How to integrate the Form 8949.com app outputs with FreeTaxUSA tax software

FreeTaxUSA has added the ability to attach supporting documents for sales of stocks and cryptocurrency, making it even easier to e‐file your tax return.

- Use the Form8949.com app to generate IRS-acceptable forms and statements in Portable Document Format (PDF). The IRS rules state that the statement should contain the same information, in a format similar to Form 8949. Our statements comply with this requirement.

- Enter your summary totals into the FreeTaxUSA program

- Attach the PDF file to your FreeTaxUSA tax return

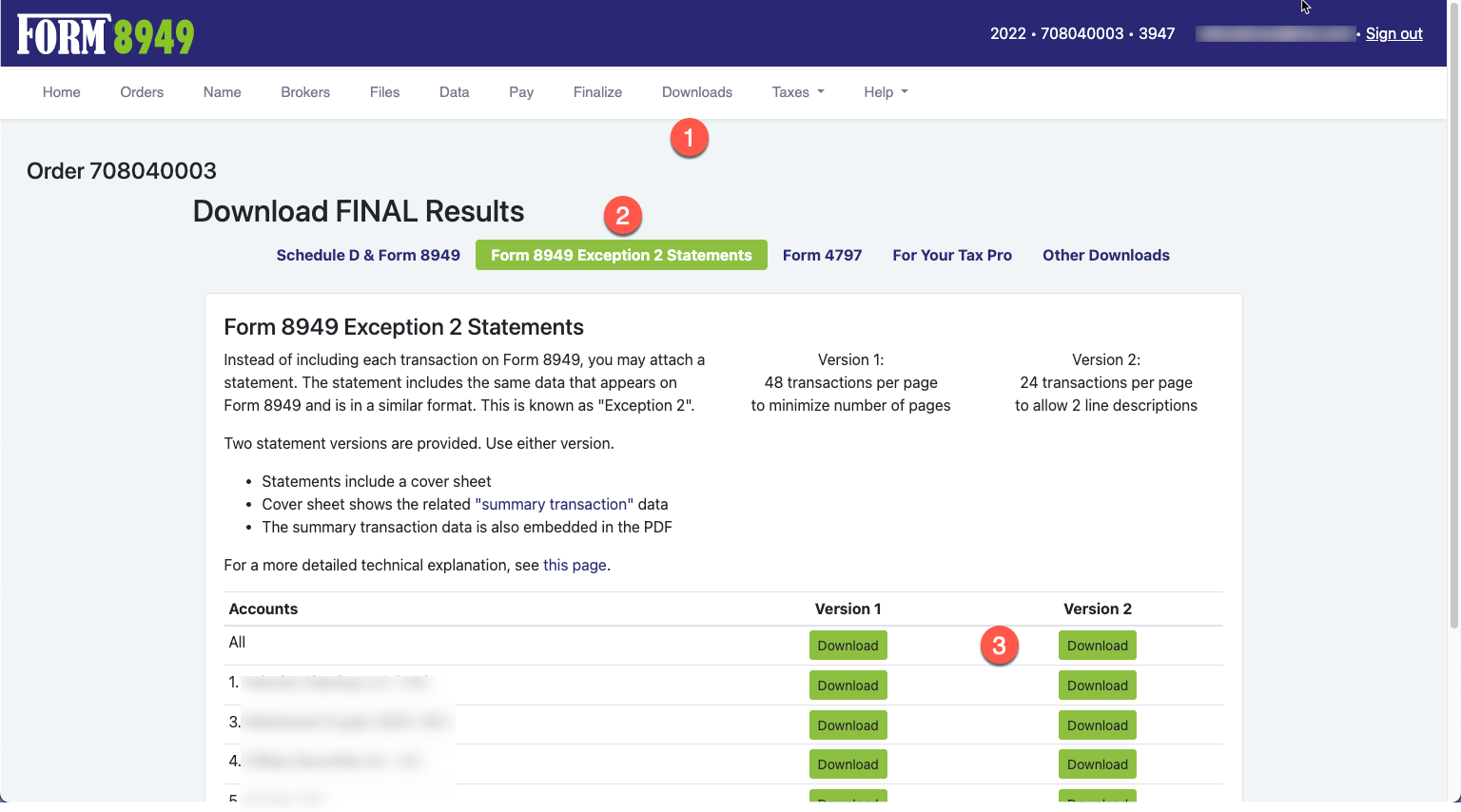

1. Use the Form8949.com app

Use the Form8949.com app to process your broker data file.

