How Cryptocurrency Tax Accounting Services

Should Expand and Improve the

Tax Reports They Provide to Taxpayers

by Bruce Wilcox, CPA (Inactive), MSSE

President, Internet Tax Information Processing Services, Inc (ITIPS)

Co-chair Financial Data Exchange (FDX) Tax Task Force

Many services are now available to help taxpayers comply with the tax reporting requirements associated with their cryptocurrency trading activities.

These services include the following companies:

- Accointing (www.accointing.com)

- BitCoinTax (www.bitcoin.tax)

- CoinPanda (coinpanda.io)

- CoinTracker (www.cointracker.io/)

- CoinTracking (www.cointracking.info)

- Crypto Tax Calculator (cryptotaxcalculator.io)

- Crypto Trader Tax aka Coin Ledger (www.cryptotrader.tax)

- Koinly (koinly.io)

- TAXbit (taxbit.com)

- TokenTax (tokentax.co)

- ZenLedger (zenledger.io)

These companies typically provide tax reports in the following formats:

- Statement of Gains and Losses (PDF)

- CSV file(s) for TurboTax Online and TaxAct Import

- TXF file for TurboTax Desktop Import

- Form 8949 (PDF)

Below is a list of additional types of tax reporting files that should be provided and the reasons why.

FDX JSON File

The Financial Data Exchange (FDX) organization sets API and data structure standards for use in both the banking and income tax return preparation industries. FDX member companies include Intuit, H&R Block, and TaxAct.

FDX data structure standards:

- Are public (non-proprietary)

- Replace non-standard, proprietary data formats such as CSV

- Replace older standards that are no longer being maintained such as TXF

JSON is readily consumed by computer applications. And FDX JSON is an open standard that can be used by any application supporting this new data import standard.

Downloadable files containing FDX JSON should be added by these companies.

Contrast the CSV and FDX JSON representations of realized gain data shown below. Admittedly, the CSV file is less verbose. But the use of the industry-standard FDX JSON data structure eliminates the need for custom CSV parsing code on the part of tax software applications.

CSV

FDX JSON

Currency Name,Purchase Date,Cost Basis,Date Sold,Proceeds "0.00491 ETH","04/02/2021","10.11","04/02/2021","10.26" "597.402 VTHO","04/02/2021","10.11","04/02/2021","10.21" "908.598 VTHO","04/02/2021","15.01","04/02/2021","15.52" "0.00000508 ETH","04/02/2021","0.01","04/02/2021","0.01" "0.00482492 ETH","04/02/2021","10.10","04/02/2021","10.25" "29.4 HBAR","04/02/2021","10.11","04/02/2021","10.26"

{

"forms" : [ {

"tax1099B" : {

"securityDetails" : [ {

"checkboxOnForm8949" : "C",

"saleDescription" : "0.00491 ETH",

"dateAcquired" : "2021-04-02",

"dateOfSale" : "2021-04-02",

"salesPrice" : 10.26,

"costBasis" : 10.11

}, {

"checkboxOnForm8949" : "C",

"saleDescription" : "597.402 VTHO",

"dateAcquired" : "2021-04-02",

"dateOfSale" : "2021-04-02",

"salesPrice" : 10.21,

"costBasis" : 10.11

}, {

"checkboxOnForm8949" : "C",

"saleDescription" : "908.598 VTHO",

"dateAcquired" : "2021-04-02",

"dateOfSale" : "2021-04-02",

"salesPrice" : 15.52,

"costBasis" : 15.01

}, {

"checkboxOnForm8949" : "C",

"saleDescription" : "0.00000508 ETH",

"dateAcquired" : "2021-04-02",

"dateOfSale" : "2021-04-02",

"salesPrice" : 0.01,

"costBasis" : 0.01

}, {

"checkboxOnForm8949" : "C",

"saleDescription" : "0.00482492 ETH",

"dateAcquired" : "2021-04-02",

"dateOfSale" : "2021-04-02",

"salesPrice" : 10.25,

"costBasis" : 10.1

}, {

"checkboxOnForm8949" : "C",

"saleDescription" : "29.4 HBAR",

"dateAcquired" : "2021-04-02",

"dateOfSale" : "2021-04-02",

"salesPrice" : 10.26,

"costBasis" : 10.11

} ]

}

} ]

}

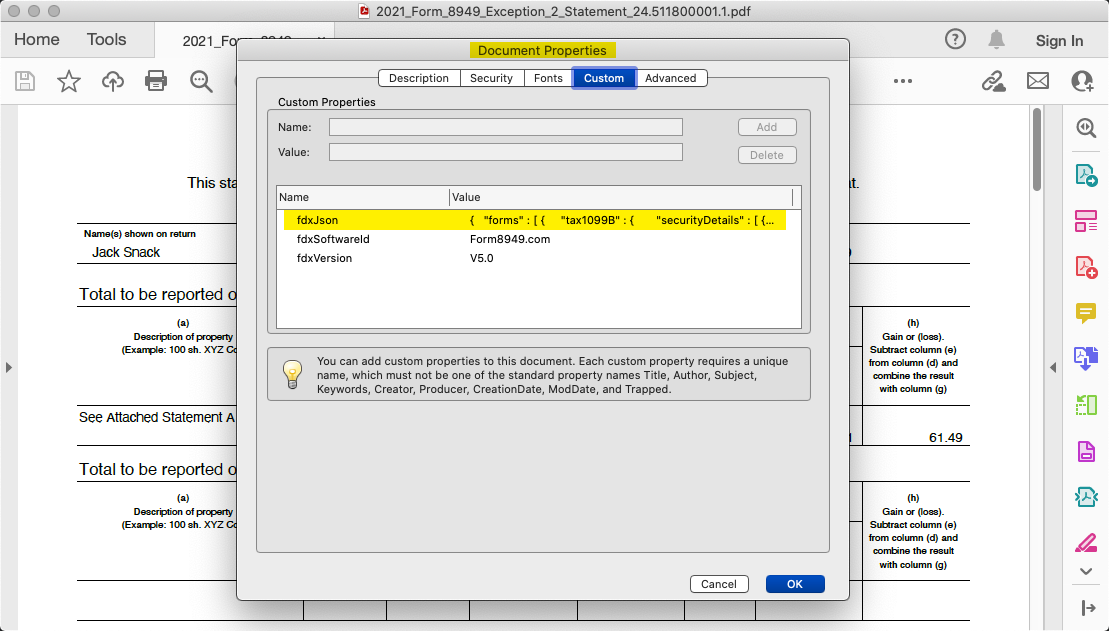

Statement with Embedded FDX JSON (PDF)

FDX JSON can be distributed as a file. It also can be embedded inside a PDF file.

This convenient approach to tax document distribution allows taxpayers to download one file - a PDF file - and either upload the file to tax software or email the file to their tax professional. Tax software applications can readily read the embedded FDX JSON and import the data into a tax return.

Form 8949 Exception 2 Statement (PDF)

When a taxpayer or their tax preparer uses tax software, it is easier to integrate a statement into their tax return than an actual Form 8949. This is known as Form 8949 "Exception 2".

See more information about Exception 2 Statements.