What is Capital Gains Tax?

Income tax is assessed on taxable income including gains from the sale of capital assets.

The term "capital gains tax" is often used because the income tax rate applied to the gain on the sale of capital assets held over one year (long-term capital gains) is different than the rate on other taxable income. See the Capital Gains Tax Rates page on this site.

The following 5 tax forms are used in connection with the reporting of the sale of capital assets and the calculation of tax on long-term capital gains:

Form #1:

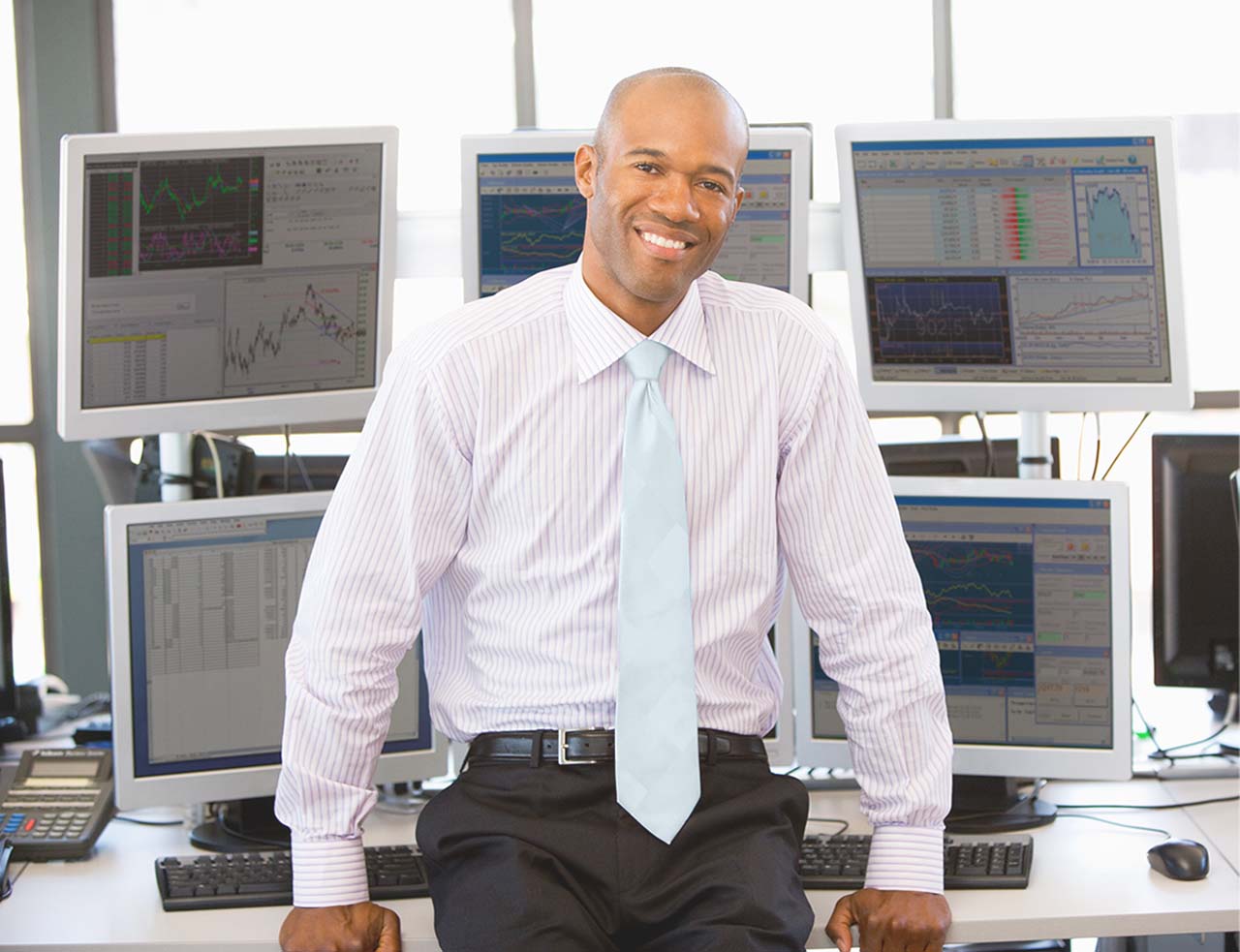

Form 1099-B,

Proceeds From Broker Transactions

At the end of each year, your broker supplies you with Form 1099-B or a substitute statement, as required by the IRS.

