How tax professionals can use the Form8949.com app and

get 50 percent off regular pricing

Concept

After your client sends you via portal, file share, or email their broker 1099-B data file, you submit the file for processing. Our app converts the broker file into a file that can be imported into your tax software and a statement that can be attached to the tax return. As a tax professional you can get 50% off our regular processing fees.

Specific Steps

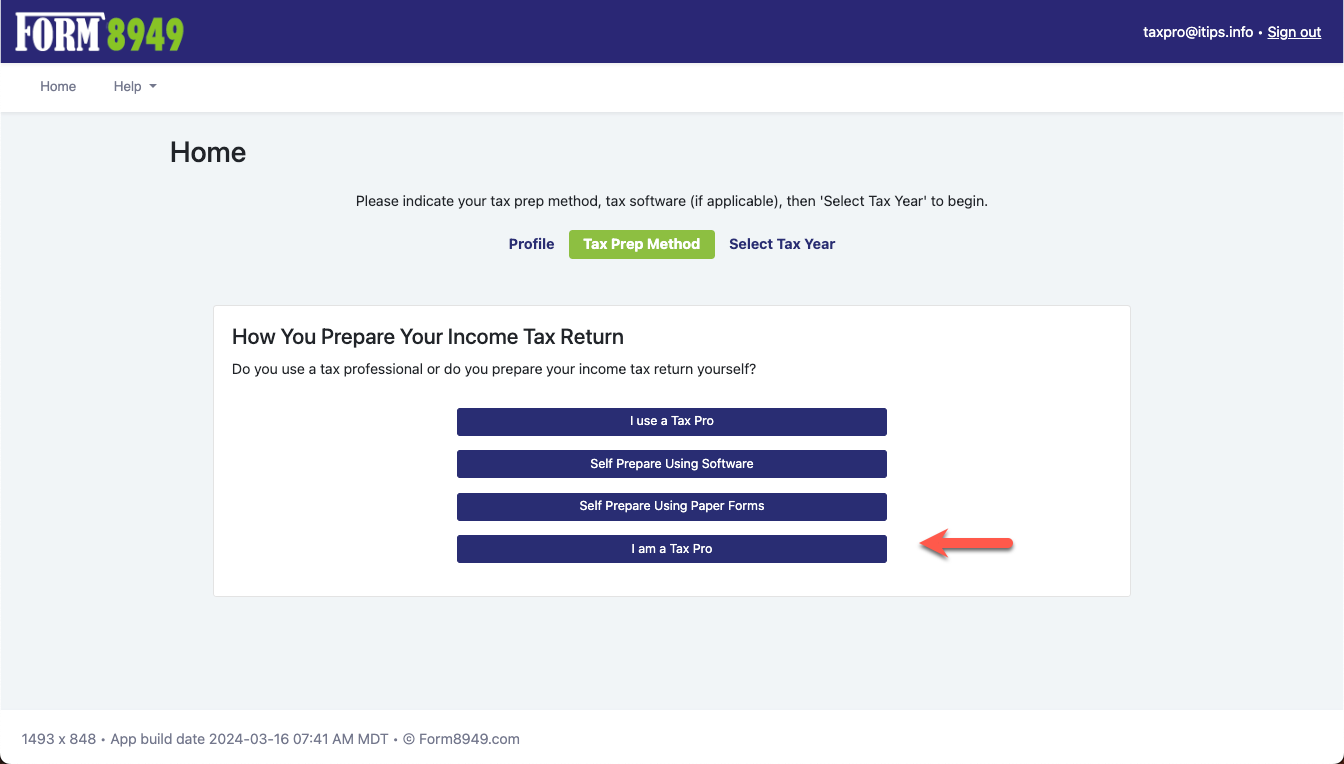

1. When you sign in to the app, on the Tax Prep Method screen, select "I am a Tax Pro"

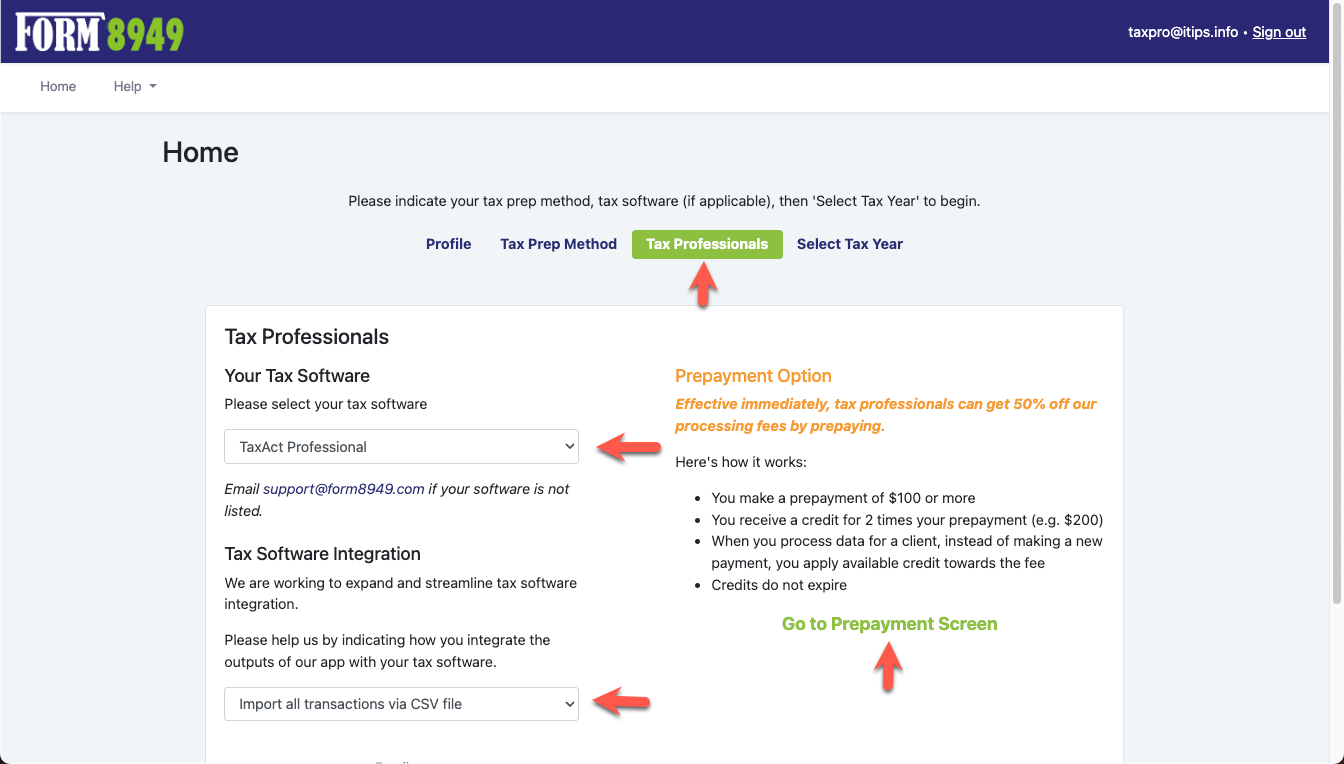

2. On the Tax Professionals screen select your tax software and how you integrate the outputs of our app with your tax software. Then click 'Go to Prepayment Screen'.

