Reporting Form 8949 Information via OFX Import

Form8949.com App Users

1.Collect

Upload their 1099-B file(s) to the Form8949.com app.

2.Perfect

Review the generated form(s) for completeness and, using Excel or Google Sheets, make any required edits.

3.Integrate

Import data and, if applicable, attach statement(s) in tax software.

Integration is done using 1 of 4 reporting options:

- Traditional — Report all transactions on IRS Form 8949

- Exception 1 — Aggregate qualifying transactions* and report them directly on either line 1a (for short-term transactions) or line 8a (for long-term transactions) of Schedule D. Report only non-qualifying transactions on Form 8949.

- Exception 2 — Instead of reporting all transactions on Form 8949, report all transactions on an attached statement containing "all the same information as Form 8949 Parts I and II and in a similar format”.

- Exceptions 1 and 2 Combined

* For purposes of Exception 1, qualifying transactions are transactions for which ALL of the following statements are true :

- You received a Form 1099-B (or substitute statement)

- The 1099-B shows that basis WAS reported to the IRS

- Does NOT show an adjustment in box 1f for accrued market discount

- Does NOT show an adjustment in box 1g for wash sale loss disallowed

- The Ordinary box in box 2 is NOT checked

- Is NOT a sale of collectibles

- You are NOT electing to defer income due to an investment in a Qualified Opportunity Fund (QOF) and are NOT terminating deferral from an investment in a QOF

1. Traditional

Import detail of all transactions

Advantages

Straight-forward

Disadvantages

Not available if over MAXIMUM transactions

Introduces rounding differences

Can yield unnecessary warning messages

Example OFX User Inputs

1099 Data Import — Form8949.com

Users of the Form8949.com app may import their tax information by entering their tax document ID and tax document code assigned in the taxes section of the app.

If you need assistance, please visit our website or email us at support@form8949.com.

Tax Document ID

Document Code

Example OFX Response

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>DATE-HERE</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>ITIPS Inc</ORG>

<FID>itips</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAX1099MSGSRSV1>

<TAX1099TRNRS>

<TRNUID>GUID-HERE</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAX1099RS>

<TAX1099B_V100>

<SRVRTID>6329626670399488</SRVRTID>

<TAXYEAR>2023</TAXYEAR>

<EXTDBINFO_V100>

<PROCDET_V100>

<FORM8949CODE>A</FORM8949CODE>

<DTAQD>20231208</DTAQD>

<DTSALE>20231227</DTSALE>

<SALEDESCRIPTION>5.000 FORD MTR CO DEL COM</SALEDESCRIPTION>

<COSTBASIS>55.08</COSTBASIS>

<SALESPR>61.87</SALESPR>

</PROCDET_V100>

<PROCDET_V100>

<FORM8949CODE>A</FORM8949CODE>

<DTAQD>20231208</DTAQD>

<DTSALE>20231227</DTSALE>

<SALEDESCRIPTION>5.000000 FORD MTR CO DEL COM F 345370860 </SALEDESCRIPTION>

<COSTBASIS>55.08</COSTBASIS>

<SALESPR>61.87</SALESPR>

</PROCDET_V100>

<PROCDET_V100>

<FORM8949CODE>A</FORM8949CODE>

<DTAQD>20231208</DTAQD>

<DTSALE>20231227</DTSALE>

<SALEDESCRIPTION>10 FORD MOTOR CO S</SALEDESCRIPTION>

<COSTBASIS>110.16</COSTBASIS>

<SALESPR>123.75</SALESPR>

</PROCDET_V100>

<PROCDET_V100>

<FORM8949CODE>B</FORM8949CODE>

<DTVAR>Y</DTVAR>

<DTSALE>20231229</DTSALE>

<SALEDESCRIPTION>1 PUT SPXW 03/02/23 3930 CBOE</SALEDESCRIPTION>

<SALESPR>0.00</SALESPR>

</PROCDET_V100>

...

