Turbo Tax Online E-File Attachment Workaround

Importing your summary transactions and attaching the required PDF attachment involves the following 10 steps:

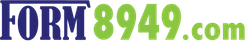

STEP 1: Import your summary transactions into TurboTax by entering in the "Tax Document ID" and passcode shown in our app and clicking the "Get my form" button.

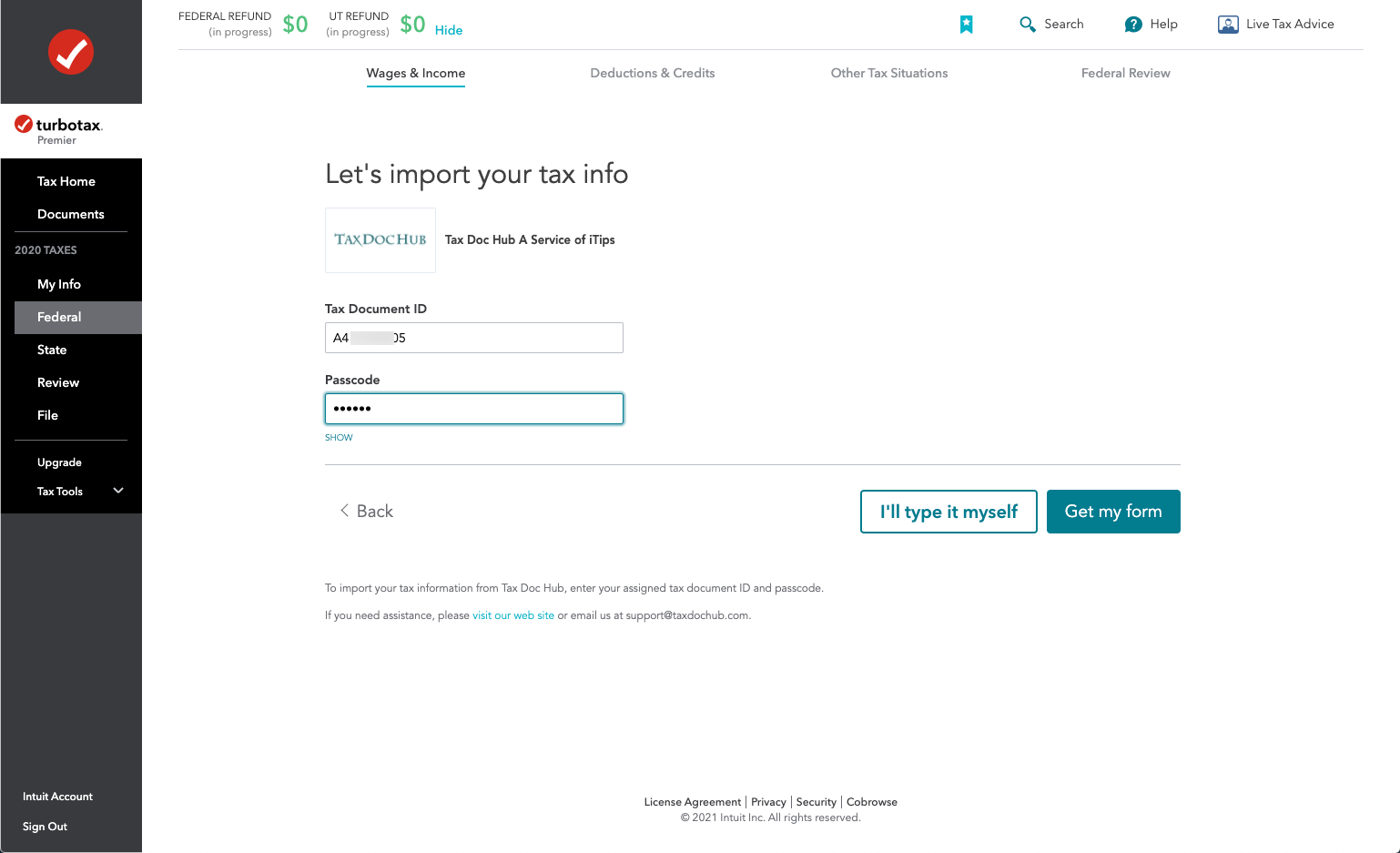

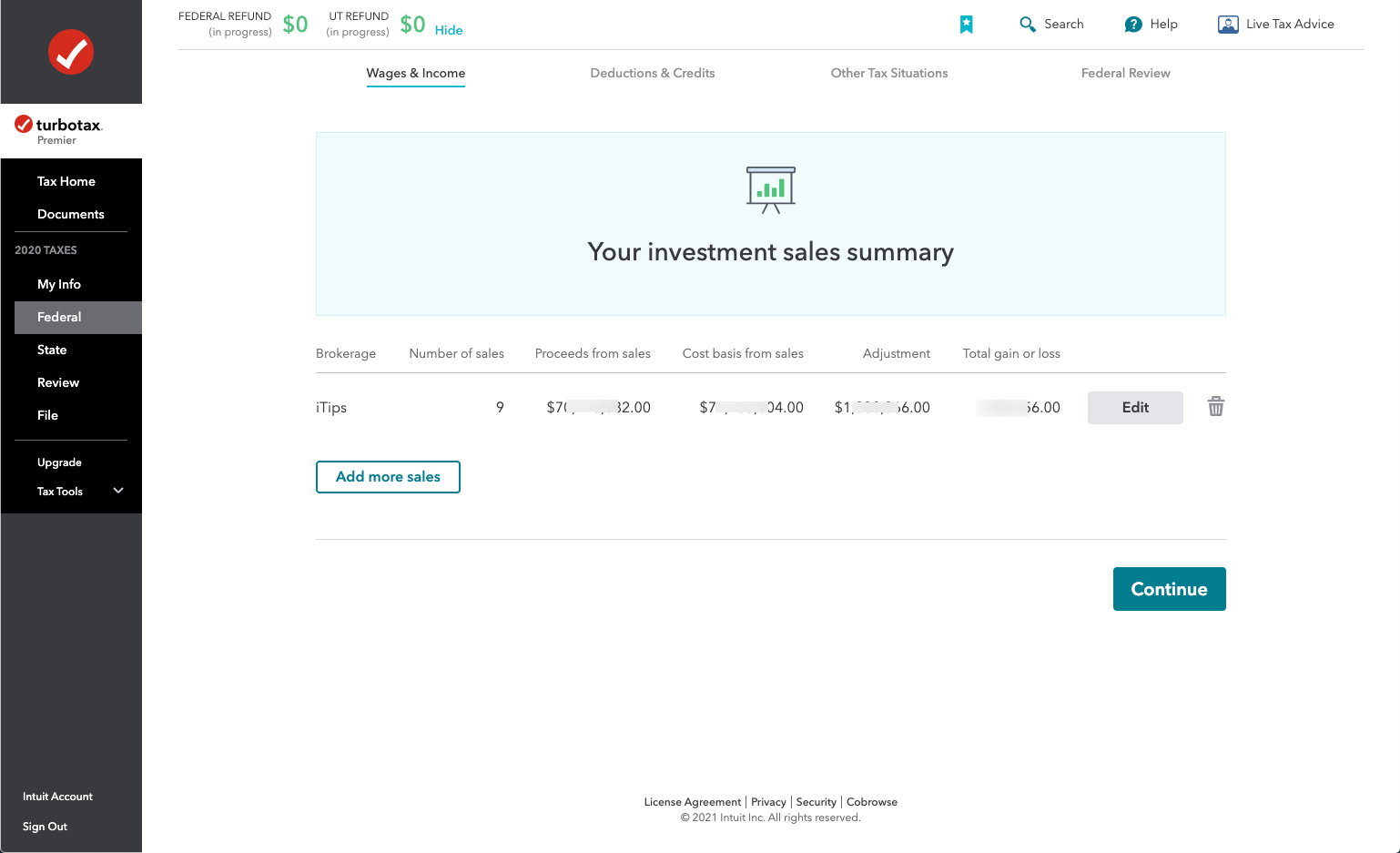

STEP 2: The import should take less than 30 seconds. Then click "Continue".

STEP 3: At this point, your totals are included in your tax return. But, to add your PDF attachment, you need to get to the screen where you can upload your PDF file. This will require a workaround described below. Click the "Add more sales" button.