This information forms the basis for your reporting of your sales and the resulting gains or losses on IRS Form 8949.

Your broker may also supply you with a computer-readable file of your 1099-B data. See this discussion of broker 1099-B data files.

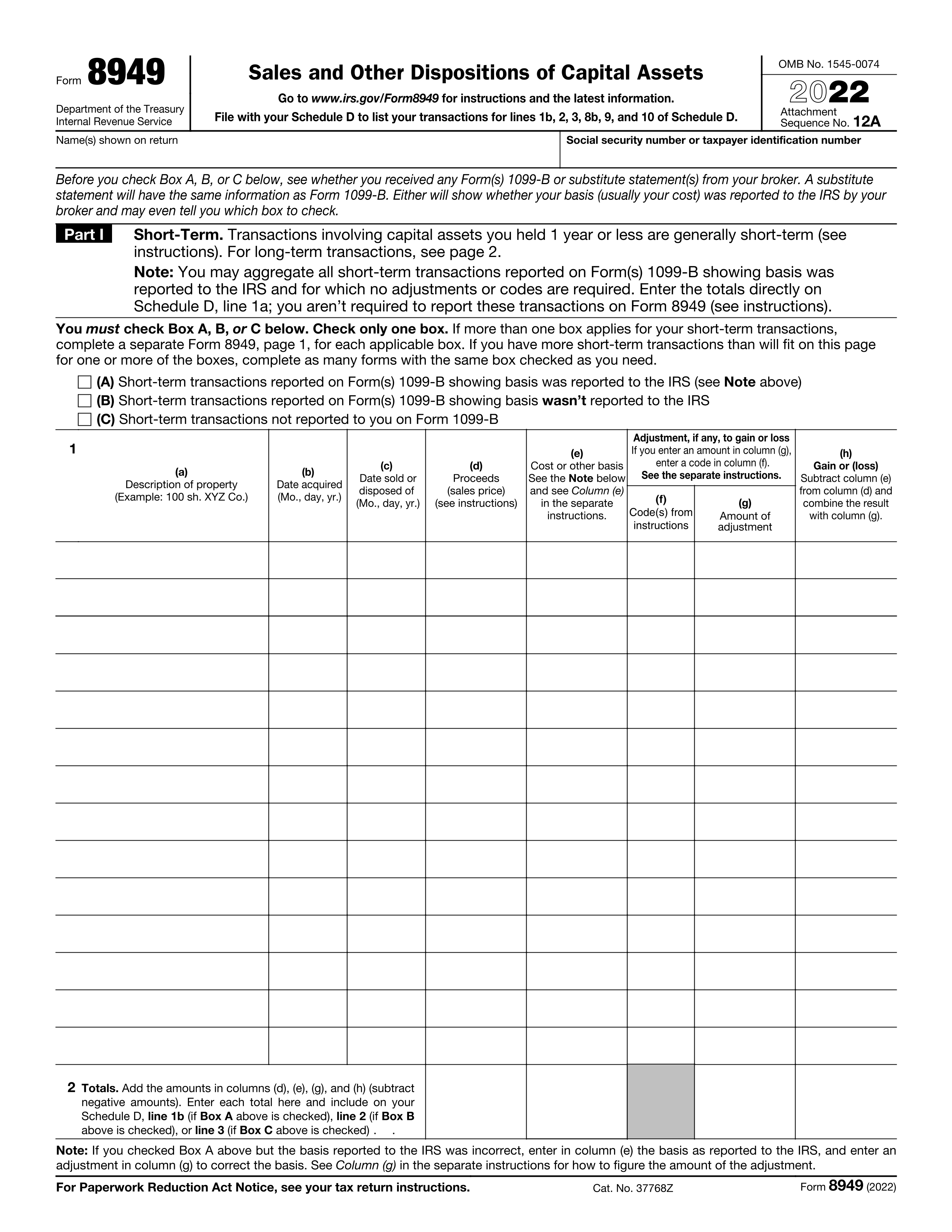

Form #2:

Form 8949,

Sales and Other Dispositions of Capital Assets

Using your Form 1099-B data as source, you report each of your sales on a line of Form 8949, as a general rule.