After finalizing your results, go to the Downloads page and download a "Form 8949 Exception 2 Statement" as seen here.

On the cover page of the statement you will see the summary totals that need to be entered into your tax software.

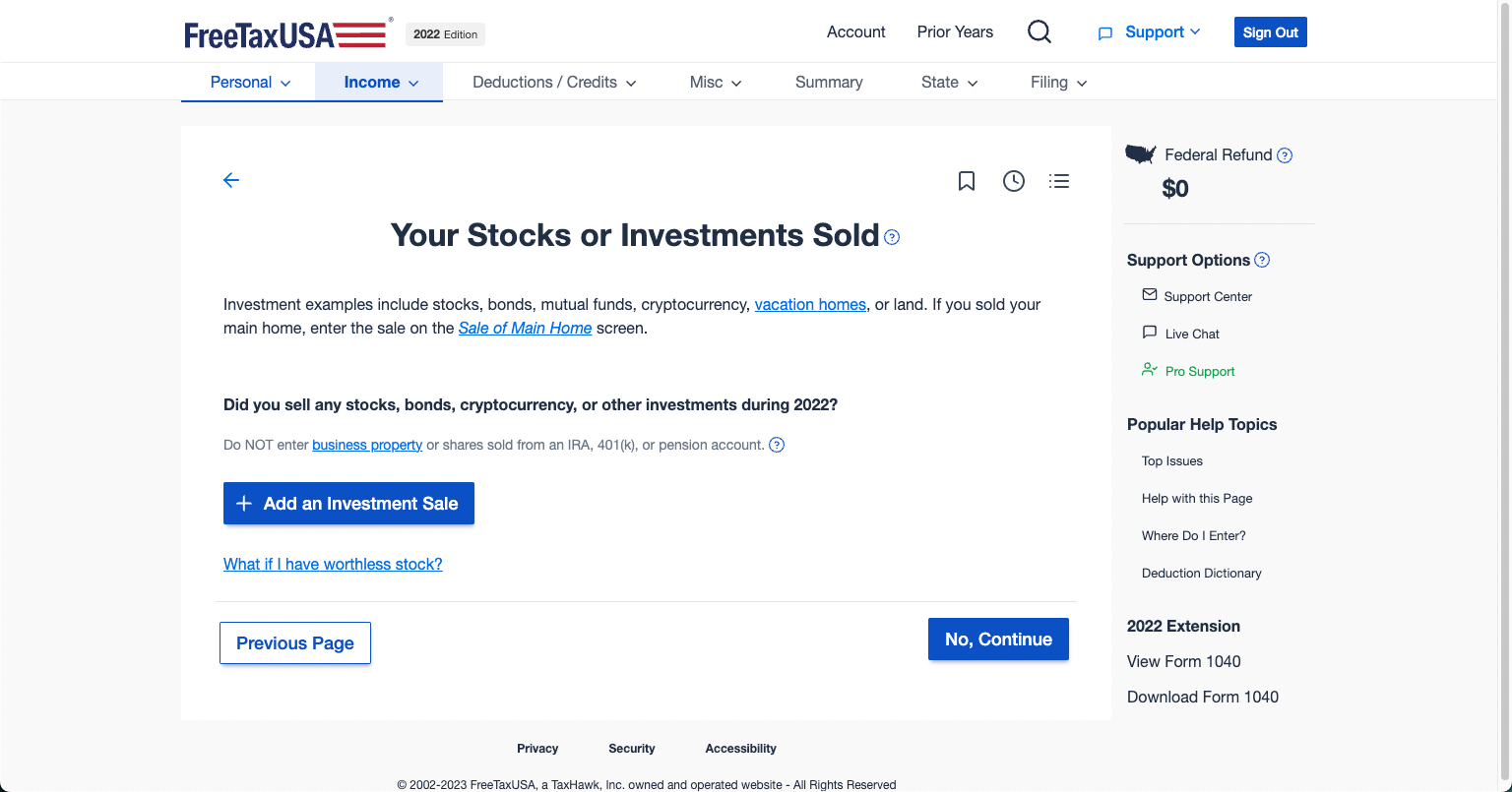

2. Enter your summary totals into the FreeTaxUSA program

Go to the 'Income' > 'Your Stocks or Investments Sold' screen in the program.

