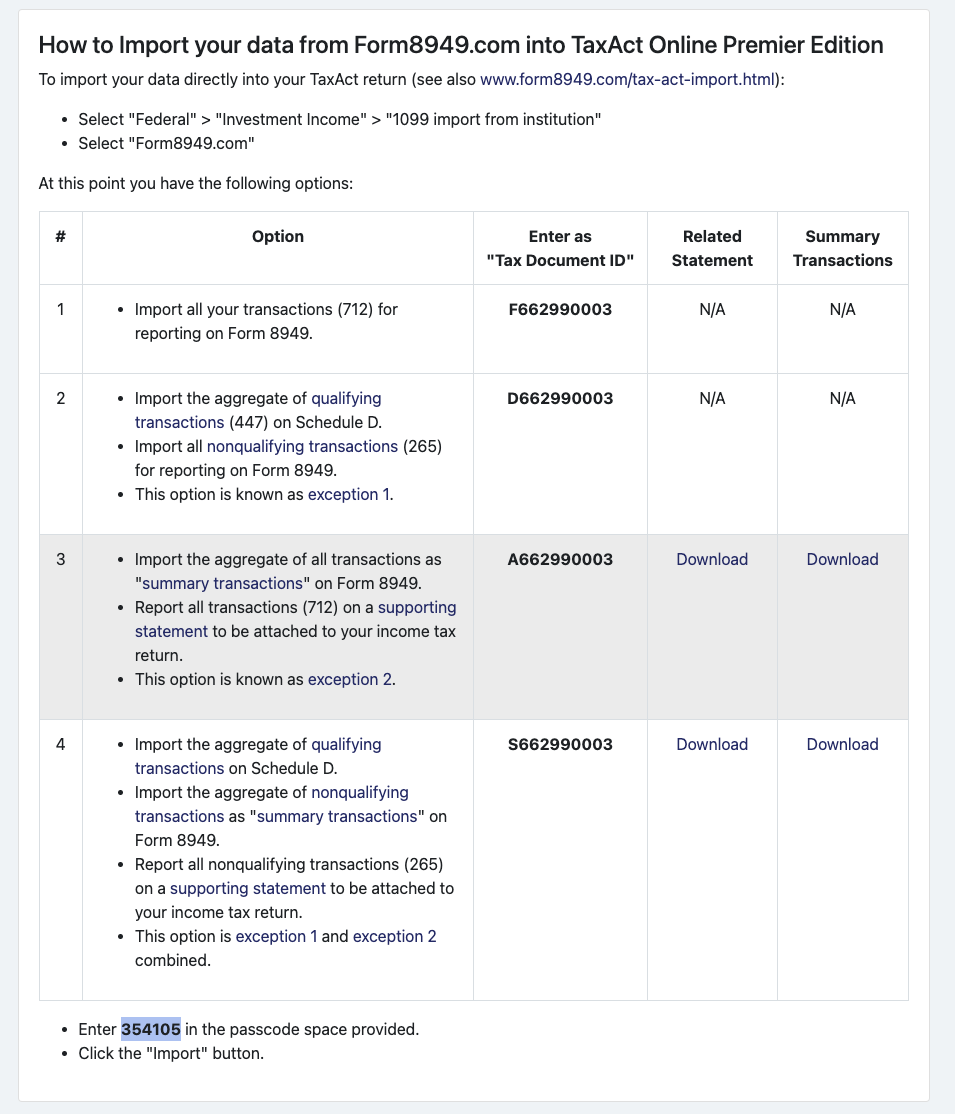

Go the Taxes menu in the app. There the app will provide you with import codes as seen here:

