Qualified Opportunity Funds

If you have an eligible gain, you can

- invest that gain in a Qualified Opportunity Fund (QOF) and

- elect to defer part or all of the gain that you would otherwise include in income.

The gain is not recognized until you sell or exchange the investment in the QOF or December 31, 2026, whichever is earlier.

If you make the election, you only include gain to the extent, if any, the amount of realized gain is more than the aggregate amount invested in a QOF during the 180-day period beginning on the date the gain was realized.

What is a QOF?

A QOF is an investment vehicle that is organized as either a corporation or partnership for the purpose of investing in eligible property that is located in a qualified opportunity zone.

How to Report the Gain

Report the eligible gain as you normally would on Form 8949.

Do not make any adjustments for the deferral in column (g).

How to Report the Deferral

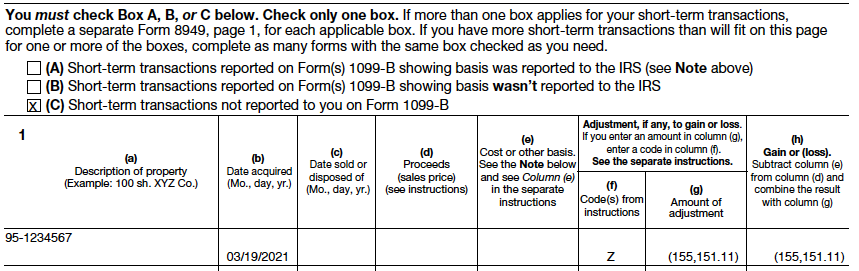

Report the deferral of the eligible gain on its own row of Form 8949 in Part I with box C checked or Part II with box F checked (depending on whether the gain being deferred is short term or long term).

If you made multiple investments in different QOFs or in the same QOF on different dates, use a separate row for each investment.

If you invested eligible gains of the same character (but from different transactions) on the same date into the same QOF, you can group those investments on the same row.

Example of Form 8949 Reporting:

In column (a), enter only the EIN of the QOF into which you invested.

In column (b), enter the date you invested in the QOF.

Leave columns (c), (d), and (e) blank.

In column (f), enter code Z. You are electing to postpone all or part of your gain under the rules explained in the Schedule D instructions for investments in QOFs

In column (g), enter the amount of the deferred gain as a negative number (in parentheses).

How to Report the Disposition of QOF

In column (f), enter code Y. You are reporting your gain from a QOF investment that you deferred in a prior tax year.

Open Financial Exchange Schema

Excerpt

<xsd:element name="QOFADJ" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>

Code Z, electing to postpone all or part of your gain under the rules

explained in the Schedule D instructions for investments in QO Fund(s).

</xsd:documentation>

</xsd:annotation>

</xsd:element>

Open Financial Exchange XML Example

Excerpt

<TAX1099RS>

<TAX1099B_V100>

<TAXYEAR>2021</TAXYEAR>

<EXTDBINFO_V100>

<PROCDET_V100>

<FORM8949CODE>C</FORM8949CODE>

<DTAQD>20210319</DTAQD>

<SALEDESCRIPTION>95-1234567</SALEDESCRIPTION>

<QOFADJ>-155151.11</QOFADJ>

</PROCDET_V100>

</EXTDBINFO_V100>

</TAX1099B_V100>