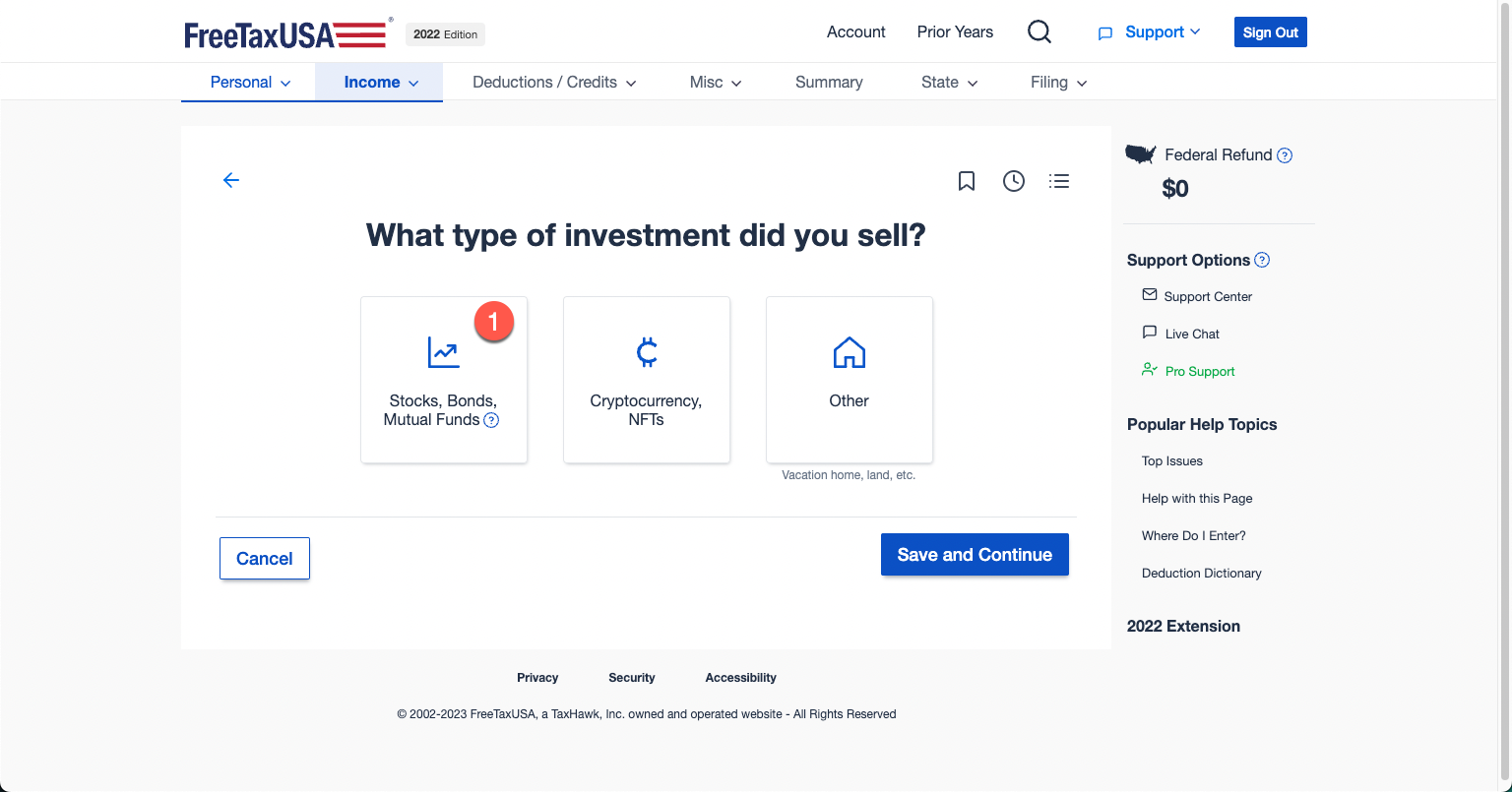

Select 'Stocks, Bonds, Mutual Funds', 'Save and Continue'.