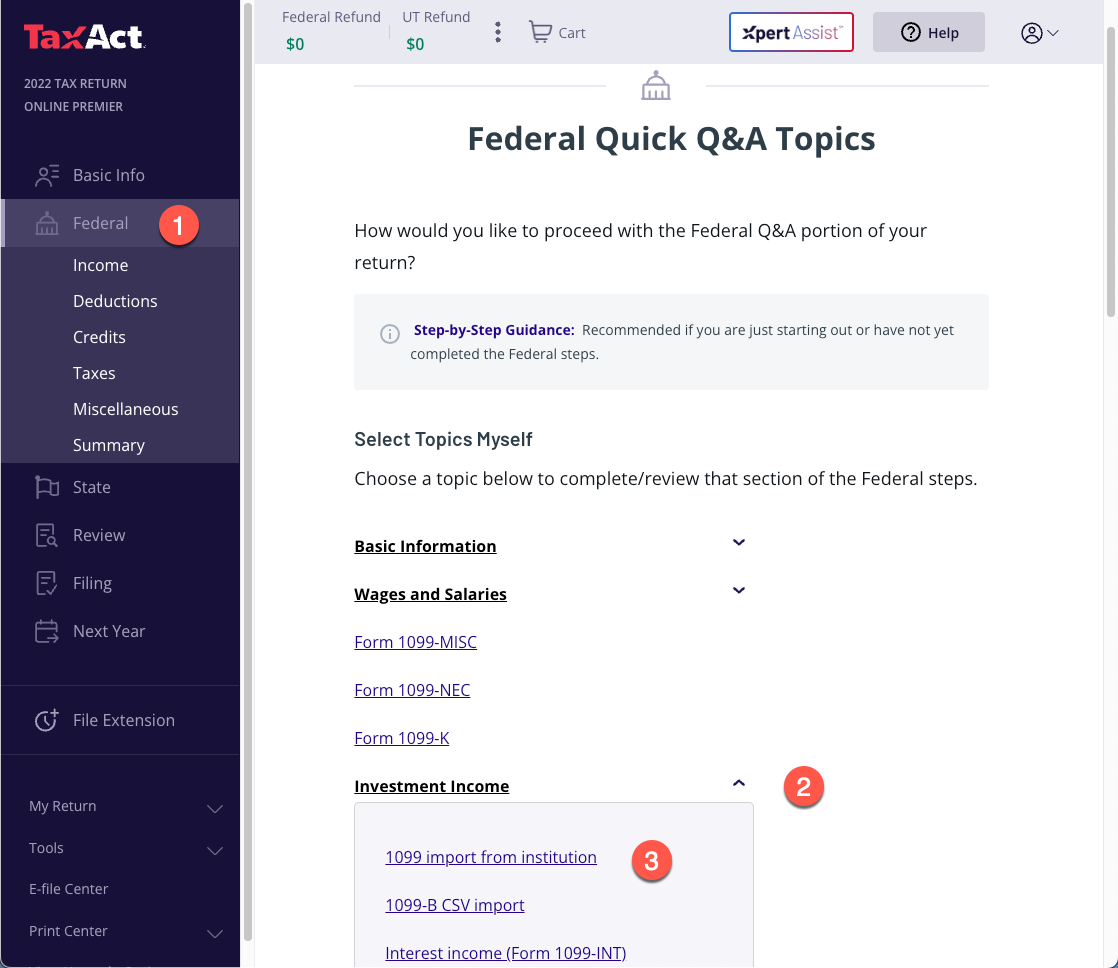

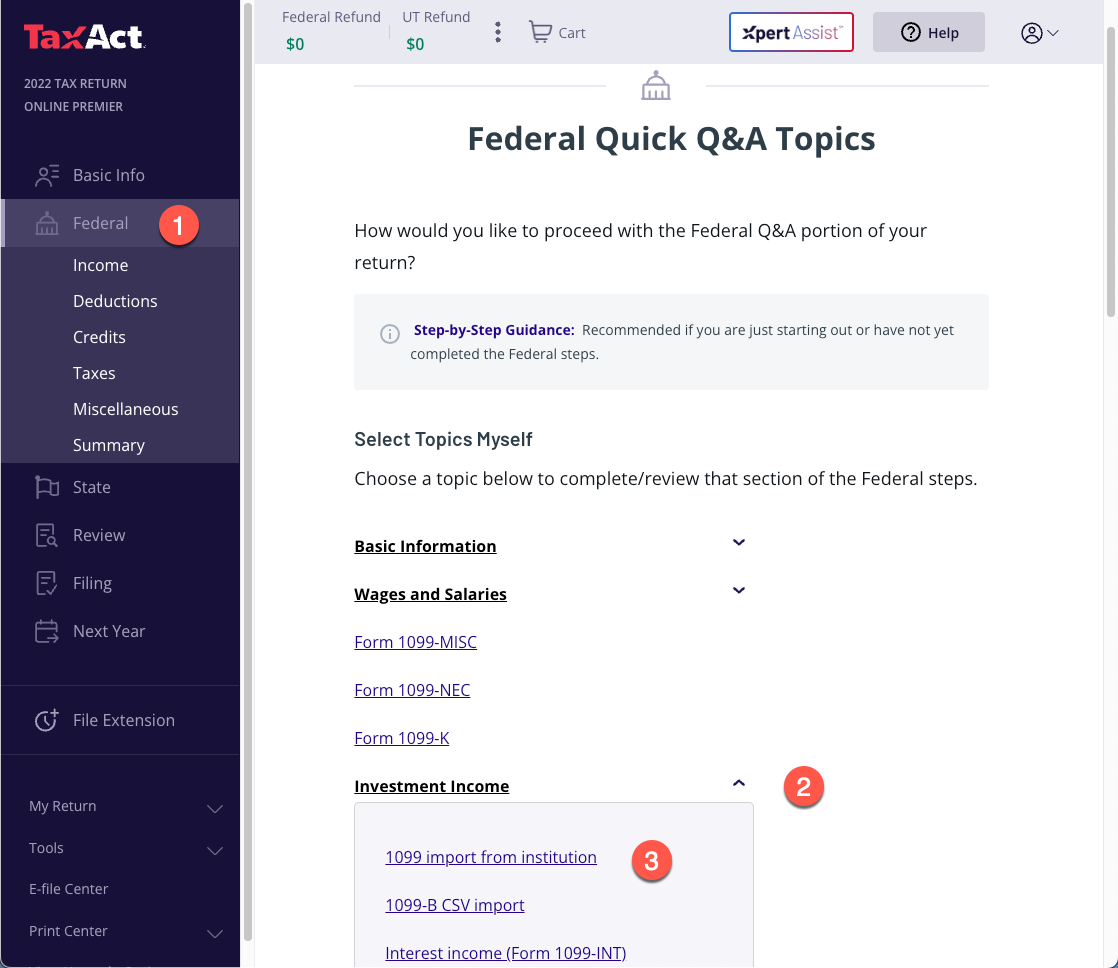

1. Select "Federal" > "Investment Income" > "1099 import from institution".

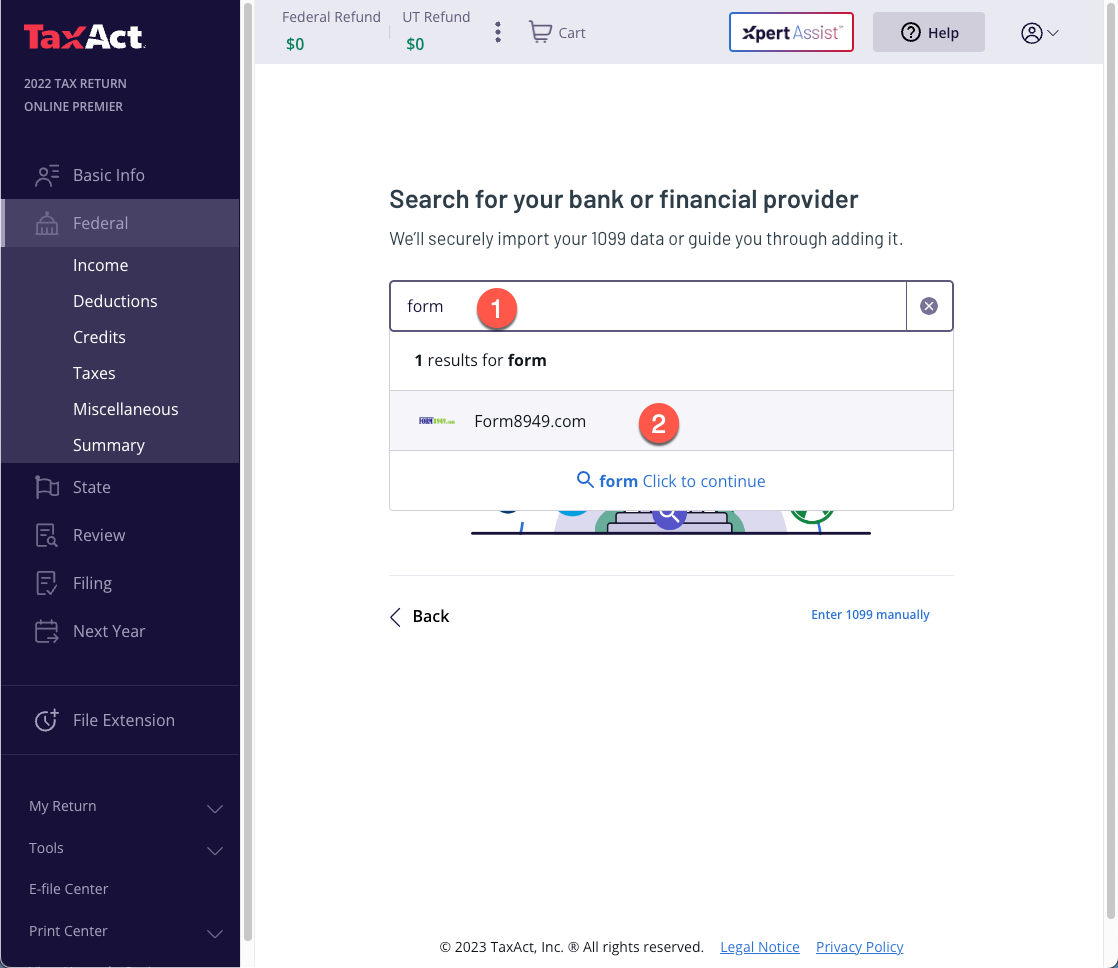