But there are 2 "exceptions" to this rule. For more information, see an explanation of "Exception 1" and "Exception 2".

Depending on certain criteria, up to 6 different copies of Form 8949 are required. The IRS requires that sales be grouped into 6 different groups and reported on separate copies of Form 8949.

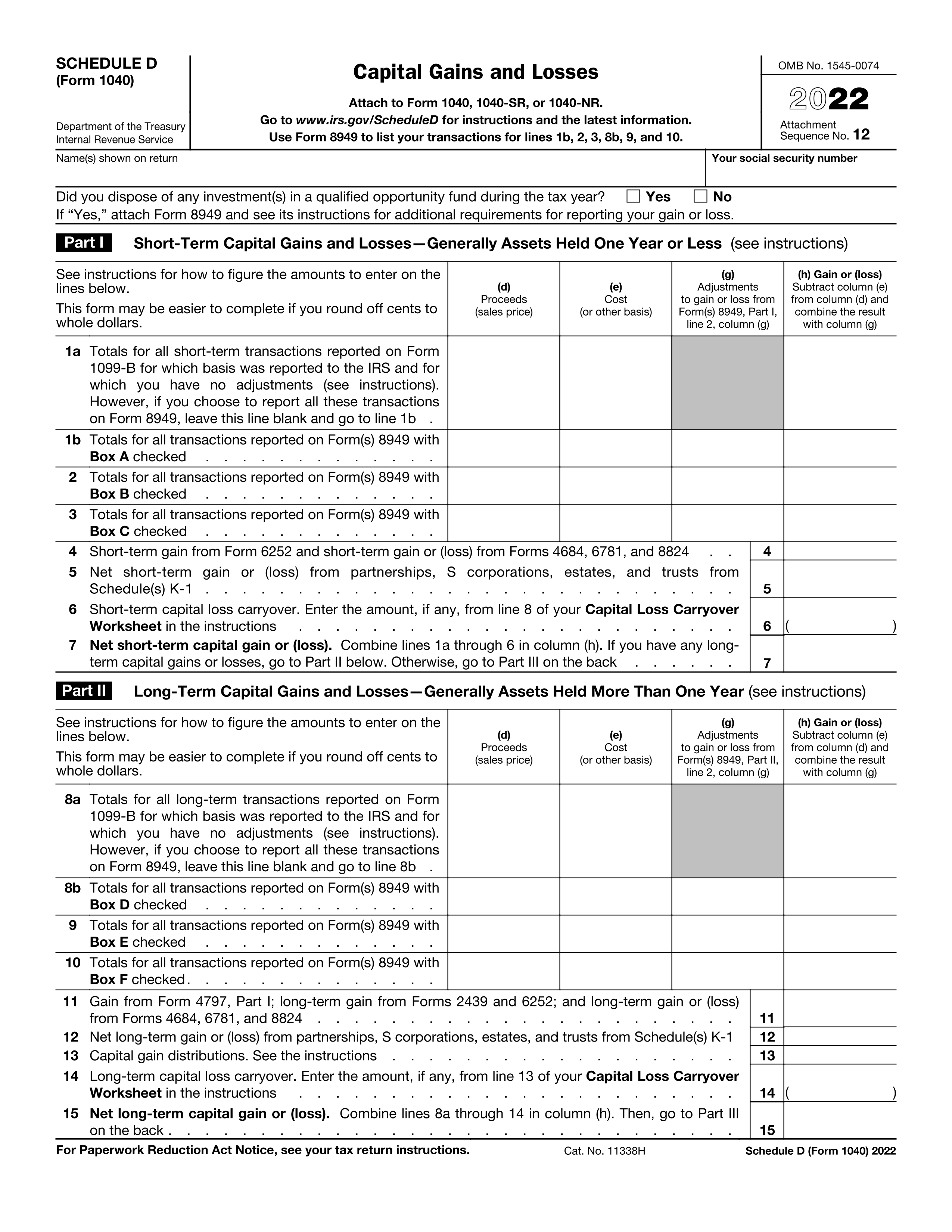

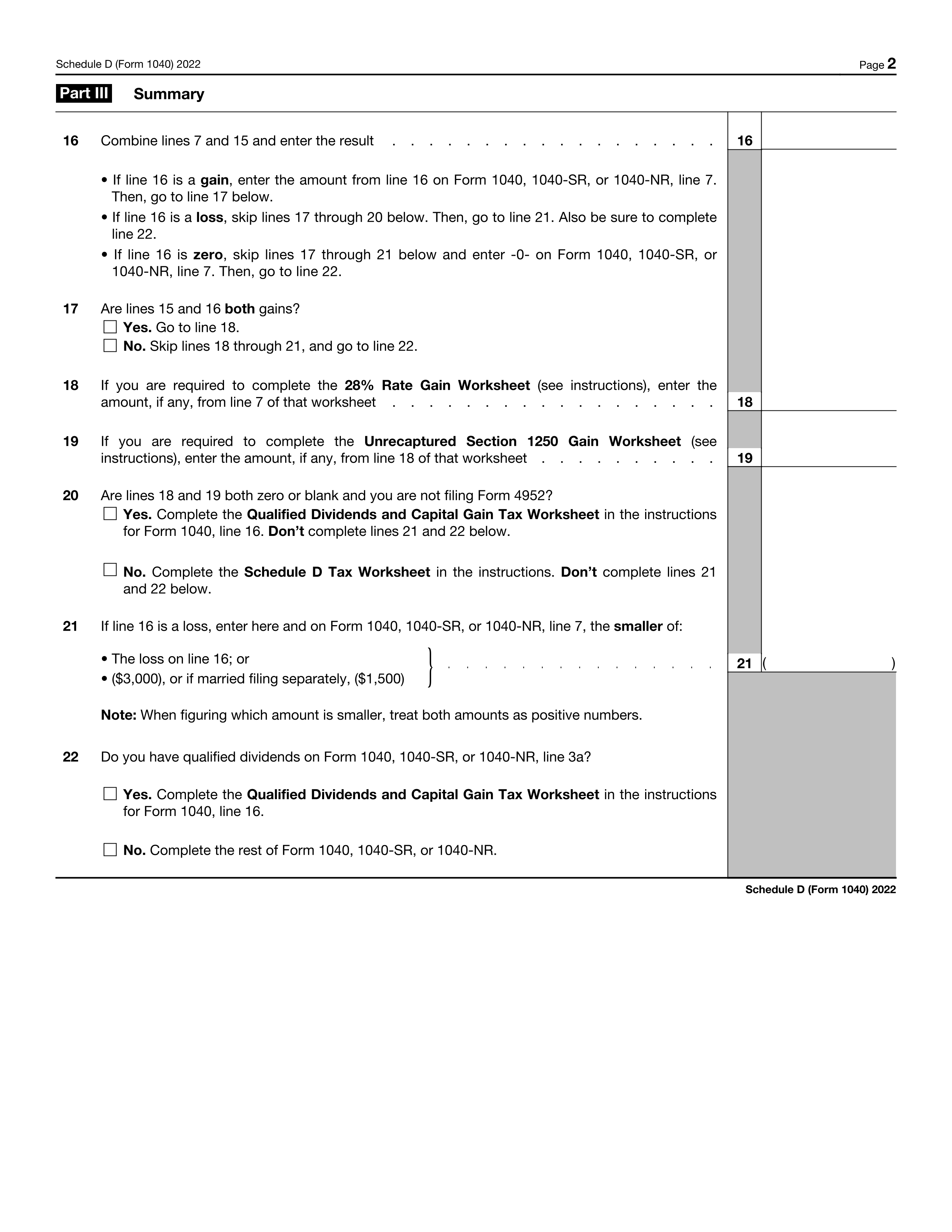

Form #3:

Schedule D,

Capital Gains and Losses

The total of gains and losses reported on Form 8949 are shown on Schedule D, lines 1b, 2, 3, 4, 8b, 9, 10, and 11.