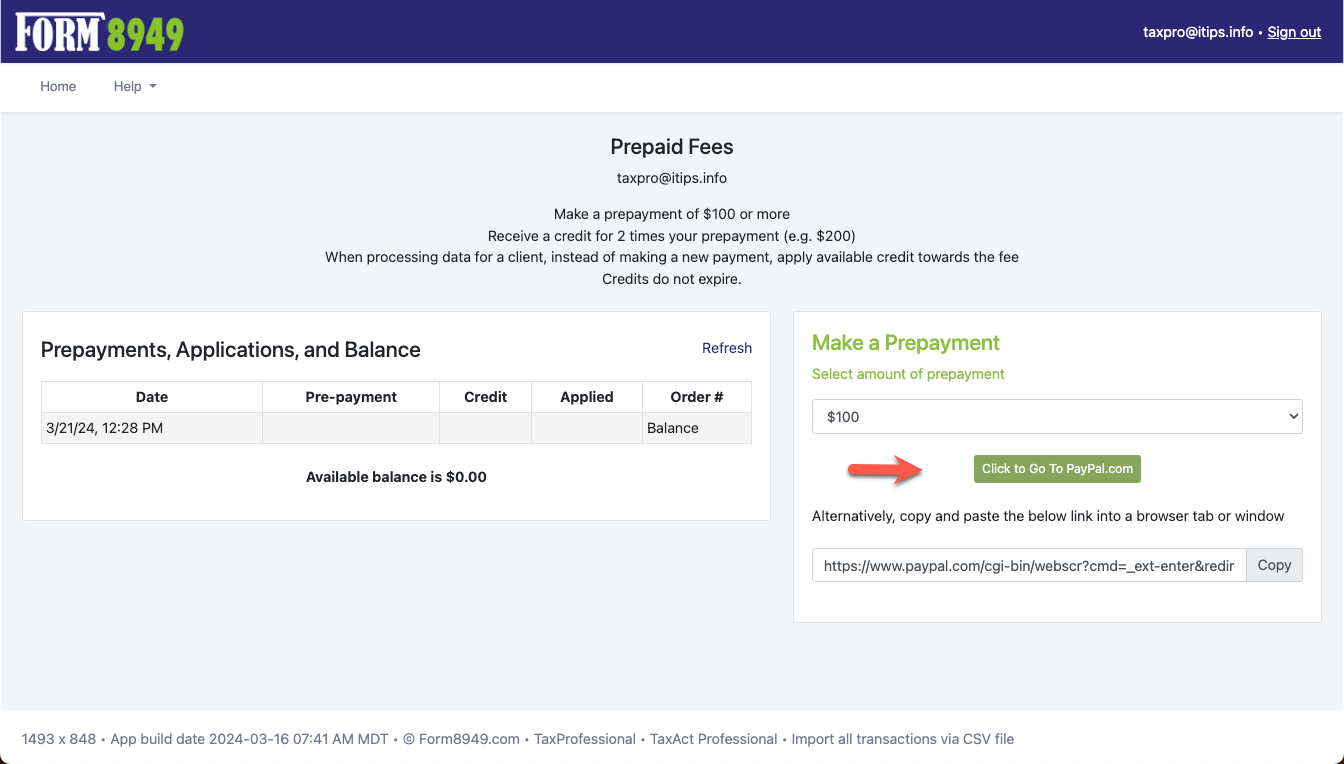

3. Select a prepayment amount and click 'Click to Go to PayPal.com'. At paypal.com you may pay with a credit card or with your PayPal account, if you have one.