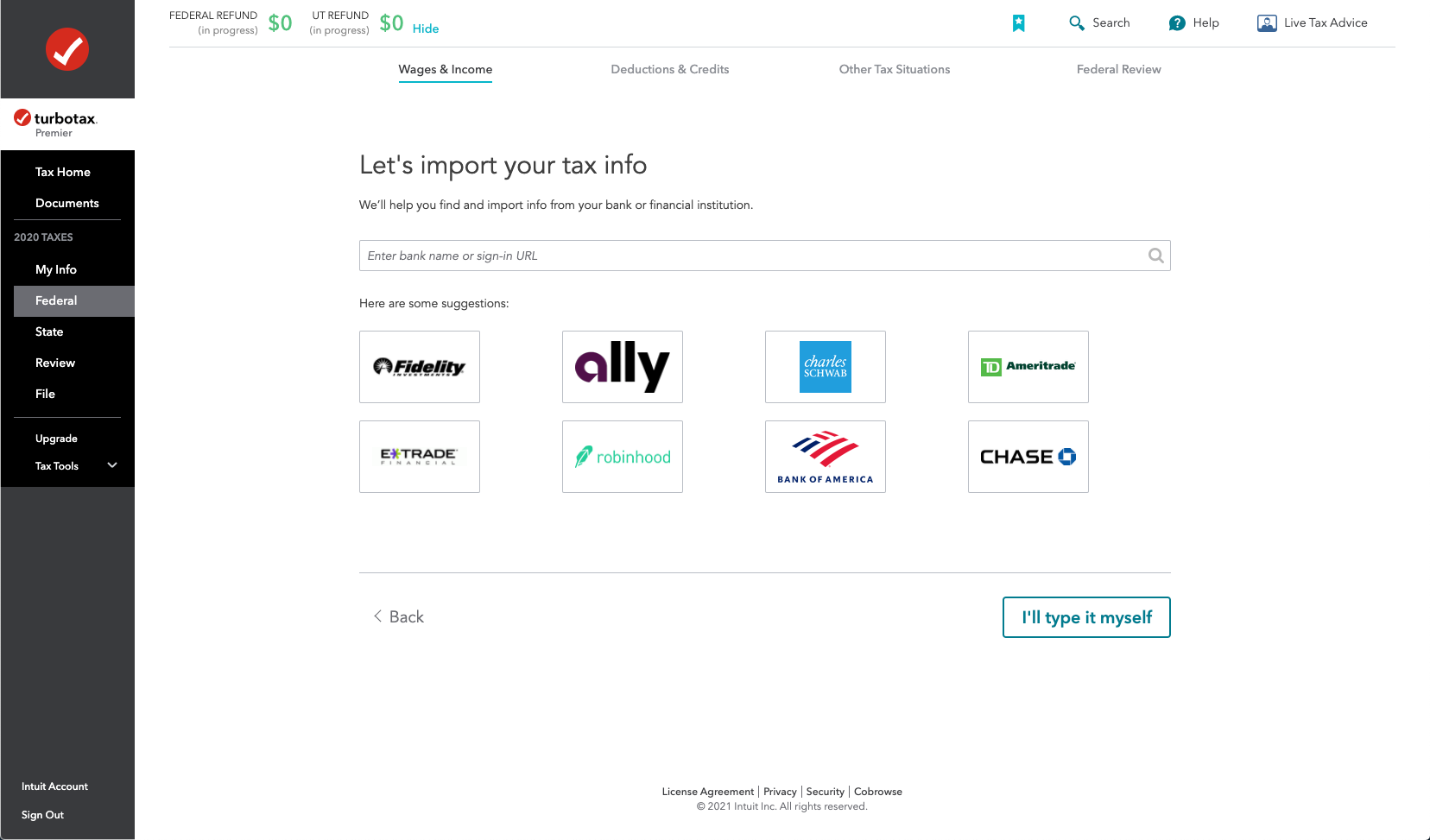

STEP 4: Click the "I'll type it myself" button.

