IRS Form 1099-B History

See also instructions.

2025

- No change from 2024

2024

- No change from 2023

2023

- No change from 2022

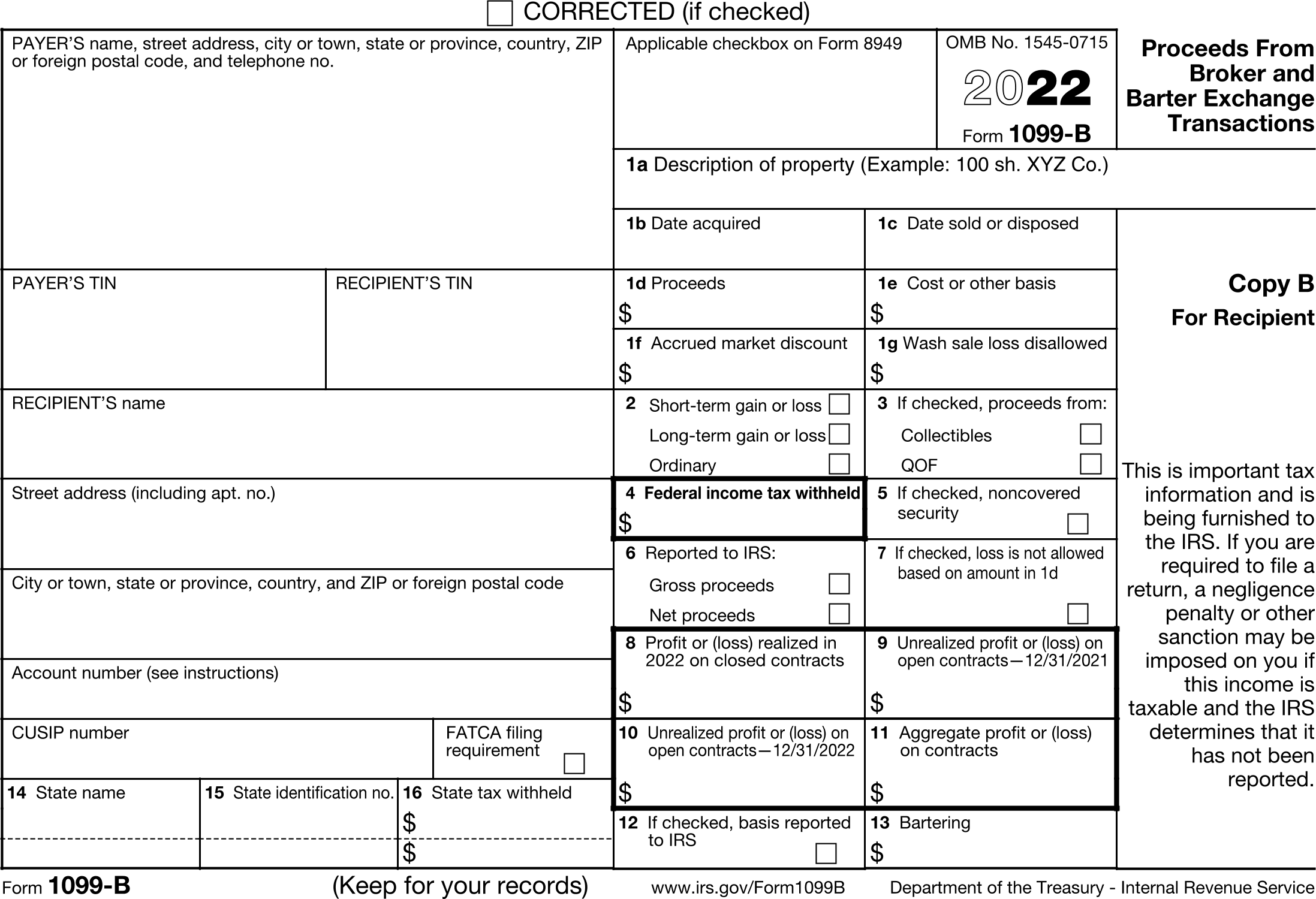

2022

- No change from 2021