<PROCDET_V100>

<FORM8949CODE>A</FORM8949CODE>

<DTAQD>20230223</DTAQD>

<DTSALE>20230224</DTSALE>

<SALEDESCRIPTION>1 CALL AMZN 02/24/23 95 AMAZO</SALEDESCRIPTION>

<COSTBASIS>135.05</COSTBASIS>

<SALESPR>21.93</SALESPR>

</PROCDET_V100>

<PROCDET_V100>

<FORM8949CODE>A</FORM8949CODE>

<DTAQD>20230228</DTAQD>

<DTSALE>20230302</DTSALE>

<SALEDESCRIPTION>1 CALL SPY 03/02/23 406 STAND</SALEDESCRIPTION>

<COSTBASIS>22.05</COSTBASIS>

<SALESPR>0.00</SALESPR>

</PROCDET_V100>

</EXTDBINFO_V100>

</TAX1099B_V100>

</TAX1099RS>

</TAX1099TRNRS>

</TAX1099MSGSRSV1>

</OFX>

2. Exception 1

Import aggregate of qualifying transactions + import detail of non-qualifying

Advantages

Reduces rounding differences

Reduces Form 8949 size

Disadvantages

Not available if over MAXIMUM non-qualifying transactions

Can be confusing to users

Example OFX User Inputs — Prefix D

1099 Data Import — Form8949.com

Users of the Form8949.com app may import their tax information by entering their tax document ID and tax document code assigned in the taxes section of the app.

If you need assistance, please visit our website or email us at support@form8949.com.

Tax Document ID

Document Code

Example OFX Response — using PROCDET_V100

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>DATE-HERE</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>ITIPS Inc</ORG>

<FID>itips</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAX1099MSGSRSV1>

<TAX1099TRNRS>

<TRNUID>GUID-HERE</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAX1099RS>

<TAX1099B_V100>

<SRVRTID>6329626670399488</SRVRTID>

<TAXYEAR>2023</TAXYEAR>

<EXTDBINFO_V100>

<PROCDET_V100>

<FORM8949CODE>A</FORM8949CODE>

<DTVAR>Y</DTVAR>

<DTSALE>20231231</DTSALE>

<SALEDESCRIPTION>Total of transactions reportable on Sch D line 1a</SALEDESCRIPTION>

<COSTBASIS>88064.94</COSTBASIS>

<SALESPR>84186.41</SALESPR>

</PROCDET_V100>

<PROCDET_V100>

<FORM8949CODE>D</FORM8949CODE>

<DTVAR>Y</DTVAR>

<DTSALE>20231231</DTSALE>

<SALEDESCRIPTION>Total of transactions reportable on Sch D line 8a</SALEDESCRIPTION>

<COSTBASIS>54.52</COSTBASIS>

<SALESPR>100.01</SALESPR>

</PROCDET_V100>

...

<PROCDET_V100>

<FORM8949CODE>A</FORM8949CODE>

<DTAQD>20230106</DTAQD>

<DTSALE>20230106</DTSALE>

<SALEDESCRIPTION>6 MOBILE GLOBAL ESPORTS INC COMMON</SALEDESCRIPTION>

<COSTBASIS>12.36</COSTBASIS>

<SALESPR>11.50</SALESPR>

<WASHSALELOSSDISALLOWED>0.86</WASHSALELOSSDISALLOWED>

</PROCDET_V100>

<PROCDET_V100>

<FORM8949CODE>B</FORM8949CODE>

<DTVAR>Y</DTVAR>

<DTSALE>20231229</DTSALE>

<SALEDESCRIPTION>1 CALL SPXW 02/13/23 4130 CBOE</SALEDESCRIPTION>

<SALESPR>0.00</SALESPR>

</PROCDET_V100>

</EXTDBINFO_V100>

</TAX1099B_V100>

</TAX1099RS>

</TAX1099TRNRS>

</TAX1099MSGSRSV1>

</OFX>

Example OFX User Inputs — Prefix E

1099 Data Import — Form8949.com

Users of the Form8949.com app may import their tax information by entering their tax document ID and tax document code assigned in the taxes section of the app.

If you need assistance, please visit our website or email us at support@form8949.com.

Tax Document ID

Document Code

Example OFX Response — using PROCSUM_V100

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>DATE-HERE</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>ITIPS Inc</ORG>

<FID>itips</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAX1099MSGSRSV1>

<TAX1099TRNRS>

<TRNUID>GUID-HERE</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAX1099RS>

<TAX1099B_V100>

<SRVRTID>6329626670399488</SRVRTID>

<TAXYEAR>2023</TAXYEAR>

<EXTDBINFO_V100>

<PROCSUM_V100>

<FORM8949CODE>A</FORM8949CODE>

<SUMCOSTBASIS>88064.94</SUMCOSTBASIS>

<SUMSALESPR>84186.41</SUMSALESPR>

<SUMDESCRIPTION>Total of transactions reportable on Sch D line 1a</SUMDESCRIPTION>

</PROCSUM_V100>

<PROCSUM_V100>

<FORM8949CODE>D</FORM8949CODE>

<SUMCOSTBASIS>54.52</SUMCOSTBASIS>

<SUMSALESPR>100.01</SUMSALESPR>

<SUMDESCRIPTION>Total of transactions reportable on Sch D line 8a</SUMDESCRIPTION>

</PROCSUM_V100>

...

