Schwab Clients

At Form8949.com, we help you minimize the time and expense of complying with the tax reporting requirements related to your stock trading activity.

If you use a Tax Pro, you can save your tax preparer time and save tax preparation fees. If you use tax software, we can help you either (1) import your data into H&R Block, TaxAct, or TurboTax or (2) generate a PDF file for attachment to your return.

All for as little as $18.00.

1099-B XML File

Schwab provides a downloadable Extensible Markup Language (XML) file containing your Form 1099-B information.

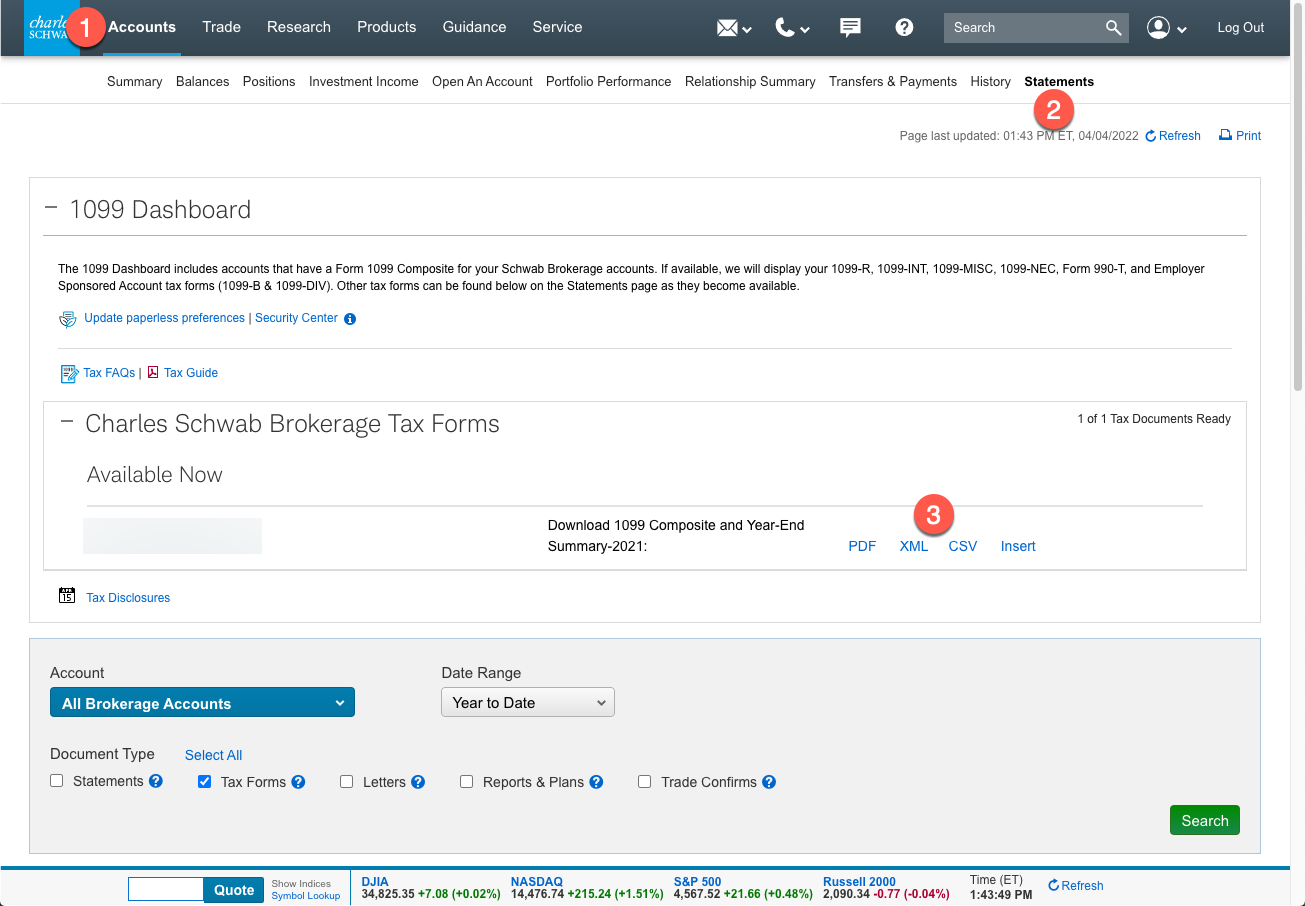

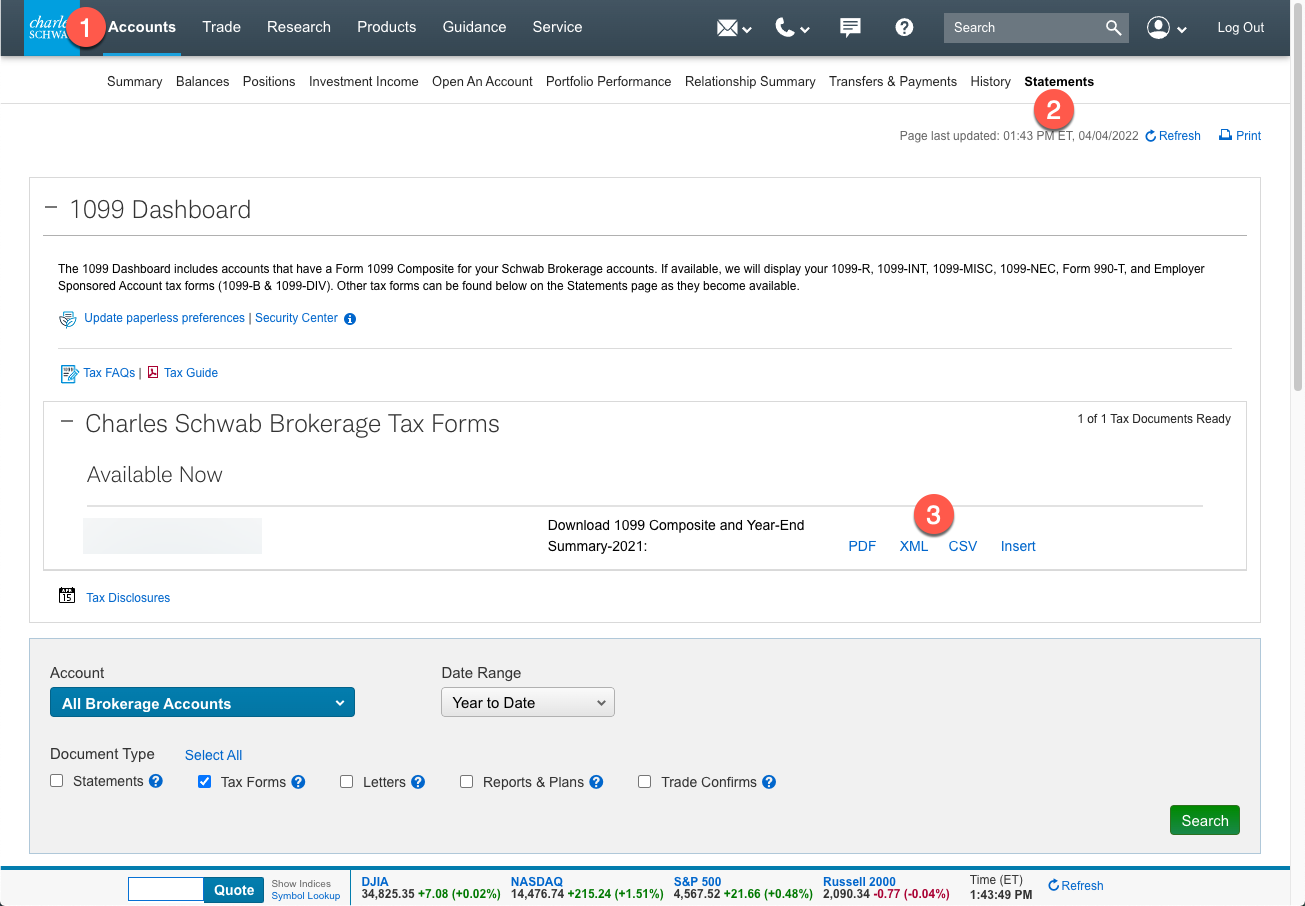

- Go to the "Accounts" Menu

- Select the "Statements" Tab

- Click the XML link to the right of "Download 1099 Composite and Year-End Summary-20xx"

A "XXXX-1234.xml" file (where 1234 is the last 4 digits of your account number) will download to your system. Save the file to your Downloads, Desktop or other folder.

See the screen shot below.

1099-B CSV Download

Schwab provides a downloadable CSV file containing your Form 1099-B information.

- Go to the "Accounts" Menu

- Select the "Statements" Tab

- Click the CSV link to the right of "Download 1099 Composite and Year-End Summary-20xx"

A "XXXX-1234.csv" file (where 1234 is the last 4 digits of your account number) will download to your system. Save the file to your Downloads, Desktop or other folder.

See the screen shot below.

1099-B Portable Document Format (PDF)

You may download your Schwab 1099 Composite and Year-End Summary PDF file and submit it for processing.

Open Financial Exchange (OFX) Server

Schwab hosts an OFX server. However, they restrict access to the server such that we cannot retrieve your data in your bahalf.

If you have additional or newer information regarding Schwab downloadable files, please email us at support@form8949.com .

Try Then Buy

The Form8949.com app helps you self-prepare your 2025 or prior year:

- Form 8949

- Form 8949 Exception 2 Statement

- Schedule D

- Form 4797, if applicable

The app can also help you import your data into tax software applications.

You don't pay until after you review and approve our web application results.