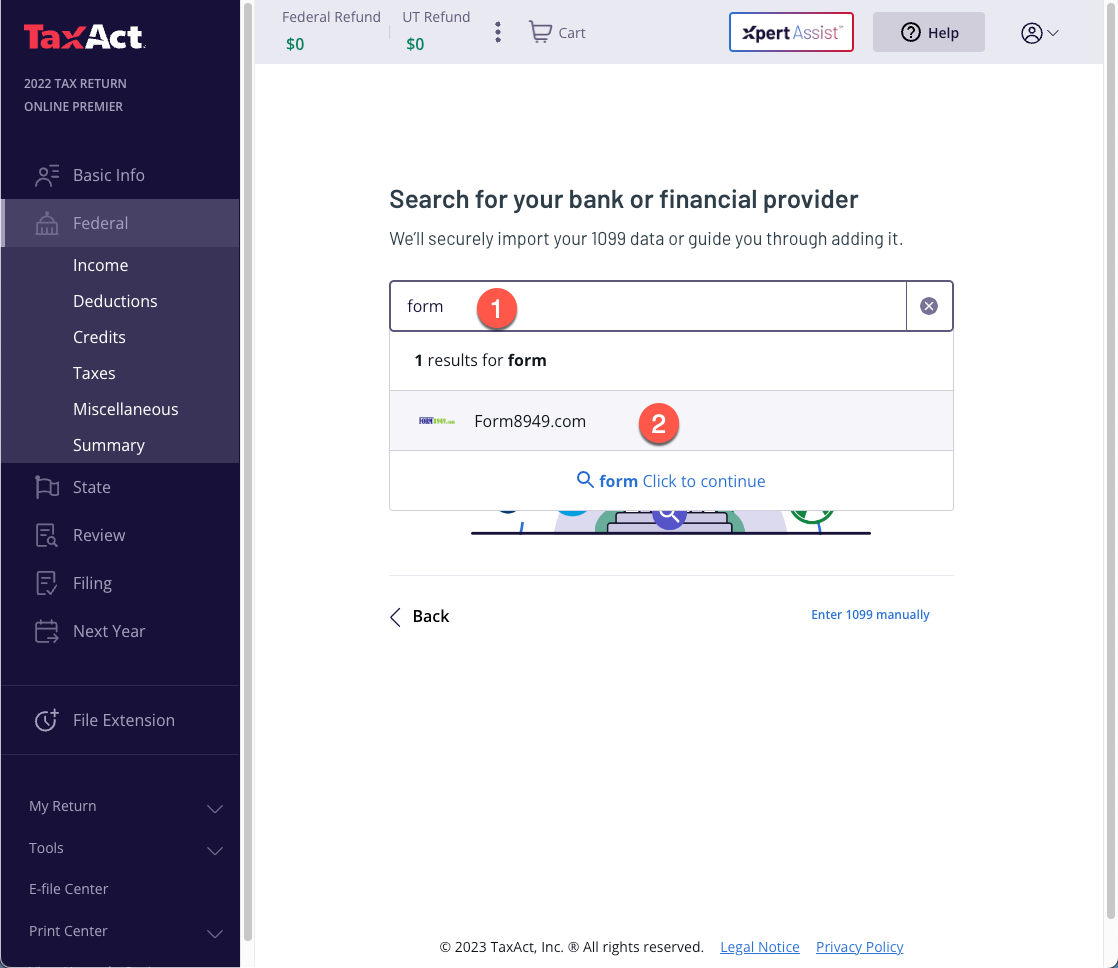

2. Enter "form" in the search box, then select "Form8949.com"

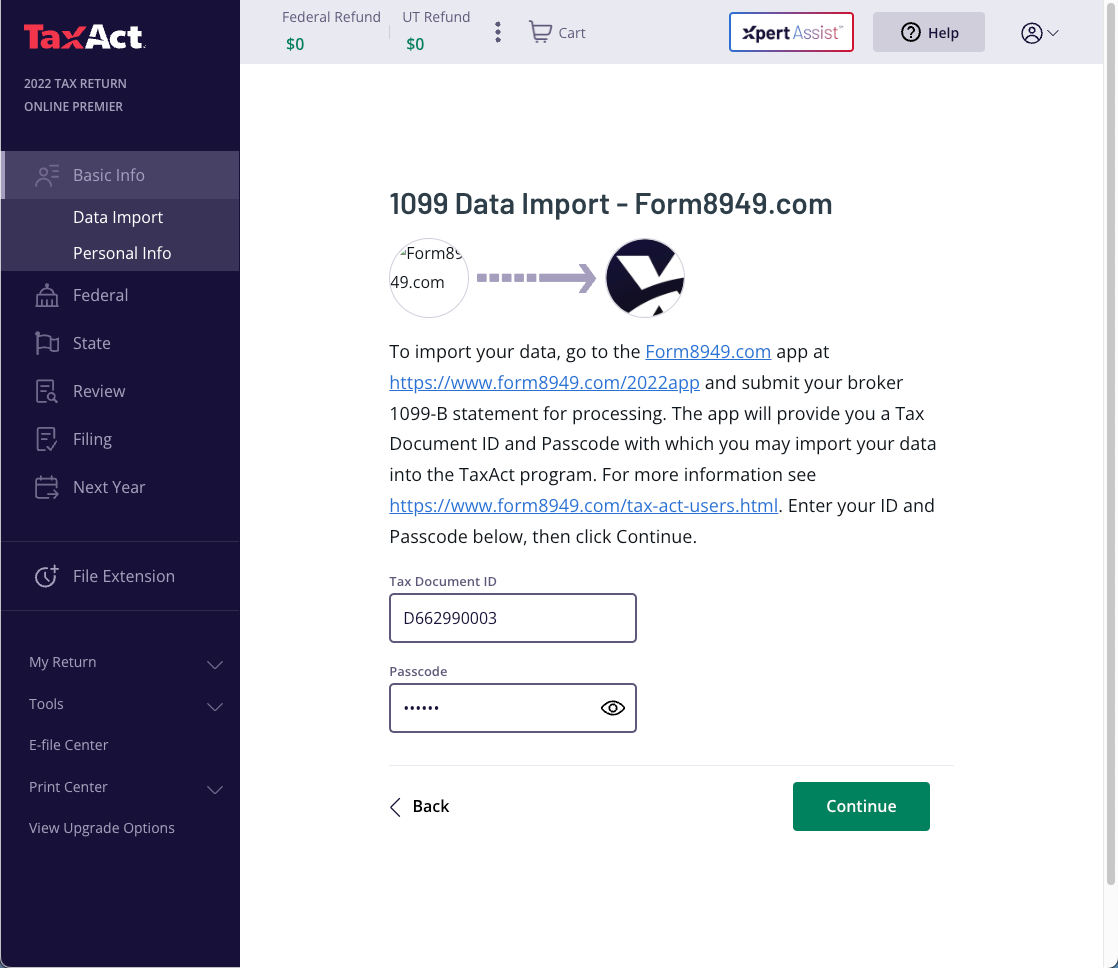

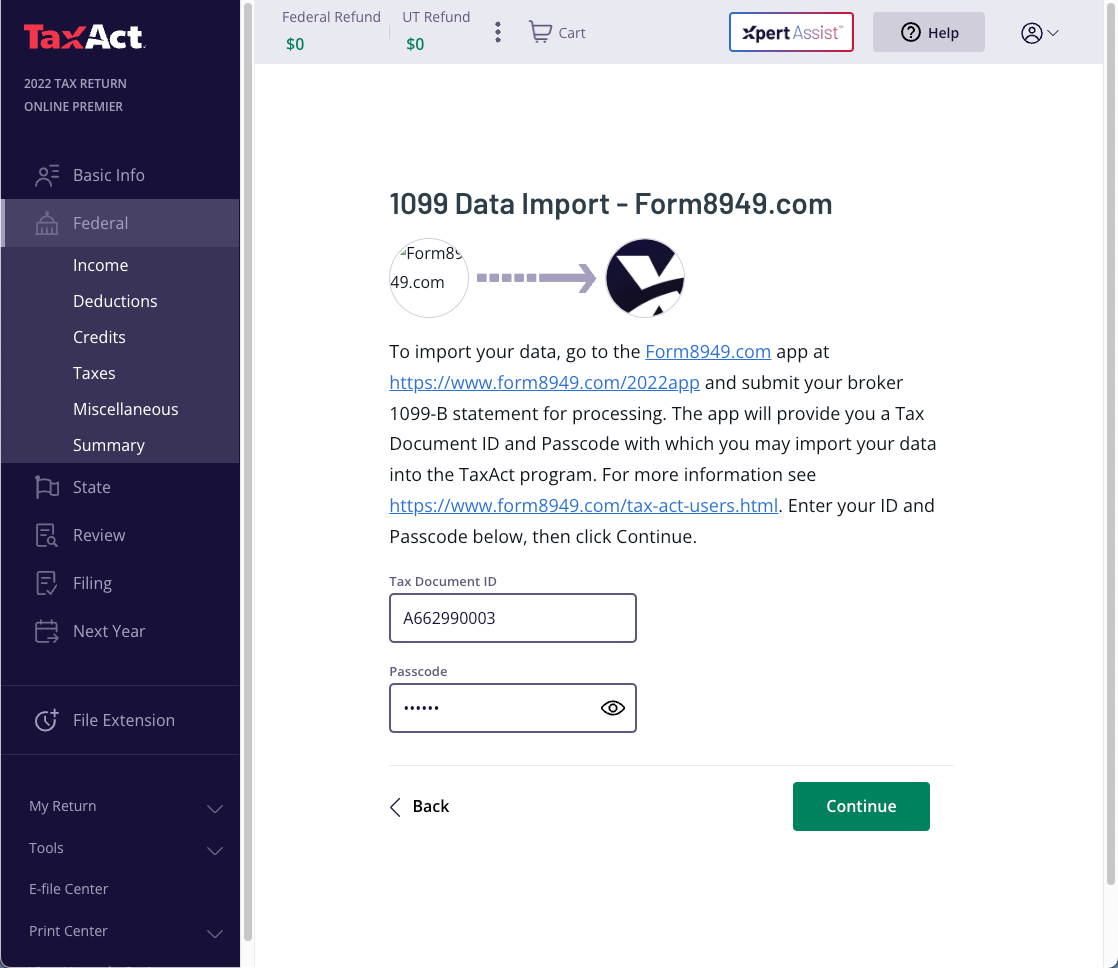

3. In 'Tax Document ID' and 'Passcode' fields, enter that codes provided you in the Form8949.com app as seen above. Then click "Continue".

Note: You may use the code starting with "F" to import all detail transactions or the code starting with "D" to aggregate qualifying transactions. Since TaxAct will automatically aggregate qualifying transactions, the results reported on Schedule D and Form 8949 should be the same either way. However, since TaxAct rounds to whole dollar amounts, a rounding difference may occur. We recommend using the code starting with "D".