<PROCDET_V100>

<FORM8949CODE>A</FORM8949CODE>

<DTAQD>20230106</DTAQD>

<DTSALE>20230106</DTSALE>

<SALEDESCRIPTION>6 MOBILE GLOBAL ESPORTS INC COMMON</SALEDESCRIPTION>

<COSTBASIS>12.36</COSTBASIS>

<SALESPR>11.50</SALESPR>

<WASHSALELOSSDISALLOWED>0.86</WASHSALELOSSDISALLOWED>

</PROCDET_V100>

<PROCDET_V100>

<FORM8949CODE>B</FORM8949CODE>

<DTVAR>Y</DTVAR>

<DTSALE>20231229</DTSALE>

<SALEDESCRIPTION>1 CALL SPXW 02/13/23 4130 CBOE</SALEDESCRIPTION>

<SALESPR>0.00</SALESPR>

</PROCDET_V100>

</EXTDBINFO_V100>

</TAX1099B_V100>

</TAX1099RS>

</TAX1099TRNRS>

</TAX1099MSGSRSV1>

</OFX>

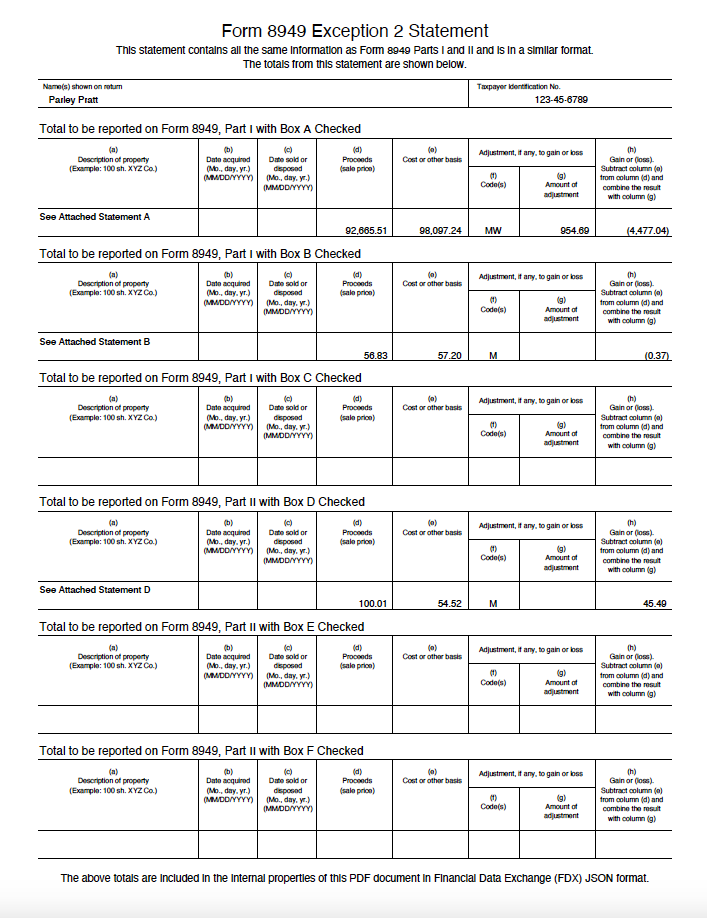

3. Exception 2

Import “summary transactions”. Attach statement (PDF).

Advantages

Solution for those with over MAXIMUM transactions

Eliminates rounding differences

Disadvantages

PDF size restrictions apply

Confusion about where and how to attach PDF

Example OFX User Inputs — Prefix A

1099 Data Import — Form8949.com

Users of the Form8949.com app may import their tax information by entering their tax document ID and tax document code assigned in the taxes section of the app.

If you need assistance, please visit our website or email us at support@form8949.com.