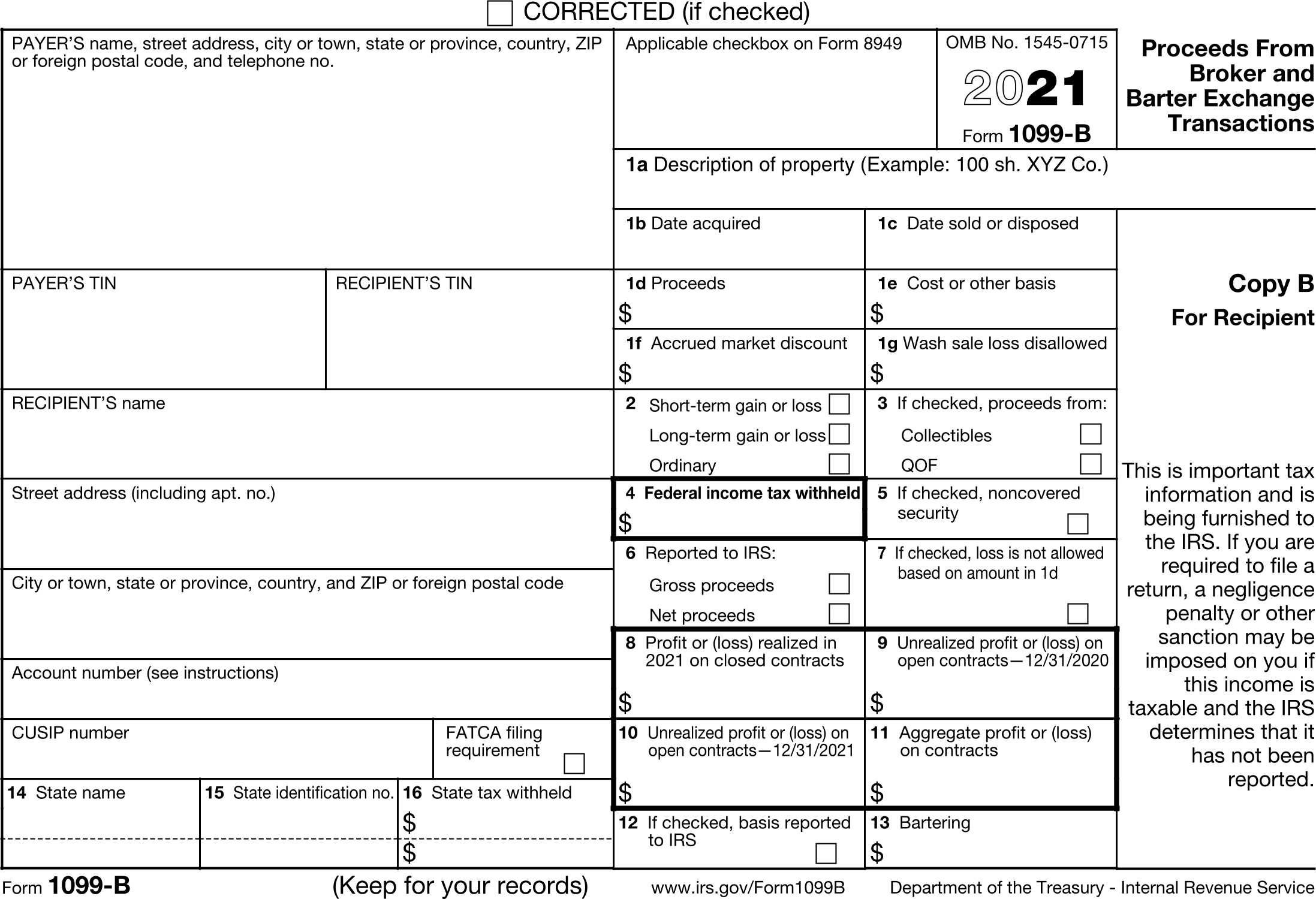

2021

- No change from 2020

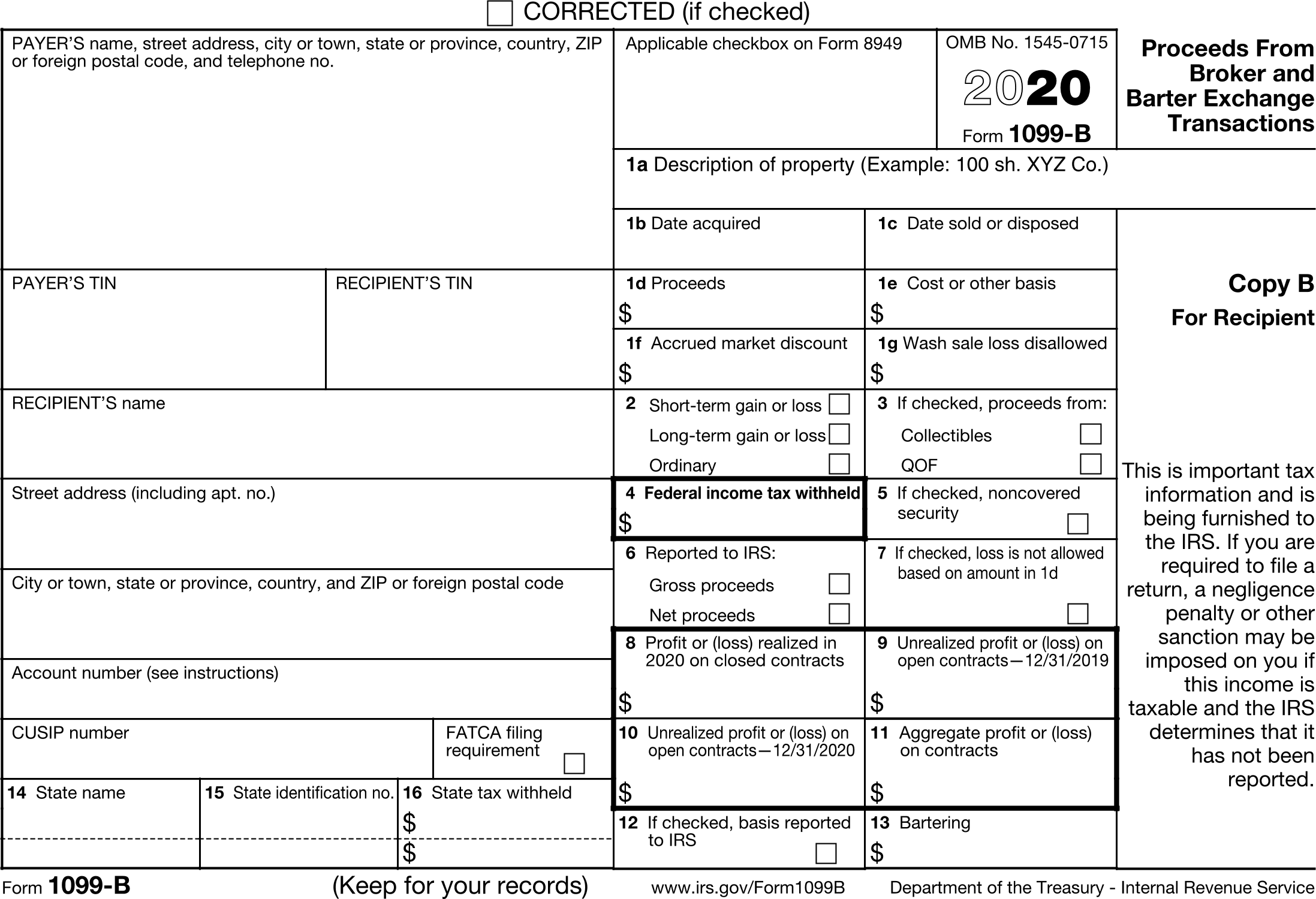

2020

- No change from 2019

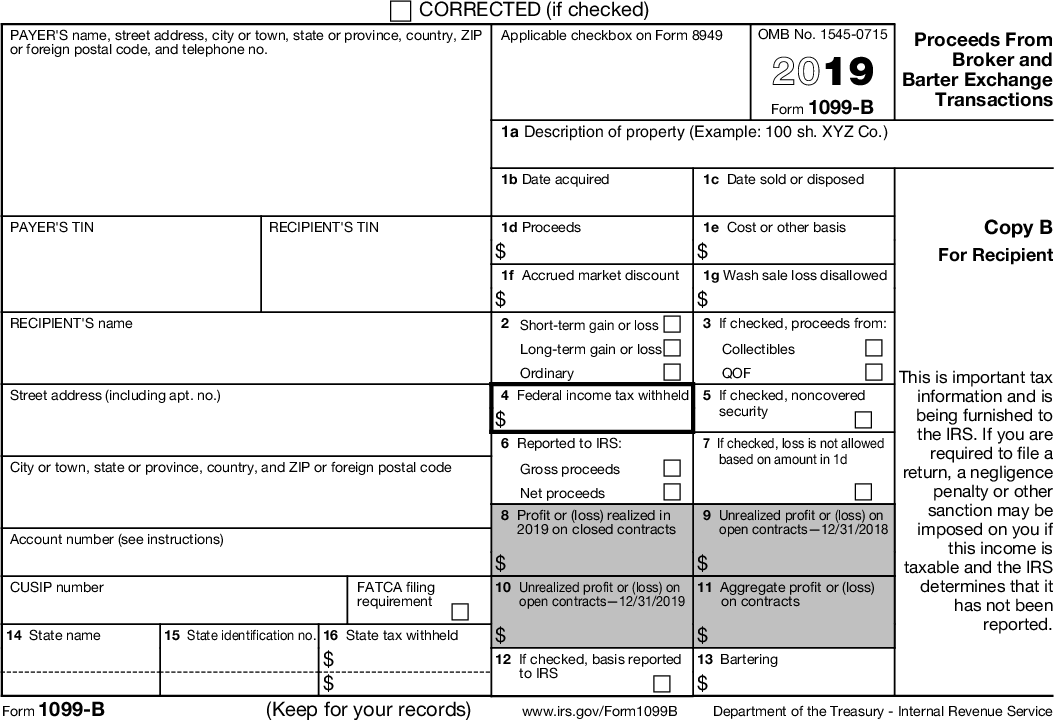

2019