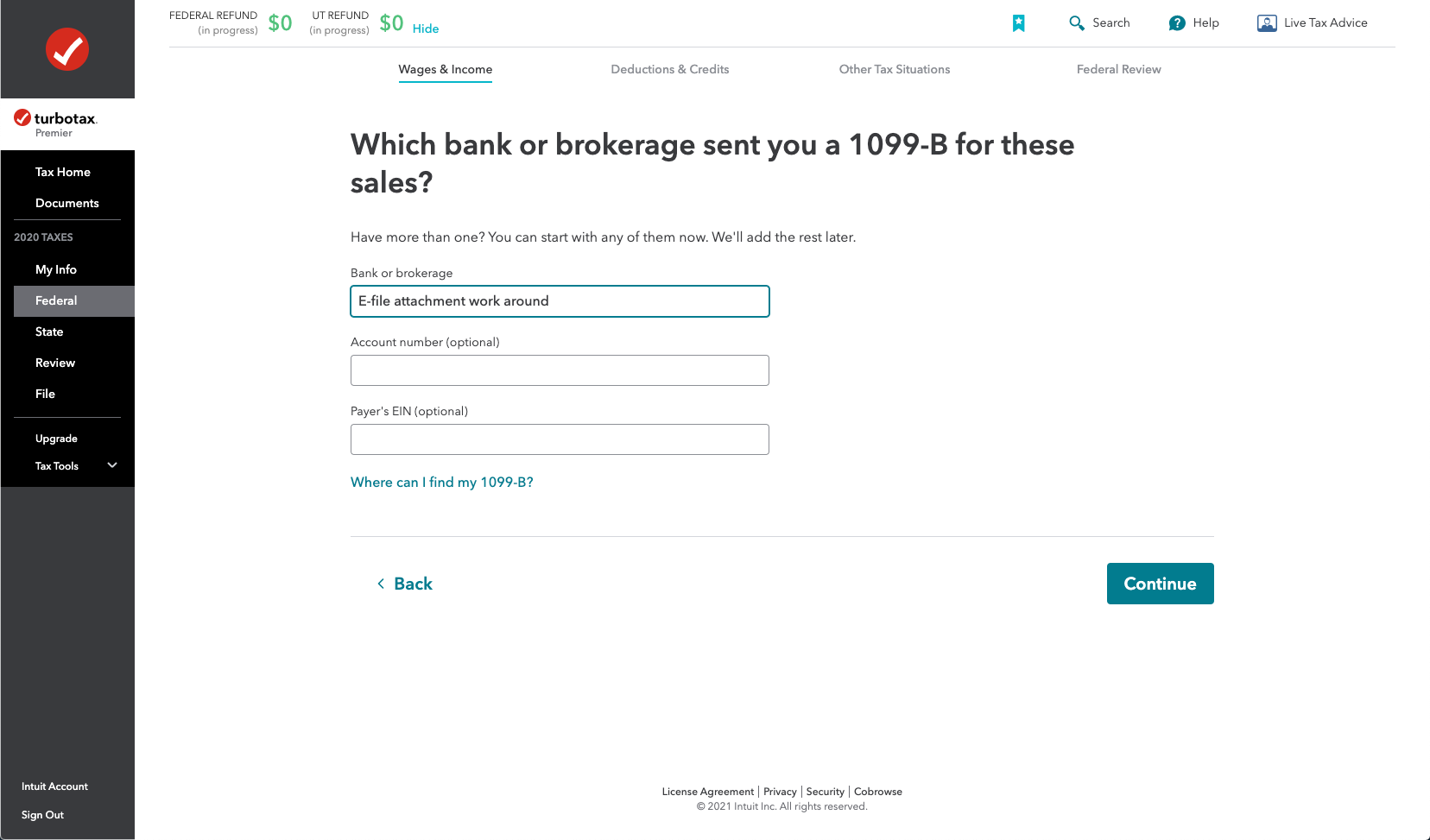

STEP 5: On this screen you can type whatever you want under "Bank or Brokerage" but we recommend you enter something like "E-file attachment workaround" to clue anyone who reviews the return into why this entry is being made. Then click "Continue".

