Form 8949 Exception 2 When Electronically Filing Form 1040

When you choose to use Form 8949 Exception 2 and electronically file your income tax return, you have 2 options:

Option 1: Mail Transmittal and Exception 2 Statement

As seen on transmittal Form 8453 below, Form 8949 Exception 2 Statements are among the paper documents you may mail to the IRS service center in connection with your electronically filed income tax return.

The IRS instructions to Form 8453 include the following:

If you are filing your tax return using an online provider,

mail Form 8453 to the IRS within 3 business days after

you have received acknowledgement...

Mail Form 8453 to:

Internal Revenue Service

Attn: Shipping and Receiving, 0254

Receipt and Control Branch

Austin, TX 73344-0254

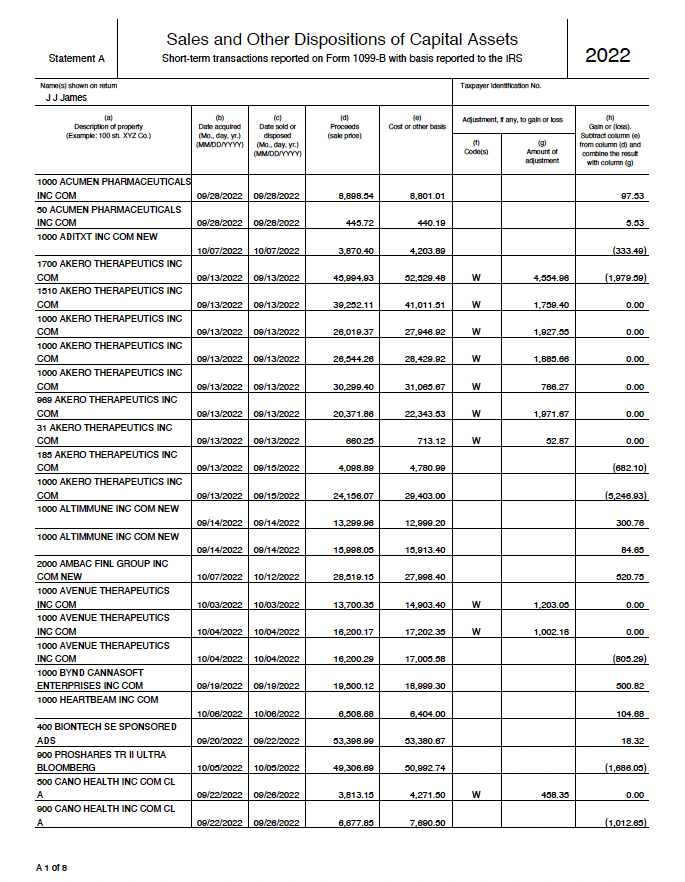

To minimize paper, our Form 8949 Statements include 49 transactions per page.

You may print these statements on both sides of sheets of paper if your printer supports duplex printing.

Option 2: Attach Exception 2 Statement PDF to Your Electronic Tax Return

The IRS electronic filing system allows for inclusion of PDF files with the electronic tax return submitted to the IRS.

Some tax software applications take advantage of this and allow you to upload your PDF file for electronic attachment. In this case, there is no need to mail paper to the IRS.

| Tax Software | Allows PDF Attachment | Does Not Allow PDF Attachment | Restrictions |

|---|---|---|---|

| Free Tax USA |

|

||

| H & R Block |

|

||

| OLT Online Taxes | UNKNOWN | ||

| TaxAct |

|

PDF file size limited to 3 Megabytes (2 MB if Desktop) | |

| Tax Slayer | UNKNOWN | ||

| TurboTax Desktop (Mac, Windows) |

|

||

| TurboTax Online (Premier) |

|

If you have information about other tax software applications or tax software capabilities above shown as UNKNOWN, please email us at support@form8949.com.