- Qualified Opportunity Fund (QOF) check box added

- Various boxes rearranged

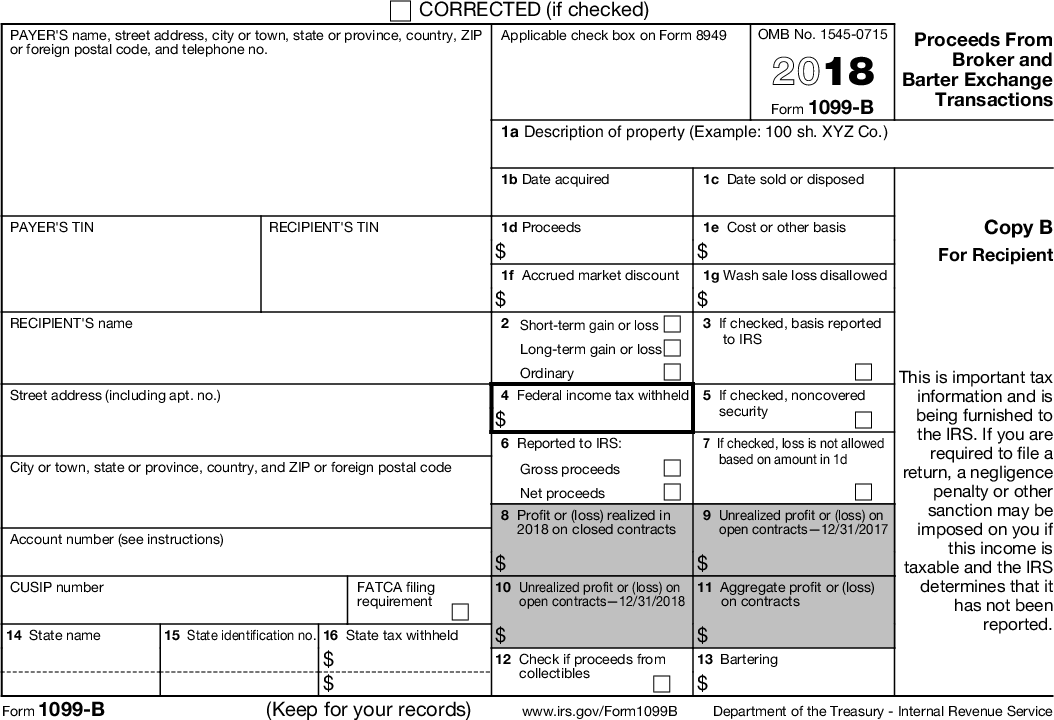

2018

- No change from 2017

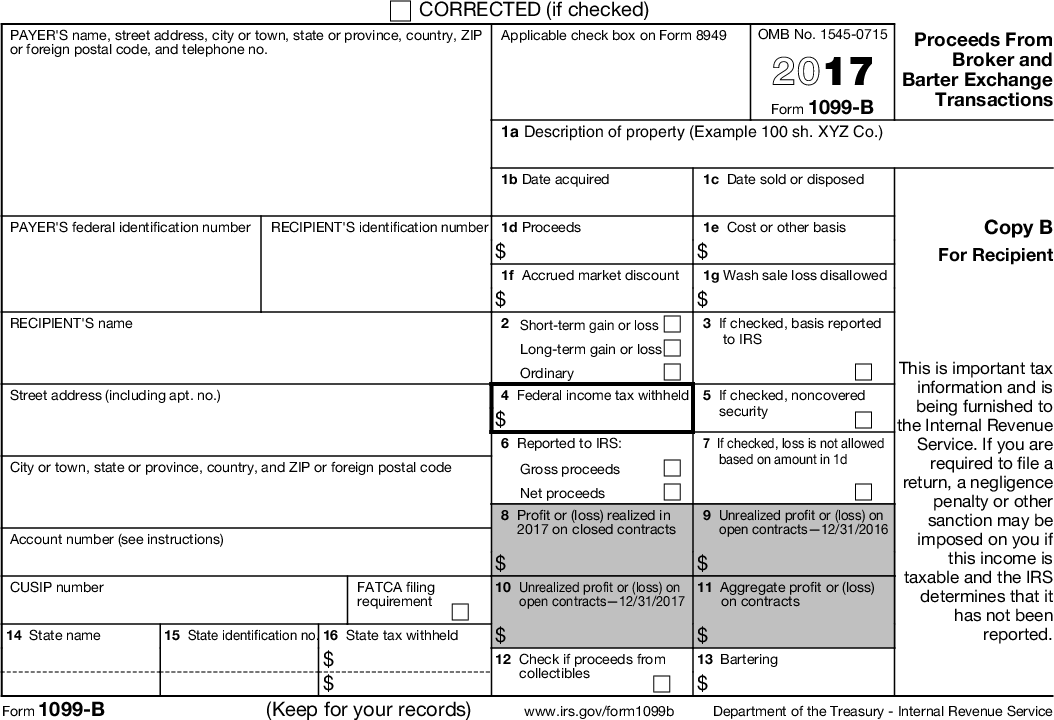

2017