The totals from other forms and schedules are also reported here.

Schedule D combines your gains and losses into one value shown on line 16.

Form #4:

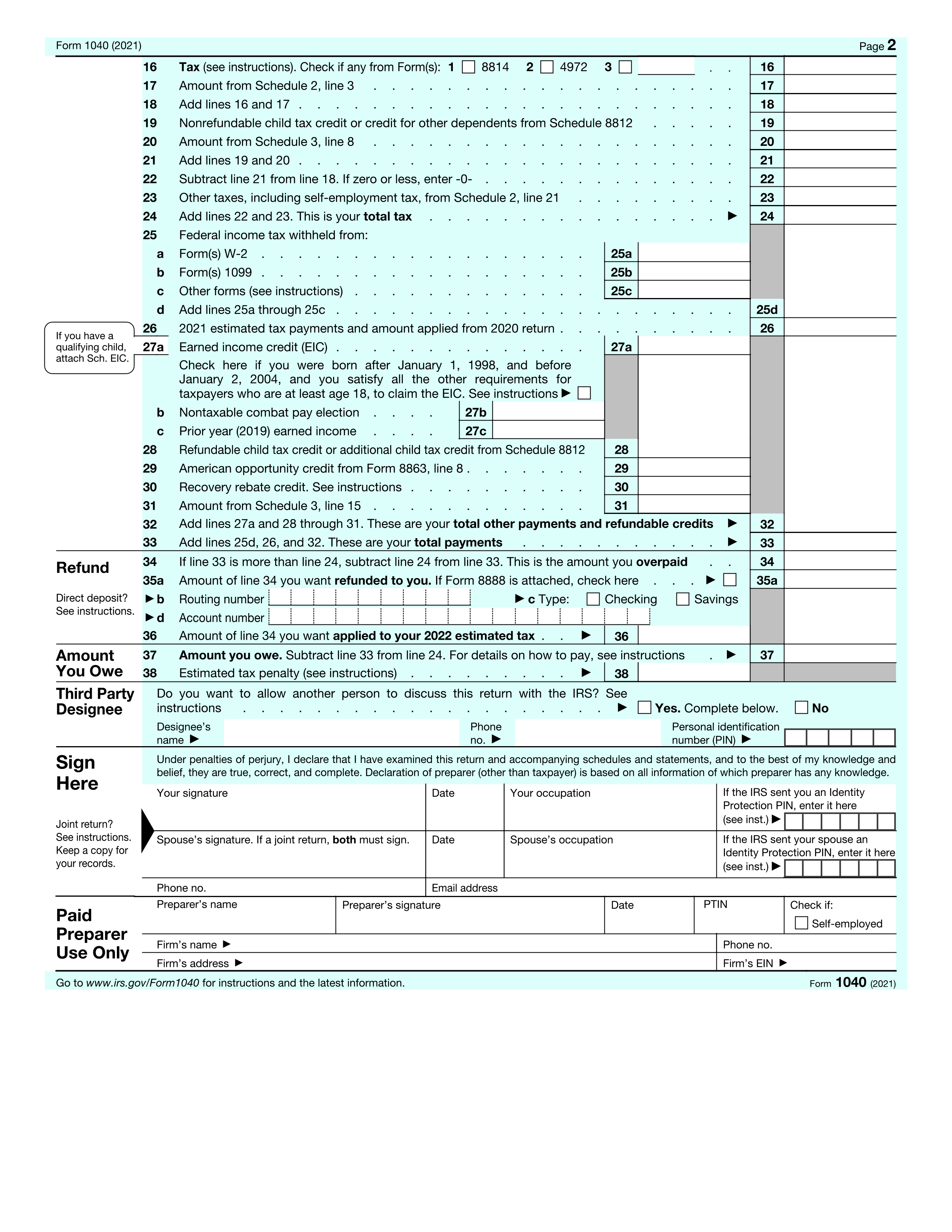

Form 1040, U.S. Individual

Income Tax Return

Your income tax is computed and entered on line 16 of page 2 of Form 1040.