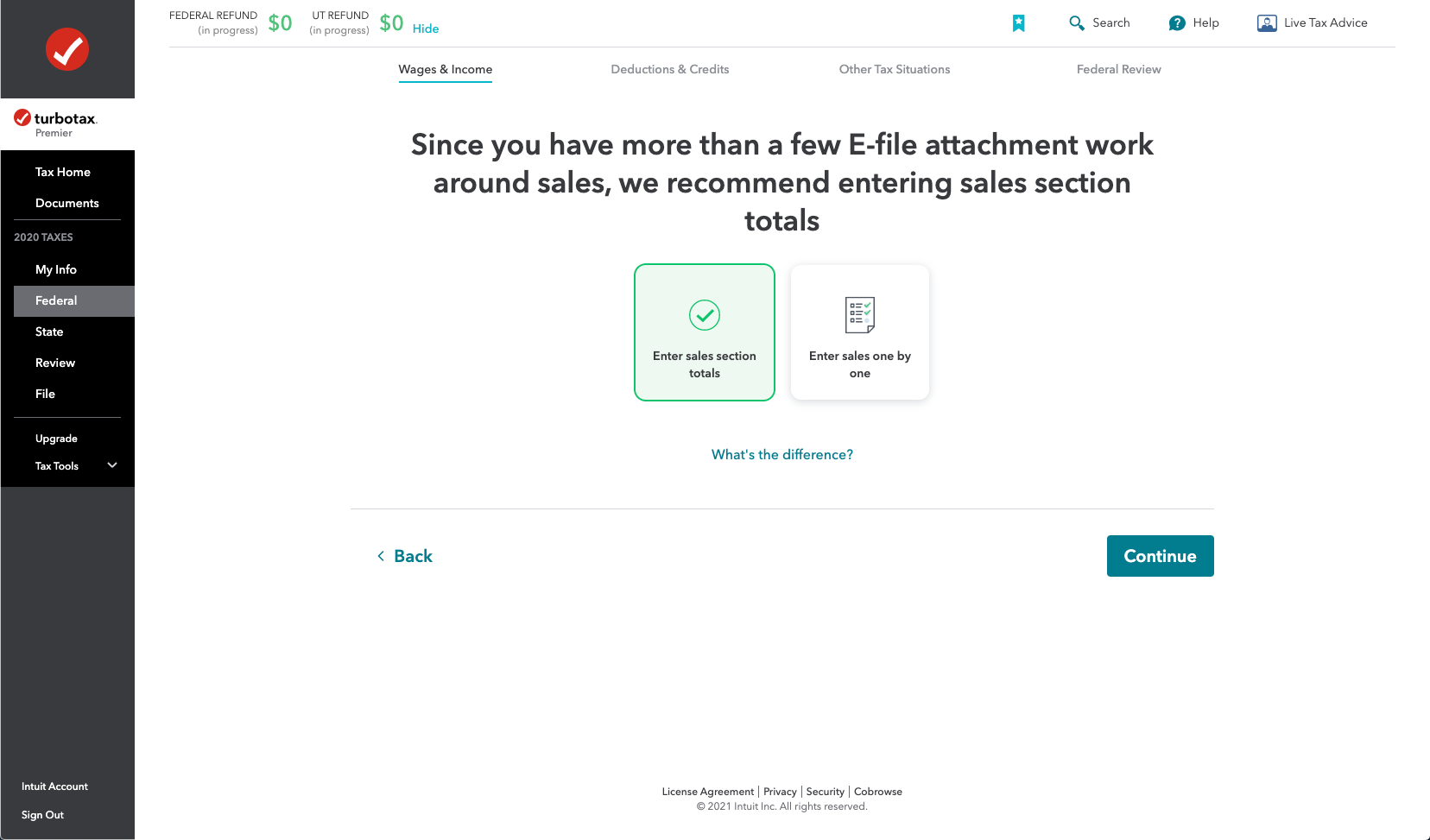

STEP 6: Answer the various questions until you get to this screen. Select "Enter sales section totals". Then click "Continue".