- No change from 2016

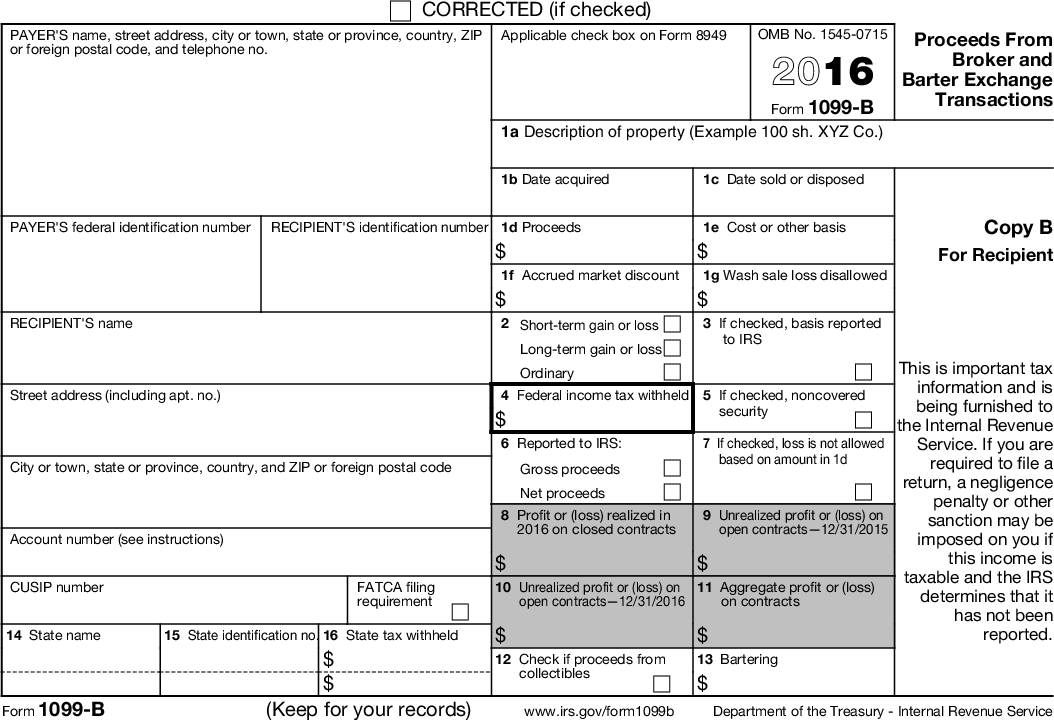

2016

- Removed: Code, if any

- Removed: Adjustments

- Added back: Wash sale loss disallowed

- Added: Accrued market discount