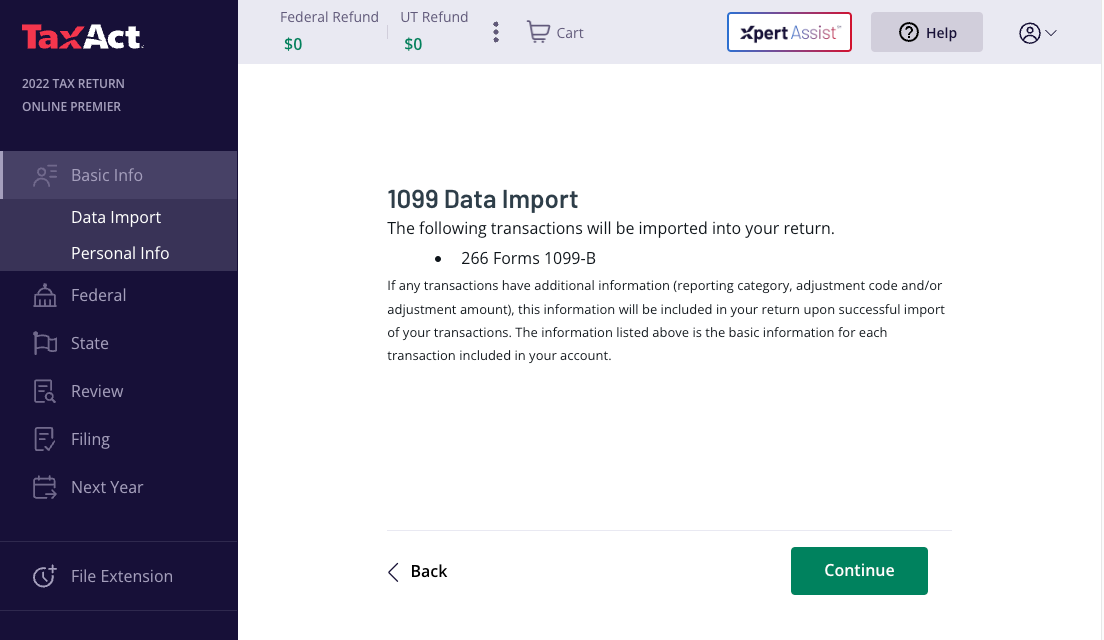

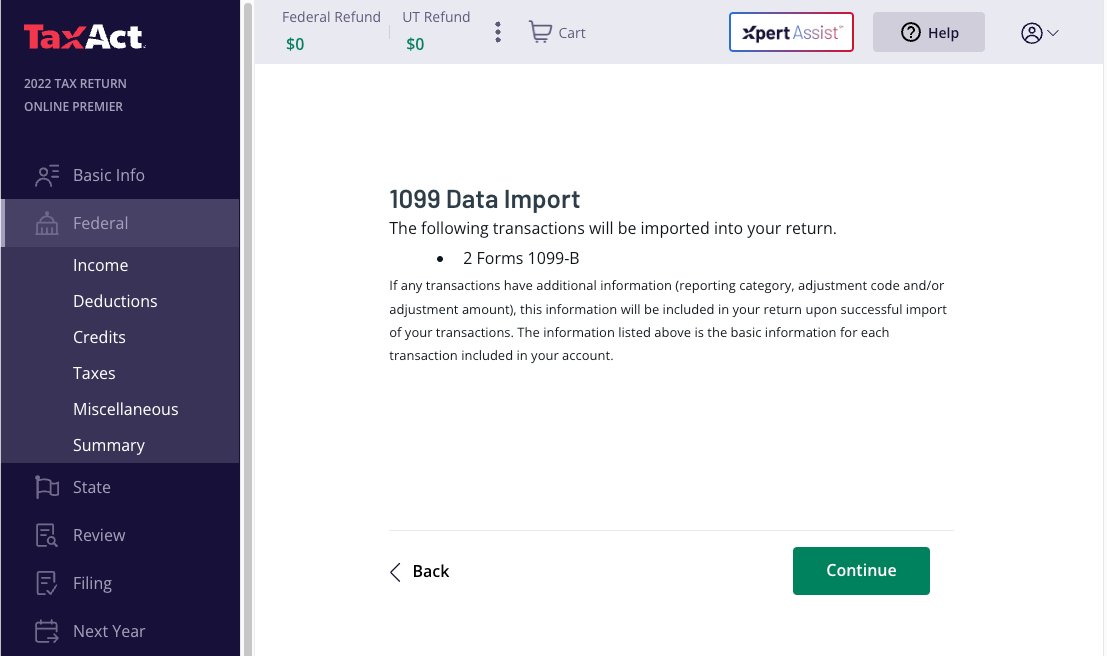

4. On the next screen, click "Continue".

5. TaxAct will show a list of the imported transactions on a subsequent screen.

Import Summary Transactions

You can directly import summary 1099-B/8949 data from FORM8949.COM into TaxAct Online Premier edition.

Go to the Taxes menu in the app. There the app will provide you with import codes as seen here:

1. Select "Federal" > "Investment Income" > "1099 import from institution".

2. Select "Form8949.com"

3. In 'Tax Document ID' and 'Passcode' fields, enter that codes provided you in the Form8949.com app as seen above. Then click "Continue".