Tax Document ID

Document Code

Example OFX Response — using PROCDET_V100

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>DATE-HERE</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>ITIPS Inc</ORG>

<FID>itips</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAX1099MSGSRSV1>

<TAX1099TRNRS>

<TRNUID>GUID-HERE</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAX1099RS>

<TAX1099B_V100>

<SRVRTID>6329626670399488</SRVRTID>

<TAXYEAR>2023</TAXYEAR>

<EXTDBINFO_V100>

<PROCDET_V100>

<FORM8949CODE>A</FORM8949CODE>

<DTVAR>Y</DTVAR>

<DTSALE>20231231</DTSALE>

<SALEDESCRIPTION>See statement attached to Form 1040 or Form 8453</SALEDESCRIPTION>

<COSTBASIS>98097.24</COSTBASIS>

<SALESPR>92665.51</SALESPR>

<WASHSALELOSSDISALLOWED>954.69</WASHSALELOSSDISALLOWED>

</PROCDET_V100>

<PROCDET_V100>

<FORM8949CODE>B</FORM8949CODE>

<DTVAR>Y</DTVAR>

<DTSALE>20231231</DTSALE>

<SALEDESCRIPTION>See statement attached to Form 1040 or Form 8453</SALEDESCRIPTION>

<COSTBASIS>57.20</COSTBASIS>

<SALESPR>56.83</SALESPR>

</PROCDET_V100>

<PROCDET_V100>

<FORM8949CODE>D</FORM8949CODE>

<DTVAR>Y</DTVAR>

<DTSALE>20231231</DTSALE>

<SALEDESCRIPTION>See statement attached to Form 1040 or Form 8453</SALEDESCRIPTION>

<COSTBASIS>54.52</COSTBASIS>

<SALESPR>100.01</SALESPR>

</PROCDET_V100>

</EXTDBINFO_V100>

</TAX1099B_V100>

</TAX1099RS>

</TAX1099TRNRS>

</TAX1099MSGSRSV1>

</OFX>

Example OFX User Inputs — Prefix B

1099 Data Import — Form8949.com

Users of the Form8949.com app may import their tax information by entering their tax document ID and tax document code assigned in the taxes section of the app.

If you need assistance, please visit our website or email us at support@form8949.com.

Tax Document ID

Document Code

Example OFX Response — using PROCSUM_V100

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>DATE-HERE</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>ITIPS Inc</ORG>

<FID>itips</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAX1099MSGSRSV1>

<TAX1099TRNRS>

<TRNUID>GUID-HERE</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAX1099RS>

<TAX1099B_V100>

<SRVRTID>6329626670399488</SRVRTID>

<TAXYEAR>2023</TAXYEAR>

<EXTDBINFO_V100>

<PROCSUM_V100>

<FORM8949CODE>A</FORM8949CODE>

<ADJCODE>W</ADJCODE>

<SUMCOSTBASIS>98097.24</SUMCOSTBASIS>

<SUMSALESPR>92665.51</SUMSALESPR>

<SUMADJAMT>954.69</SUMADJAMT>

<SUMDESCRIPTION>See statement attached to Form 1040 or Form 8453</SUMDESCRIPTION>

</PROCSUM_V100>

<PROCSUM_V100>

<FORM8949CODE>B</FORM8949CODE>

<SUMCOSTBASIS>57.20</SUMCOSTBASIS>

<SUMSALESPR>56.83</SUMSALESPR>

<SUMDESCRIPTION>See statement attached to Form 1040 or Form 8453</SUMDESCRIPTION>

</PROCSUM_V100>

<PROCSUM_V100>

<FORM8949CODE>D</FORM8949CODE>

<SUMCOSTBASIS>54.52</SUMCOSTBASIS>

<SUMSALESPR>100.01</SUMSALESPR>

<SUMDESCRIPTION>See statement attached to Form 1040 or Form 8453</SUMDESCRIPTION>

</PROCSUM_V100>

</EXTDBINFO_V100>

</TAX1099B_V100>

</TAX1099RS>

</TAX1099TRNRS>

</TAX1099MSGSRSV1>

</OFX>

Example OFX User Inputs — Prefix C

1099 Data Import — Form8949.com

Users of the Form8949.com app may import their tax information by entering their tax document ID and tax document code assigned in the taxes section of the app.

If you need assistance, please visit our website or email us at support@form8949.com.

Tax Document ID

Document Code

Example OFX Response — using PROCSUM_V100 & TAXPDF_V100

THIS RESPONSE GREATLY SIMPLIFIES THE USER EXPERIENCE,

REDUCING TO

ONE STEP

BOTH INPUT OF SUMMARY TRANSACTIONS AND STATEMENT TO BE ATTACHED.