- Added: Ordinary

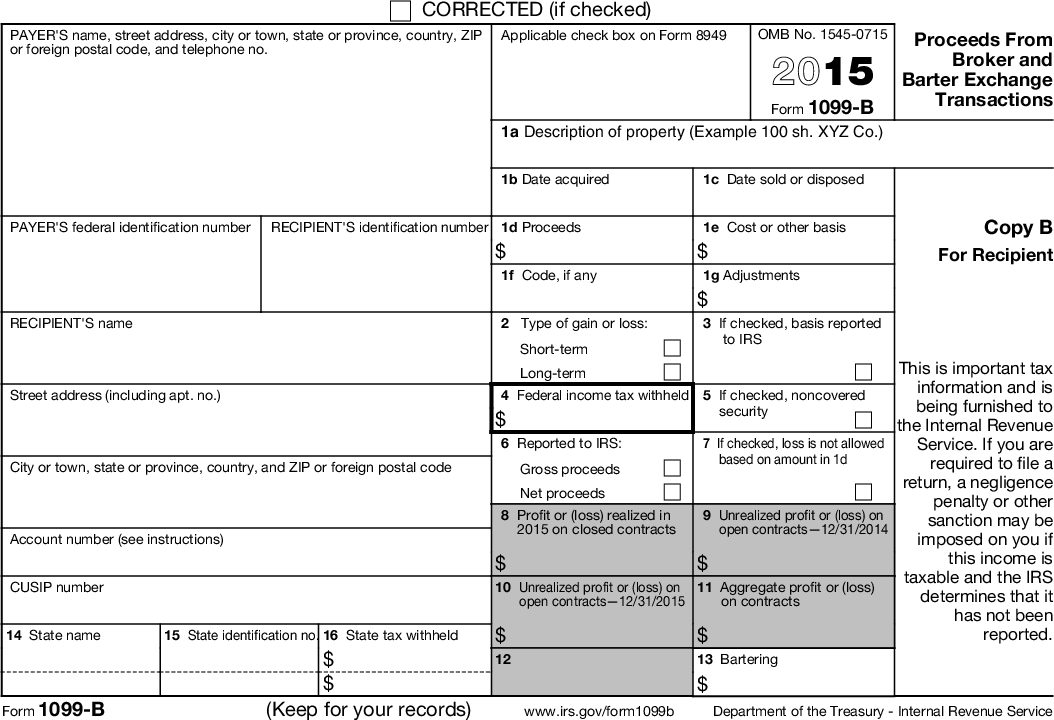

2015

- No change from 2014

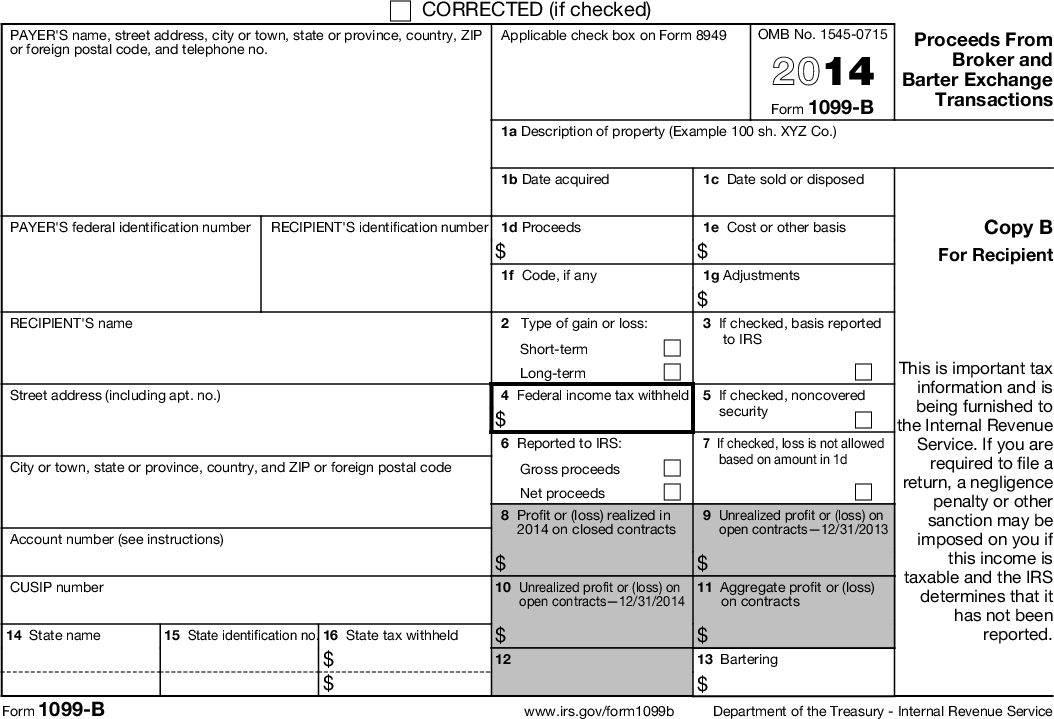

2014

- Added: Applicable check box on Form 8949

- Added: Code, if any