4. Click "Continue" on the next screen.

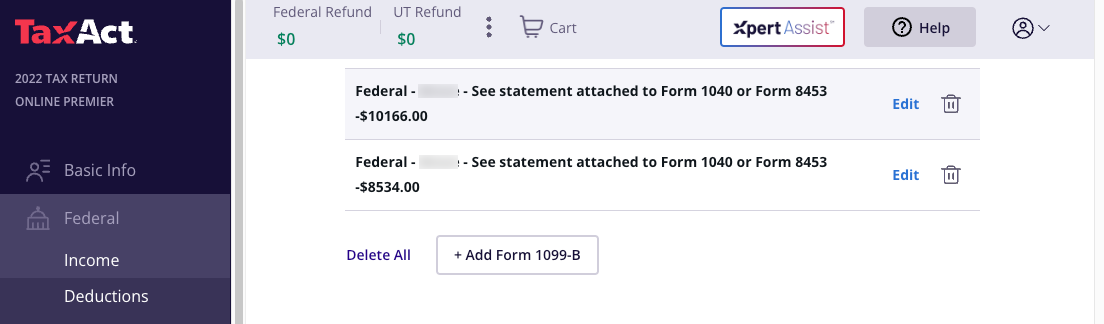

5. On a subsequent screen, TaxAct will show a list of the imported summary transactions.

Attach Form 8949 Statement

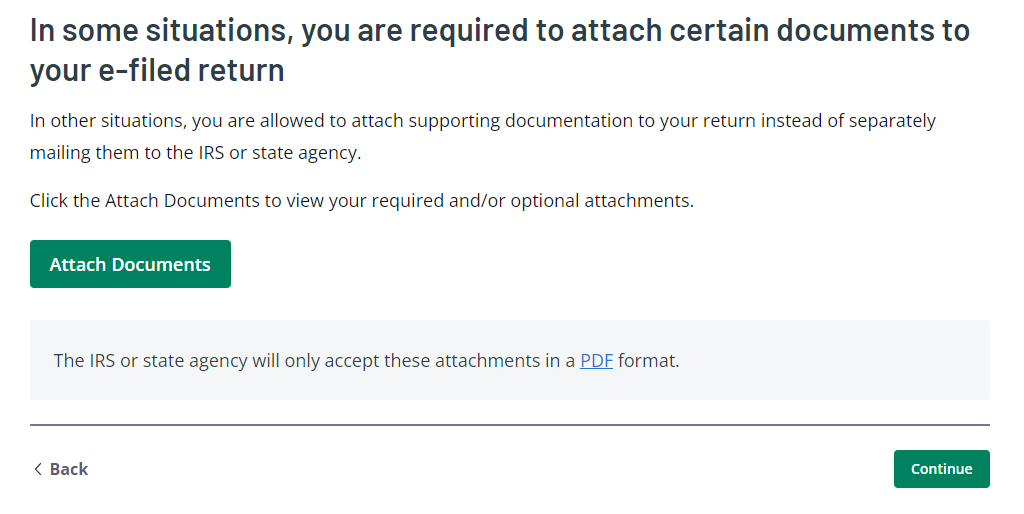

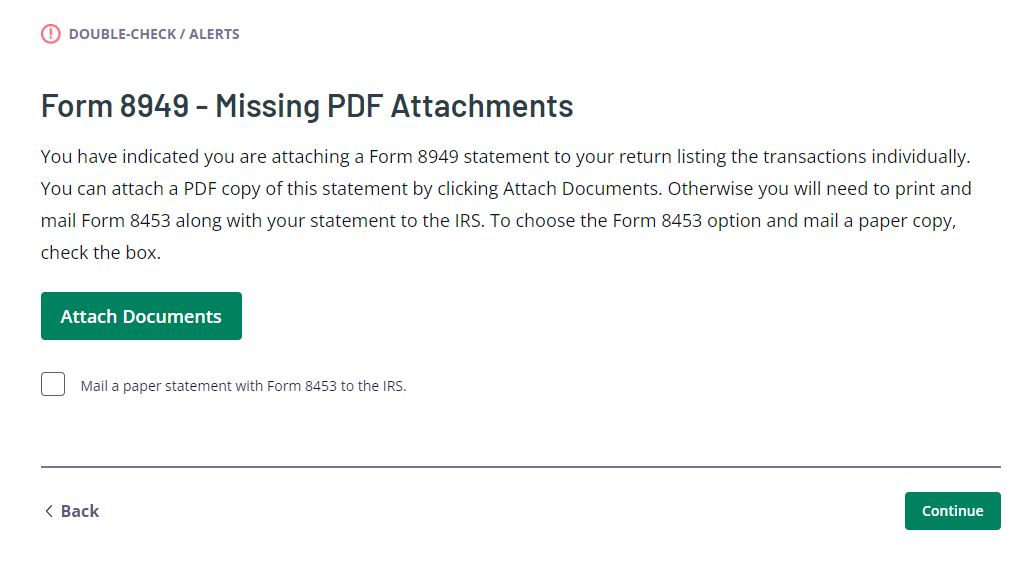

If filing electronically, you will have the option during the e-file steps to attach your Form 8949 statement as a PDF.

Click the 'Attach Documents' button.

Click the 'Attach Documents' button and follow the prompts to upload the Form 8949 Statement PDF.

If you have more up-to-date information, please email support@form8949.com.