The tax computation itself is done using the Schedule D Tax Worksheet. See below.

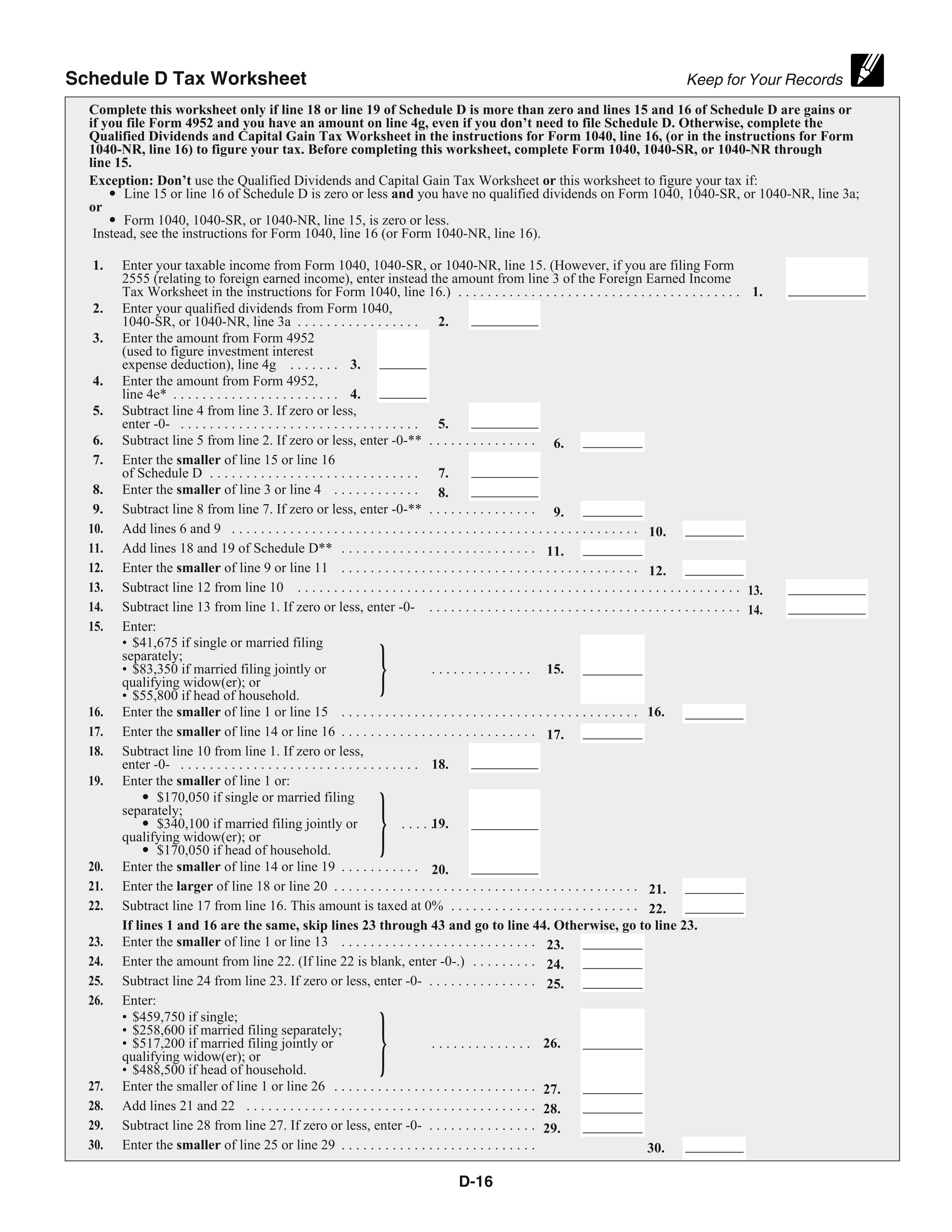

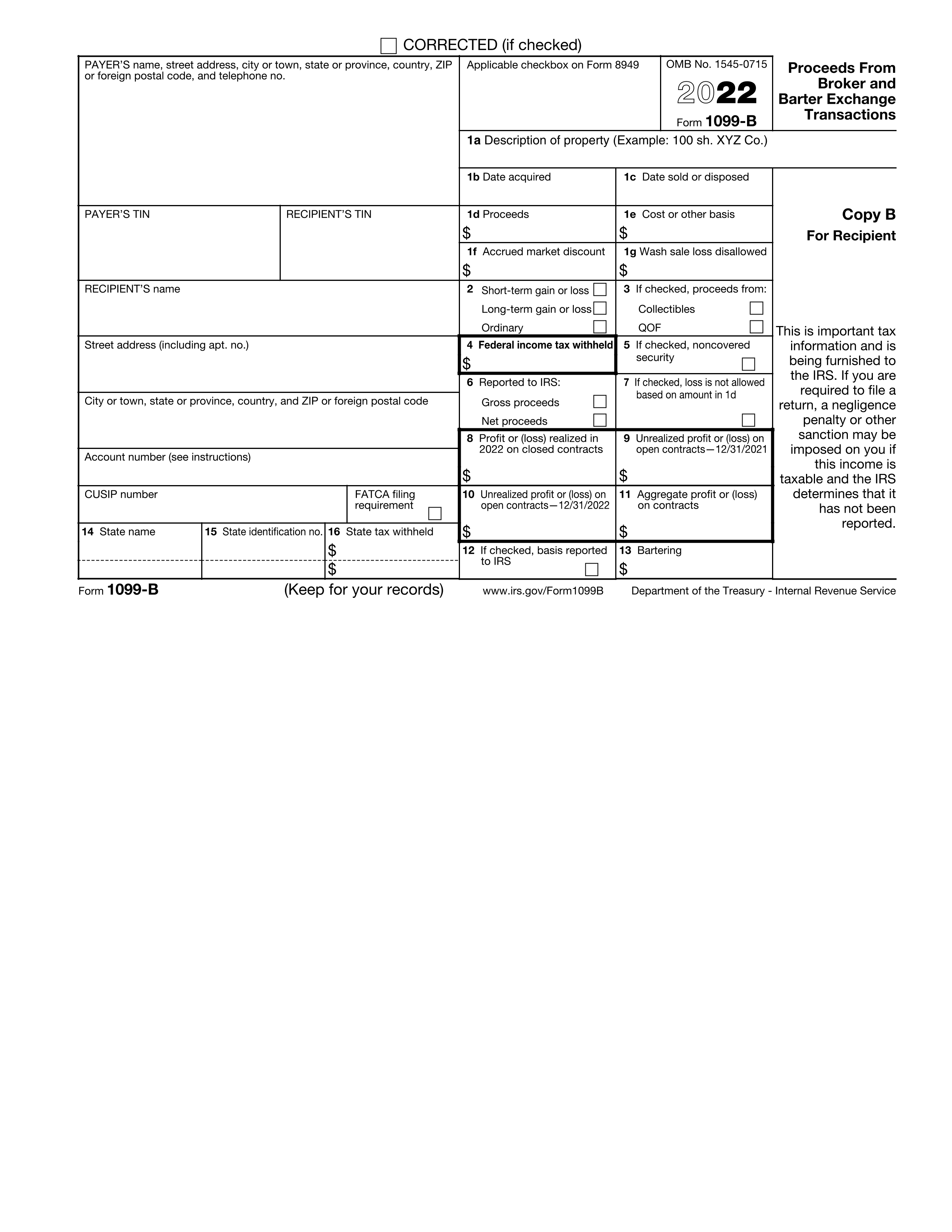