- Added: Adjustments

- Removed: Wash sale loss disallowed

- Removed: Stock or other symbol

- Removed: Quantity sold

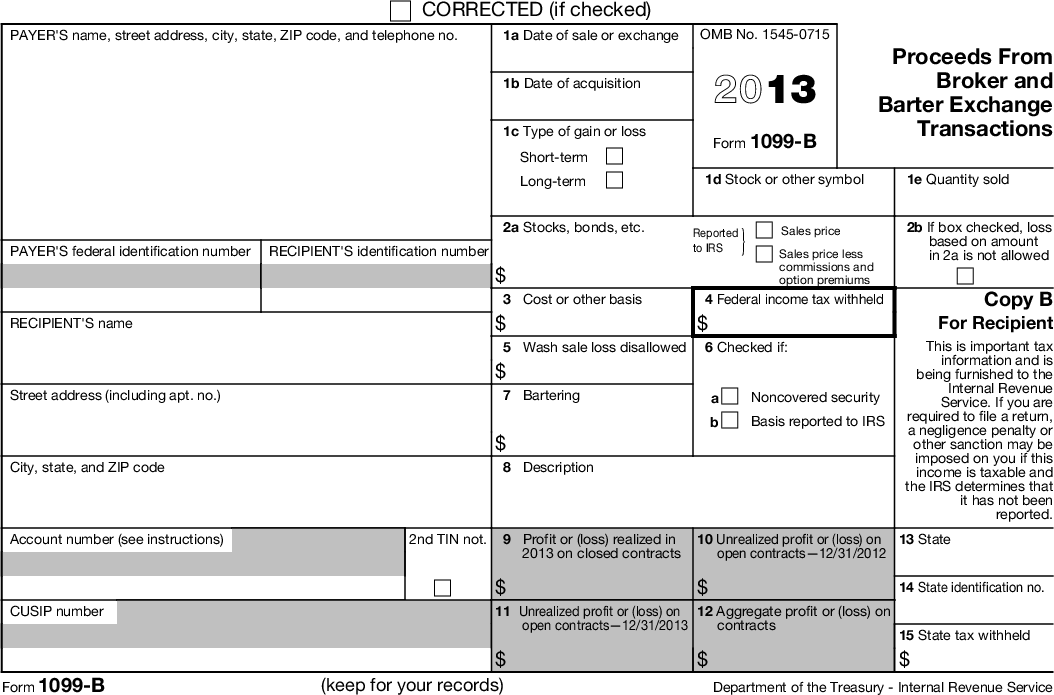

2013

- No change from 2012