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>DATE-HERE</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>ITIPS Inc</ORG>

<FID>itips</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAX1099MSGSRSV1>

<TAX1099TRNRS>

<TRNUID>GUID-HERE</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAX1099RS>

<TAX1099B_V100>

<SRVRTID>6329626670399488</SRVRTID>

<TAXYEAR>2023</TAXYEAR>

<EXTDBINFO_V100>

<PROCSUM_V100>

<FORM8949CODE>A</FORM8949CODE>

<ADJCODE>W</ADJCODE>

<SUMCOSTBASIS>98097.24</SUMCOSTBASIS>

<SUMSALESPR>92665.51</SUMSALESPR>

<SUMADJAMT>954.69</SUMADJAMT>

<SUMDESCRIPTION>See statement attached to Form 1040 or Form 8453</SUMDESCRIPTION>

</PROCSUM_V100>

<PROCSUM_V100>

<FORM8949CODE>B</FORM8949CODE>

<SUMCOSTBASIS>57.20</SUMCOSTBASIS>

<SUMSALESPR>56.83</SUMSALESPR>

<SUMDESCRIPTION>See statement attached to Form 1040 or Form 8453</SUMDESCRIPTION>

</PROCSUM_V100>

<PROCSUM_V100>

<FORM8949CODE>D</FORM8949CODE>

<SUMCOSTBASIS>54.52</SUMCOSTBASIS>

<SUMSALESPR>100.01</SUMSALESPR>

<SUMDESCRIPTION>See statement attached to Form 1040 or Form 8453</SUMDESCRIPTION>

</PROCSUM_V100>

</EXTDBINFO_V100>

</TAX1099B_V100>

</TAX1099RS>

</TAX1099TRNRS>

</TAX1099MSGSRSV1>

<TAXPDFMSGSRSV1>

<TAXPDFTRNRS>

<TRNUID>GUID-HERE</TRNUID>

<TAXPDFRS>

<TAXPDF_V100>

<SRVRTID>1</SRVRTID>

<TAXYEAR>2023</TAXYEAR>

<PDFCATEGORY>Form8949ExceptionReportingStatement</PDFCATEGORY>

<PDFDESCRIPTION>Form 8949 Statement</PDFDESCRIPTION>

<PDFFILENAME>Form8949Statement.pdf</PDFFILENAME>

<PDFCONTENT>

SlZCRVJpMHhMalFLSmVMano5TUtNaUF3SUc5aWFnbzhQQzlNWlc1bmRHZ2dNemMyTUM5R2FXeDBaWEl2Um14aGRHVkVaV052WkduTj

jbVZoYlFwNG5KVmIyM0liTnhKOTExZmdhY3RPeFdQYzVyWnZGRG1XdU11TElsSk81TklMSTlHeHRpVFJJZWxLL1BmYm1FRURuRUVEV

QrVXdVcjg0S3RIODZhOWRrdnh2TCtnMkJnK0h3bUdJZS9nbW5PU2lIWit2bnN6V0x6dkwxN2M3aDd5dzVmZG4rOXNOMBb3dNREF3TV

...

lUUmlNVGd3T0RJMU1qVStQR1U1TlRoaU9UWm1PR1ptTXpabVlXVTNOamhqWVdFMFlqRTRNRGd5TlRJMVBsMCtQZ29sYVZSbGVIUXRO

</PDFCONTENT>

</TAXPDF_V100>

</TAXPDFRS>

</TAXPDFTRNRS>

</TAXPDFMSGSRSV1>

</OFX>

Statement Looks Like This (First Page)

4. Exception 1 & 2 Combined

Import “summary transactions”. Attach statement (PDF).

Advantages

Solution for those with over MAXIMUM transactions

Eliminates rounding differences

Minimizes PDF size

Disadvantages

PDF size restrictions apply

Confusion about where and how to attach PDF

Confusion about statement contents

Example OFX User Inputs — Prefix S

1099 Data Import — Form8949.com

Users of the Form8949.com app may import their tax information by entering their tax document ID and tax document code assigned in the taxes section of the app.

If you need assistance, please visit our website or email us at support@form8949.com.