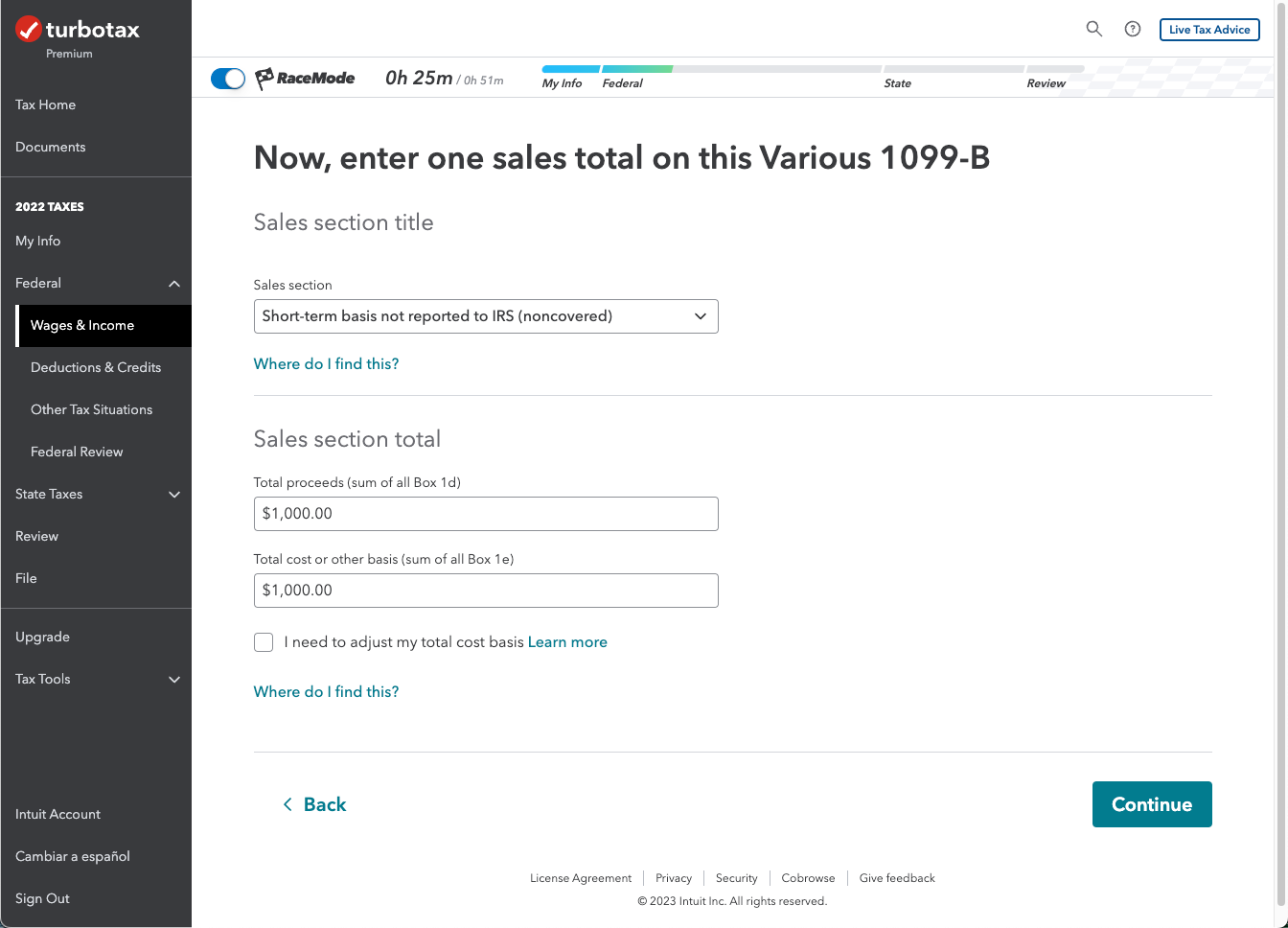

STEP 7: At this point you have to enter a "dummy" summary transaction. Because your real data is already included, we need a zero-gain transaction.

- For "Sales section" select "Short-term basis not reported to IRS (noncovered)". If you select "covered" this will not work.

- Enter a total proceeds of some value. We recommend something more than zero so the program won't issue warnings or errors later in the process.

- Enter a total cost of the same value so that the net gain is zero.

- Click "Continue"