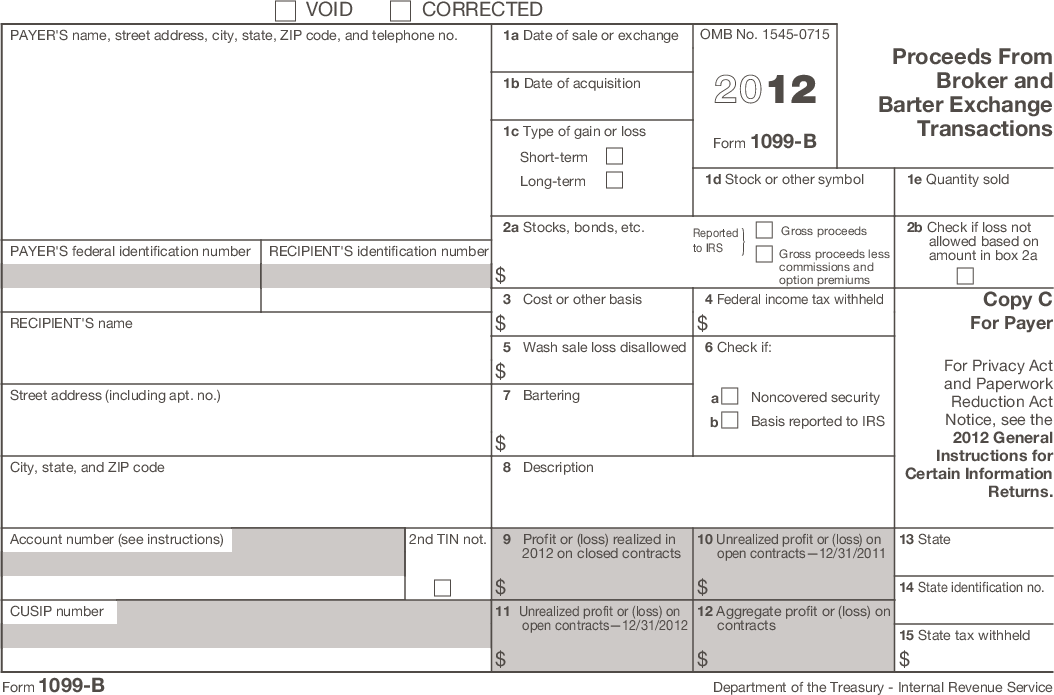

2012

- Added: Stock or other symbol

- Added: Quantity sold

- Changed: “If this box is checked, boxes 1b, 3, 5, and 8 may be blank” to “Noncovered security”

