Summary Transactions

When you have more transactions than can be imported into your tax software, you may enter or import "summary transactions" into your tax software so that the software can include the totals shown in the summary transactions on your income tax return.

TaxAct Users

See https://www.taxact.com/support/960/2020/form-1099-b-summary-totals

Turbo Tax Online Users

Importing Summary Transactions

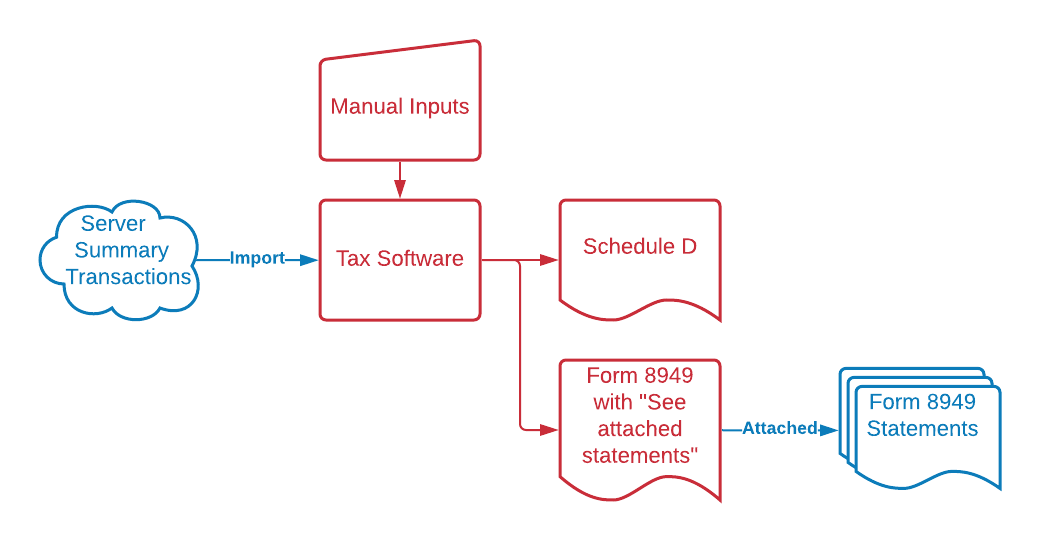

When you import summary transactions,

- Schedule D and Form 8949 are generated by the tax software (items in red)

- statements generated by Form 8949.com are attached to your tax return (either electronically or physically).

Your manual inputs would include:

- capital loss carryovers

- transactions such as the sale of your personal residence

- gains from regulated futures contracts reported on Form 6781