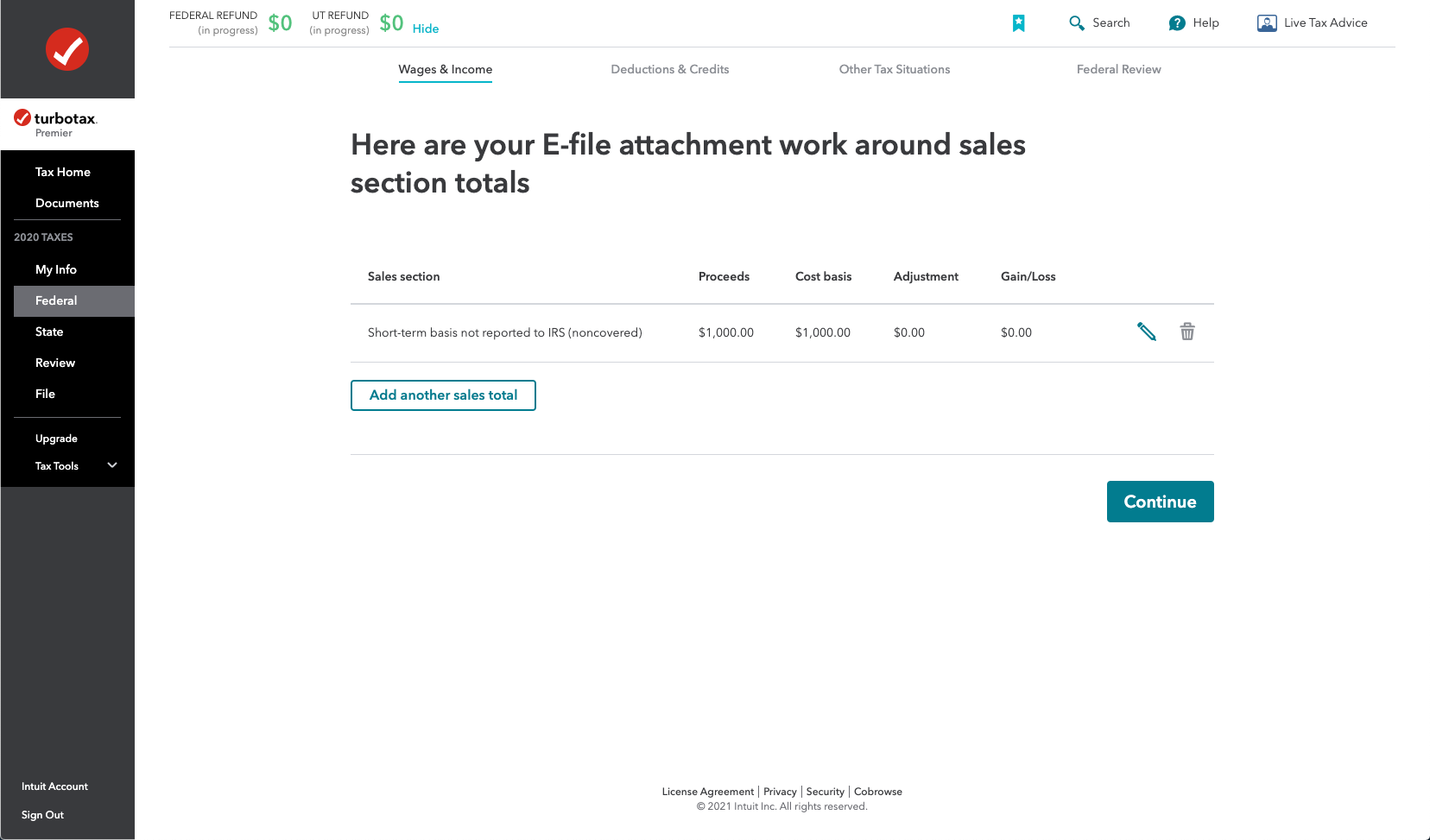

STEP 8: On the screen that follows, click the "Continue" button.