- Added: Basis reported to IRS

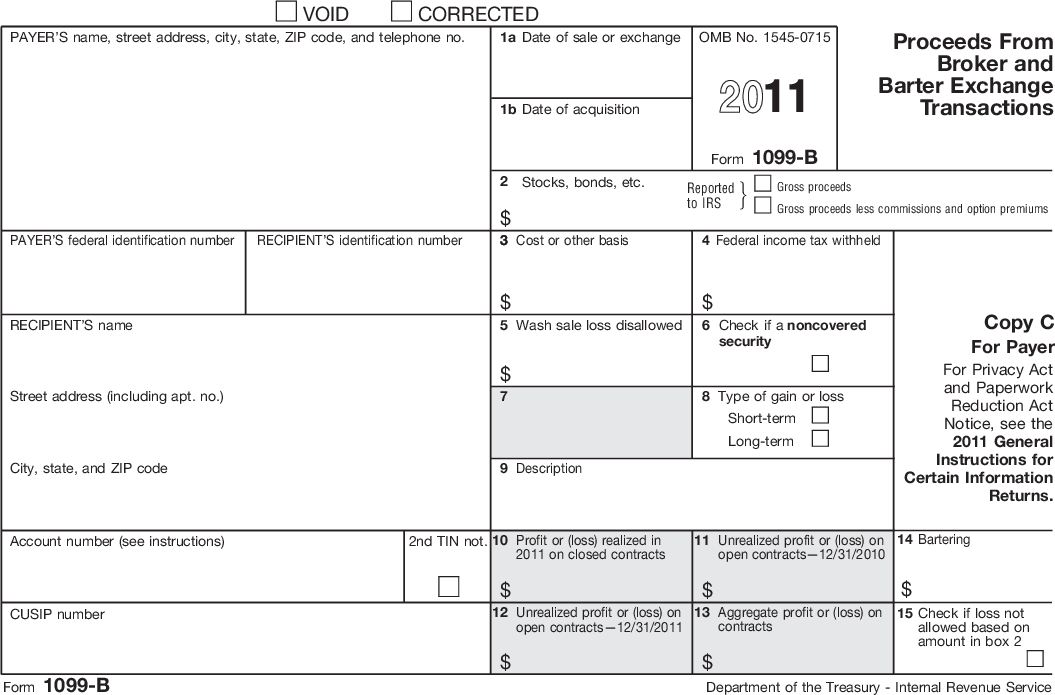

2011

- Added: Date of acquisition

- Added: Cost or other basis

- Added: Wash sale loss disallowed

- Added: Type of gain or loss

- Added: “If this box is checked, boxes 1b, 3, 5, and 8 may be blank”. Then changed to “Check if a noncovered security”.

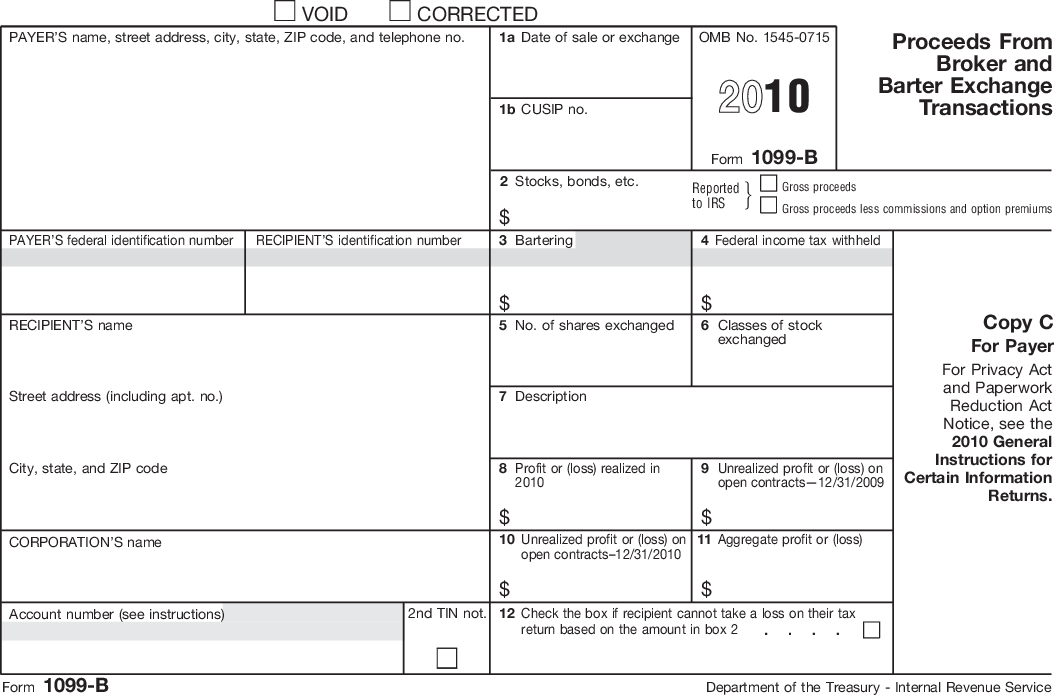

2010

- No cost or date acquired boxes in 2010 and prior years