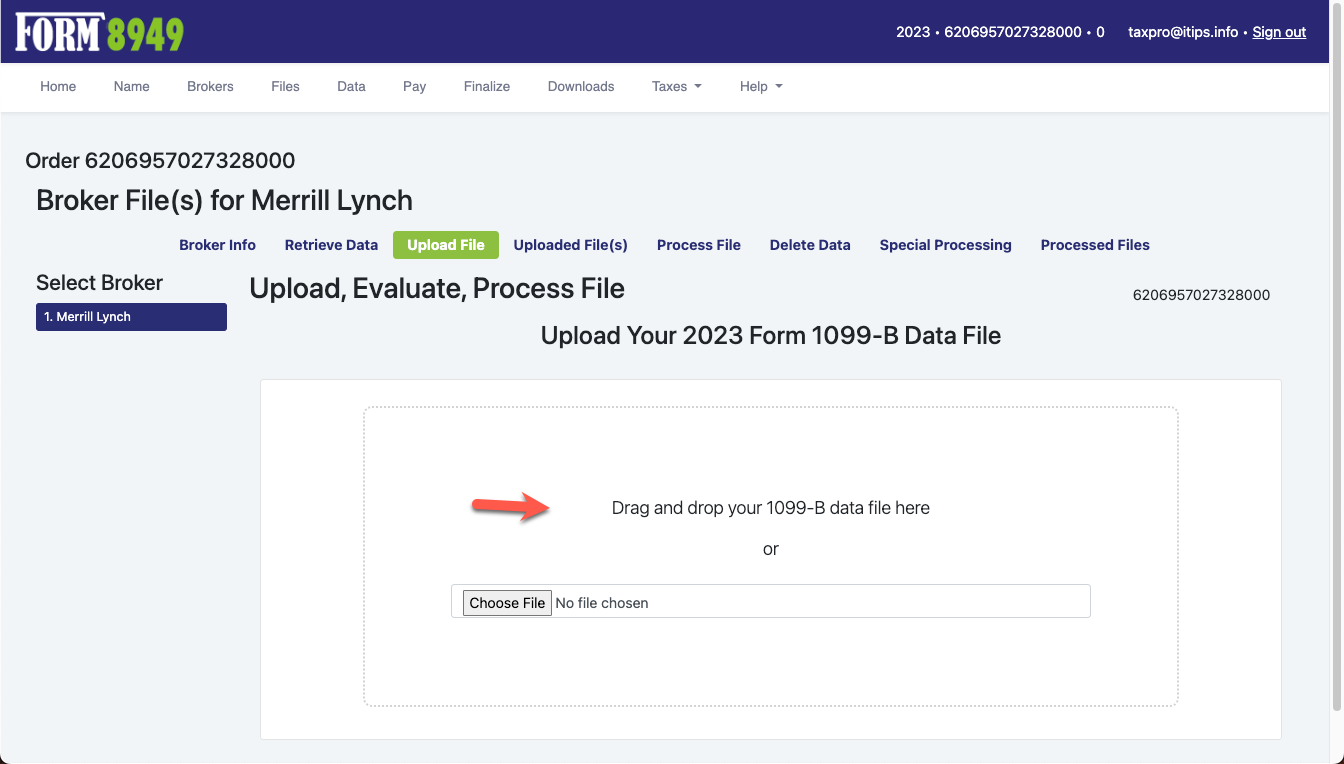

4. Submit the file your client has downloaded from their broker website for processing.

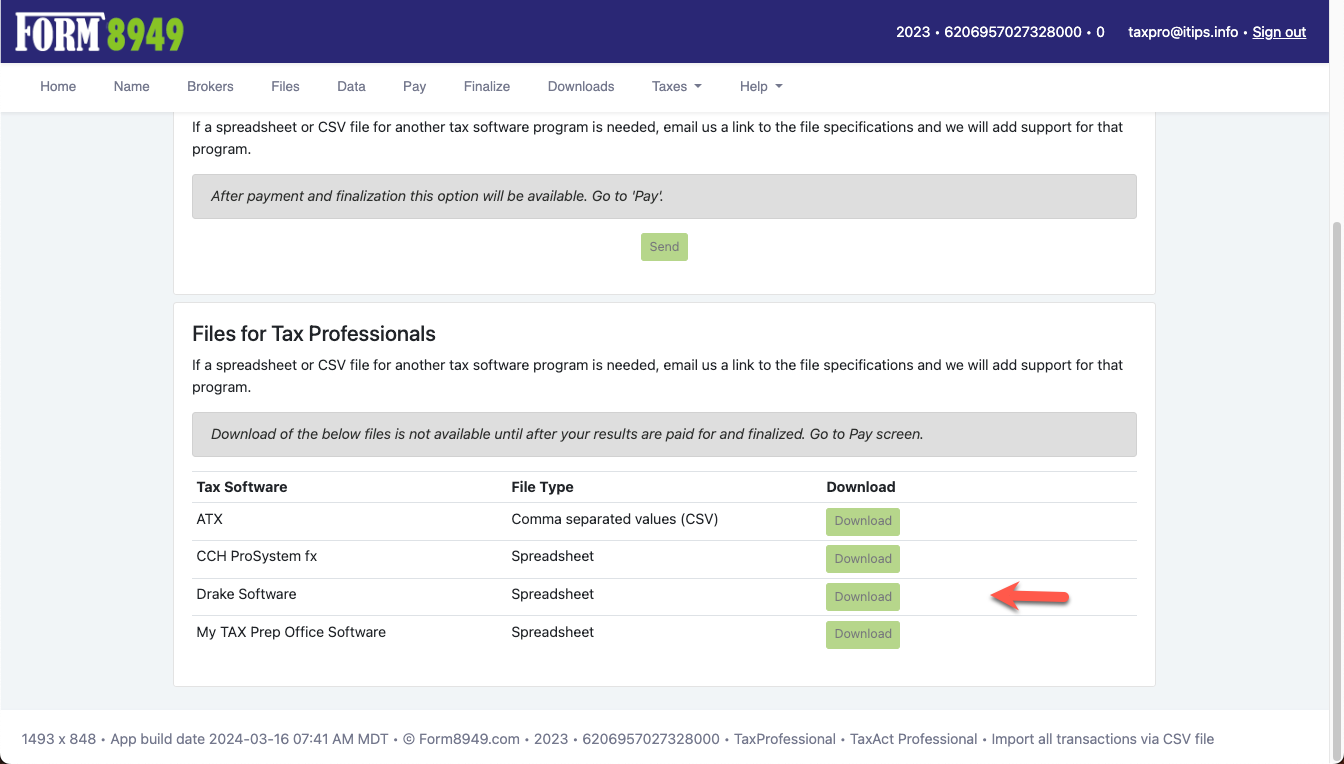

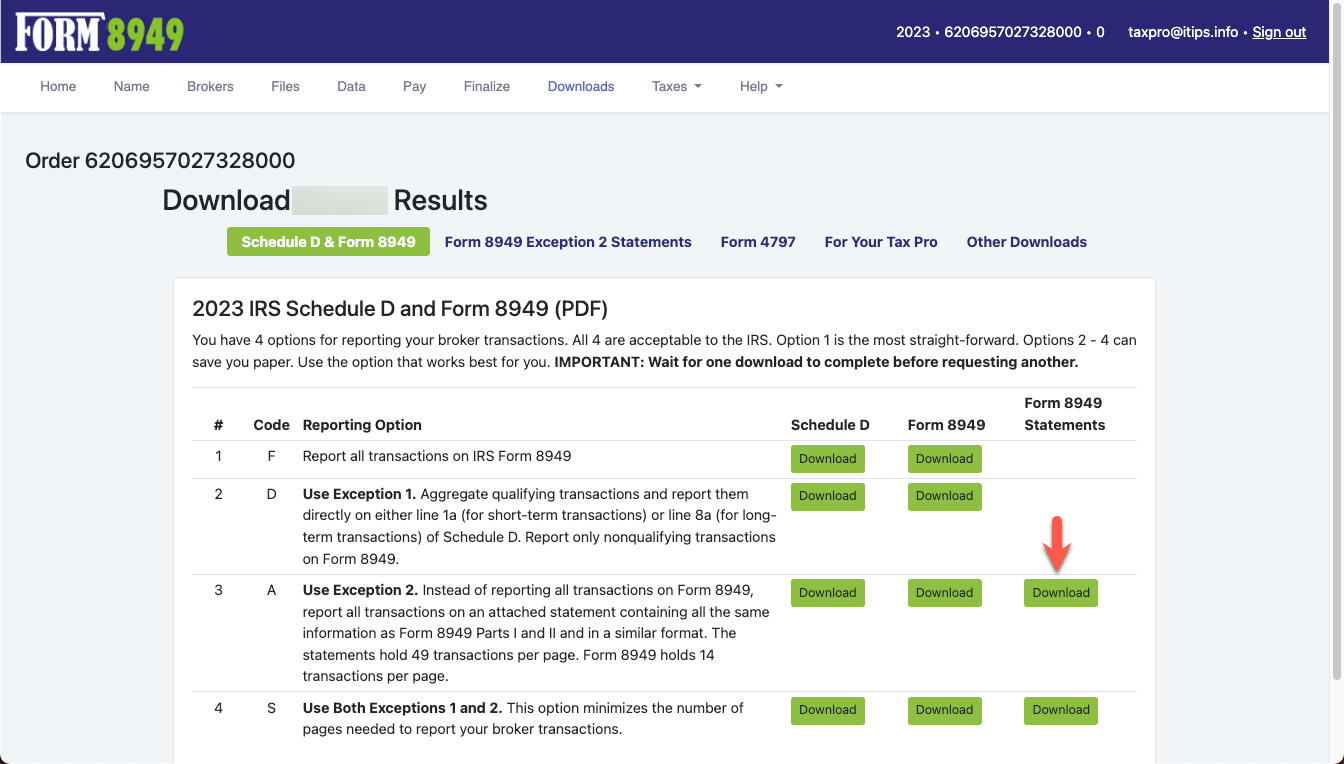

5. On the Downloads page, select the file applicable to your tax software.

6. Or you may download a statement for attachment to the tax return.

Try Then Buy

The Form8949.com app helps you self-prepare your 2024 or prior year:

- Form 8949

- Form 8949 Exception 2 Statement

- Schedule D

- Form 4797, if applicable

The app can also help you import your data into tax software applications.

You don't pay until after you review and approve our web application results.