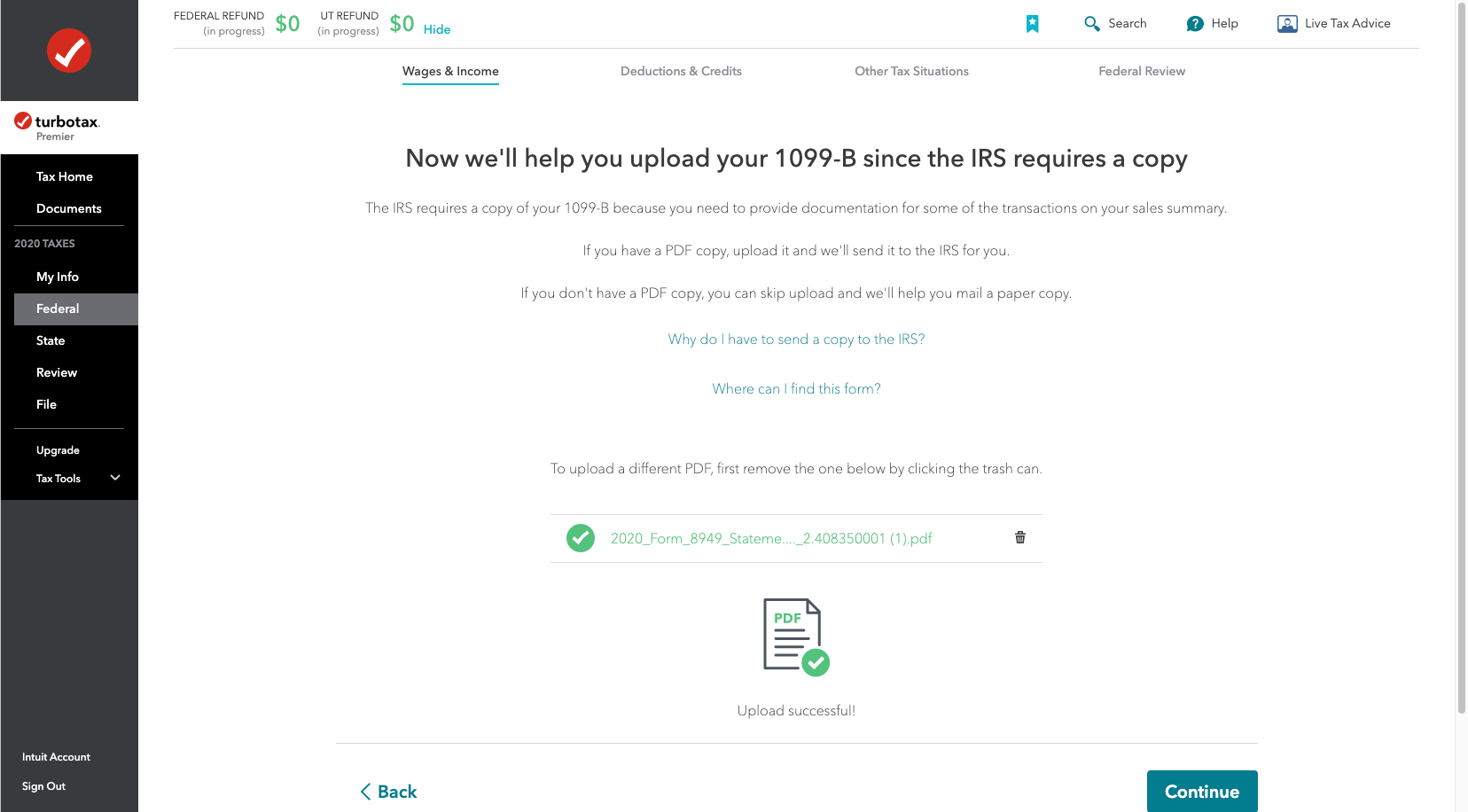

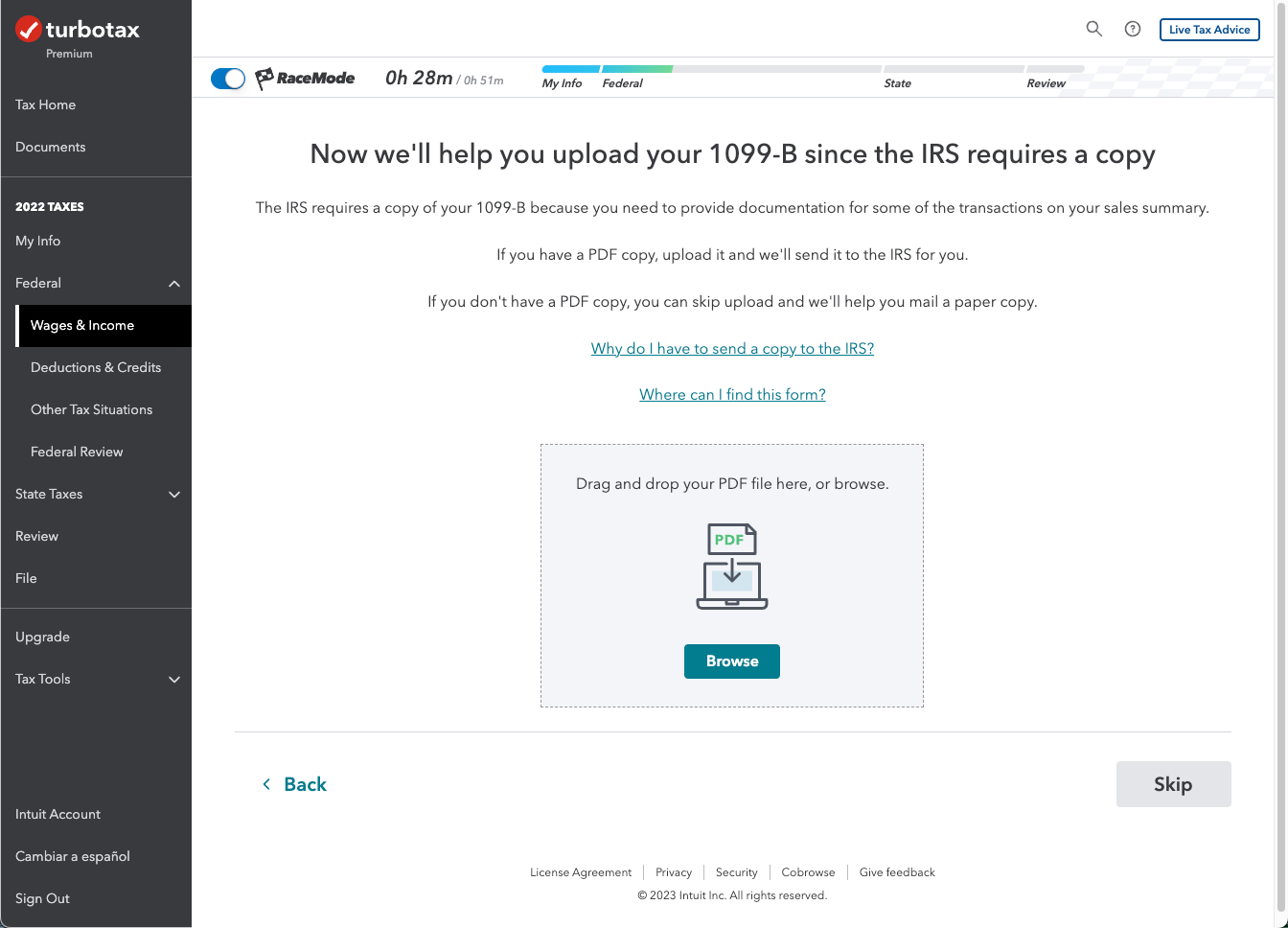

STEP 9: At this point you will be given the opportunity to upload your PDF file. Click "Browse" to your PDF or drag and drop the file into the rectangle shown.

Important note:

The software is saying the IRS requires a copy of your Form 1099-B under these circumstances.

But this is not an accurate statement.

In the relevant IRS instructions the IRS says:

Instead of reporting each of your transactions on a separate row of Part I or II, you can report them on an attached statement containing all the same information as Parts I and II and in a similar format (that is, description of property, dates of acquisition and disposition, proceeds, basis, adjustment and code(s), and gain or (loss)). Use as many attached statements as you need. Enter the combined totals from all your attached statements on Parts I and II with the appropriate box checked.

The statement we provide you conforms to the IRS requirements and should be uploaded for attachment to your return.

STEP 10: "Upload successful" should display.