Tax Document ID

Document Code

Example OFX Response — using PROCDET_V100

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>DATE-HERE</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>ITIPS Inc</ORG>

<FID>itips</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAX1099MSGSRSV1>

<TAX1099TRNRS>

<TRNUID>GUID-HERE</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAX1099RS>

<TAX1099B_V100>

<SRVRTID>6329626670399488</SRVRTID>

<TAXYEAR>2023</TAXYEAR>

<EXTDBINFO_V100>

<PROCDET_V100>

<FORM8949CODE>A</FORM8949CODE>

<DTVAR>Y</DTVAR>

<DTSALE>20231231</DTSALE>

<SALEDESCRIPTION>Total of transactions reportable on Sch D line 1a</SALEDESCRIPTION>

<COSTBASIS>88064.94</COSTBASIS>

<SALESPR>84186.41</SALESPR>

</PROCDET_V100>

<PROCDET_V100>

<FORM8949CODE>A</FORM8949CODE>

<DTVAR>Y</DTVAR>

<DTSALE>20231231</DTSALE>

<SALEDESCRIPTION>See statement attached to Form 1040 or Form 8453</SALEDESCRIPTION>

<COSTBASIS>10032.30</COSTBASIS>

<SALESPR>8479.10</SALESPR>

<WASHSALELOSSDISALLOWED>954.69</WASHSALELOSSDISALLOWED>

</PROCDET_V100>

<PROCDET_V100>

<FORM8949CODE>B</FORM8949CODE>

<DTVAR>Y</DTVAR>

<DTSALE>20231231</DTSALE>

<SALEDESCRIPTION>See statement attached to Form 1040 or Form 8453</SALEDESCRIPTION>

<COSTBASIS>57.20</COSTBASIS>

<SALESPR>56.83</SALESPR>

</PROCDET_V100>

<PROCDET_V100>

<FORM8949CODE>D</FORM8949CODE>

<DTVAR>Y</DTVAR>

<DTSALE>20231231</DTSALE>

<SALEDESCRIPTION>Total of transactions reportable on Sch D line 8a</SALEDESCRIPTION>

<COSTBASIS>54.52</COSTBASIS>

<SALESPR>100.01</SALESPR>

</PROCDET_V100>

</EXTDBINFO_V100>

</TAX1099B_V100>

</TAX1099RS>

</TAX1099TRNRS>

</TAX1099MSGSRSV1>

</OFX>

Example OFX User Inputs — Prefix T

1099 Data Import — Form8949.com

Users of the Form8949.com app may import their tax information by entering their tax document ID and tax document code assigned in the taxes section of the app.

If you need assistance, please visit our website or email us at support@form8949.com.

Tax Document ID

Document Code

Example OFX Response — using PROCSUM_V100

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>DATE-HERE</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>ITIPS Inc</ORG>

<FID>itips</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAX1099MSGSRSV1>

<TAX1099TRNRS>

<TRNUID>GUID-HERE</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAX1099RS>

<TAX1099B_V100>

<SRVRTID>6329626670399488</SRVRTID>

<TAXYEAR>2023</TAXYEAR>

<EXTDBINFO_V100>

<PROCSUM_V100>

<FORM8949CODE>A</FORM8949CODE>

<SUMCOSTBASIS>88064.94</SUMCOSTBASIS>

<SUMSALESPR>84186.41</SUMSALESPR>

<SUMDESCRIPTION>Total of transactions reportable on Sch D line 1a</SUMDESCRIPTION>

</PROCSUM_V100>

<PROCSUM_V100>

<FORM8949CODE>A</FORM8949CODE>

<ADJCODE>W</ADJCODE>

<SUMCOSTBASIS>10032.30</SUMCOSTBASIS>

<SUMSALESPR>8479.10</SUMSALESPR>

<SUMADJAMT>954.69</SUMADJAMT>

<SUMDESCRIPTION>See statement attached to Form 1040 or Form 8453</SUMDESCRIPTION>

</PROCSUM_V100>

<PROCSUM_V100>

<FORM8949CODE>B</FORM8949CODE>

<SUMCOSTBASIS>57.20</SUMCOSTBASIS>

<SUMSALESPR>56.83</SUMSALESPR>

<SUMDESCRIPTION>See statement attached to Form 1040 or Form 8453</SUMDESCRIPTION>

</PROCSUM_V100>

<PROCSUM_V100>

<FORM8949CODE>D</FORM8949CODE>

<SUMCOSTBASIS>54.52</SUMCOSTBASIS>

<SUMSALESPR>100.01</SUMSALESPR>

<SUMDESCRIPTION>Total of transactions reportable on Sch D line 8a</SUMDESCRIPTION>

</PROCSUM_V100>

</EXTDBINFO_V100>

</TAX1099B_V100>

</TAX1099RS>

</TAX1099TRNRS>

</TAX1099MSGSRSV1>

</OFX>