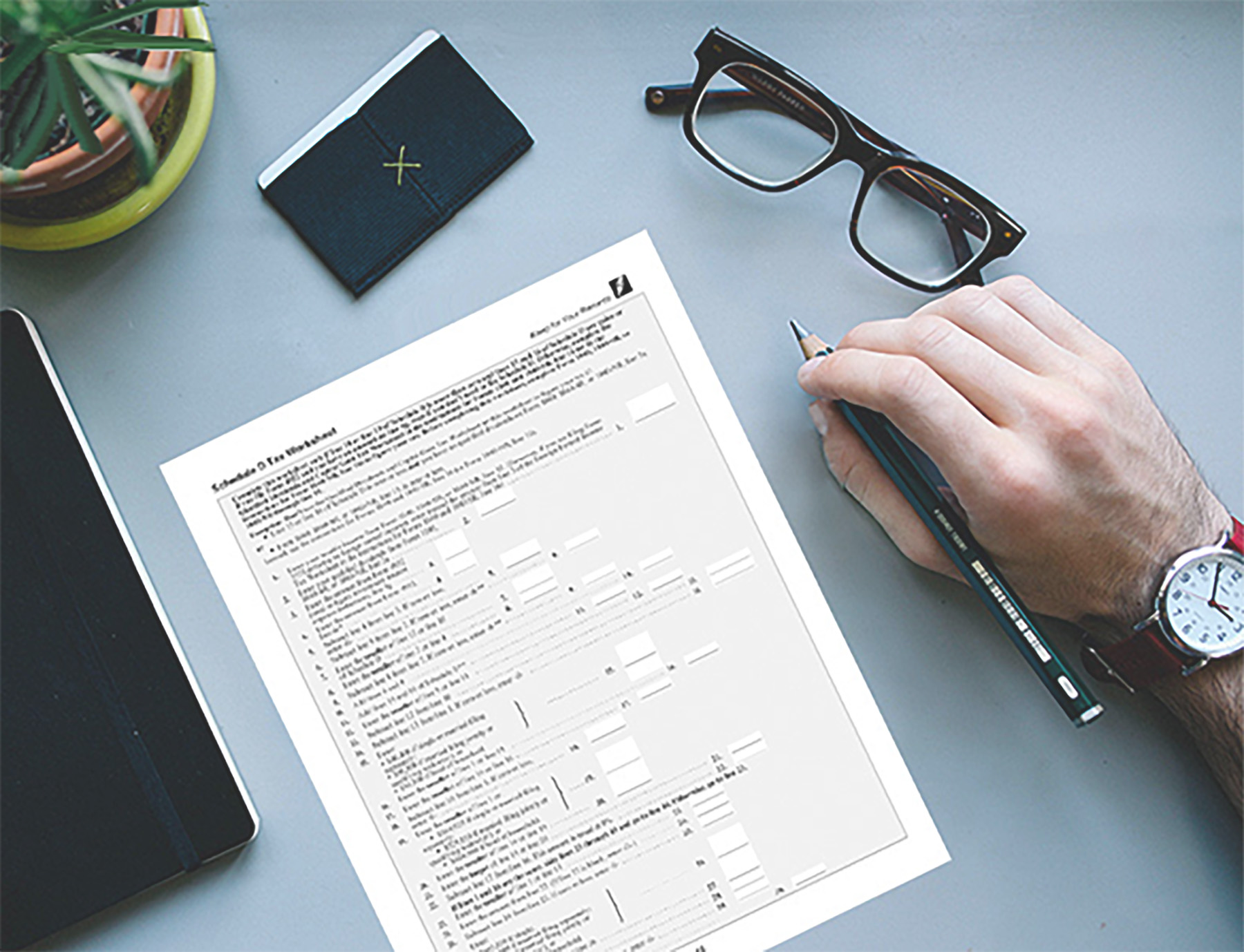

Form #5:

Schedule D Tax Worksheet

This 47-line worksheet is required to compute your tax including your "capital gains tax".

It takes into account:

- filing status

- overall taxable income

- net long-term capital gains

- qualified dividends

- net gains from certain real estate and

- net gains from collectibles