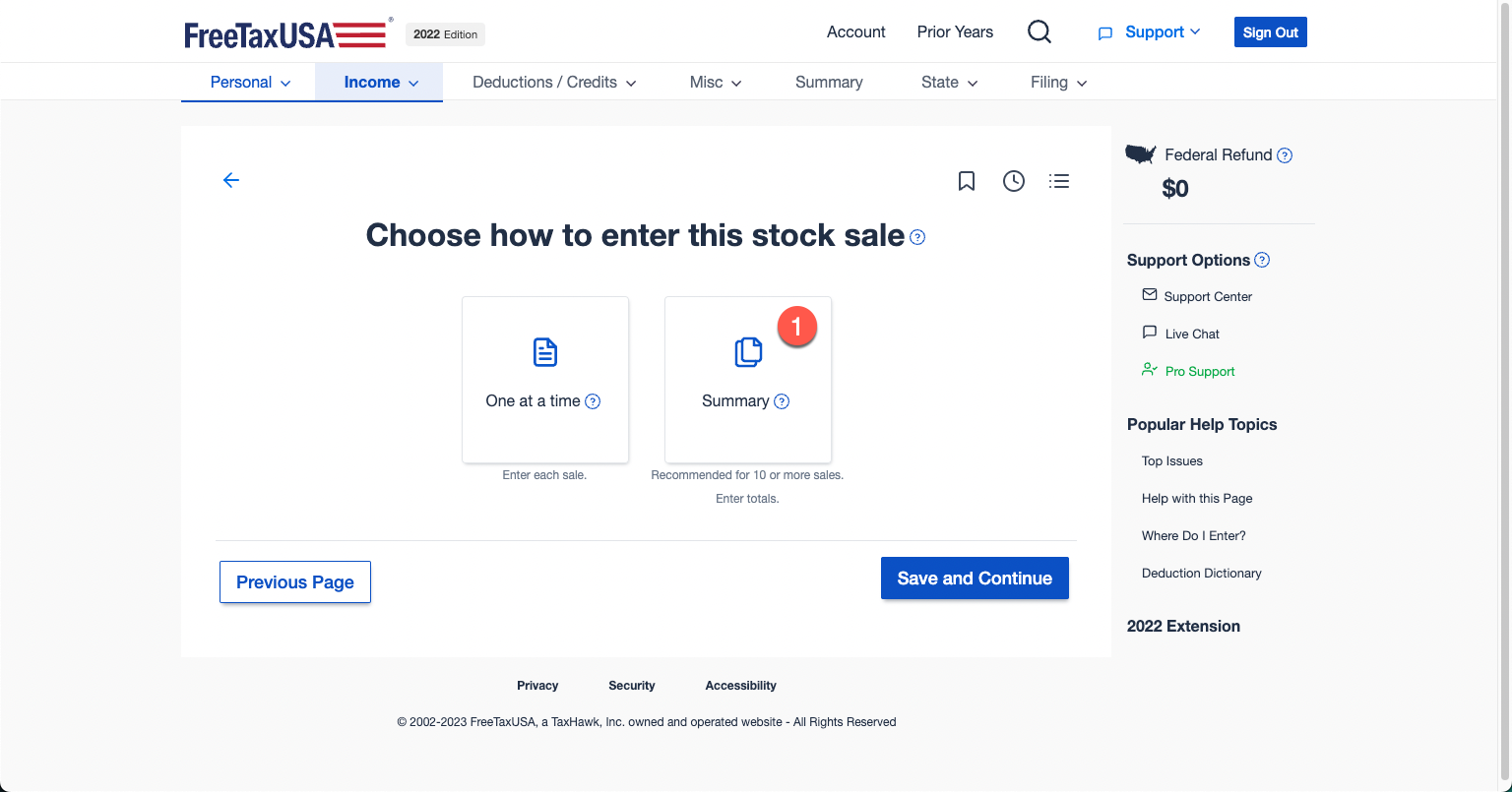

Select 'Summary', 'Save and Continue'.

For each of your summary entries, complete the next 4 screens.

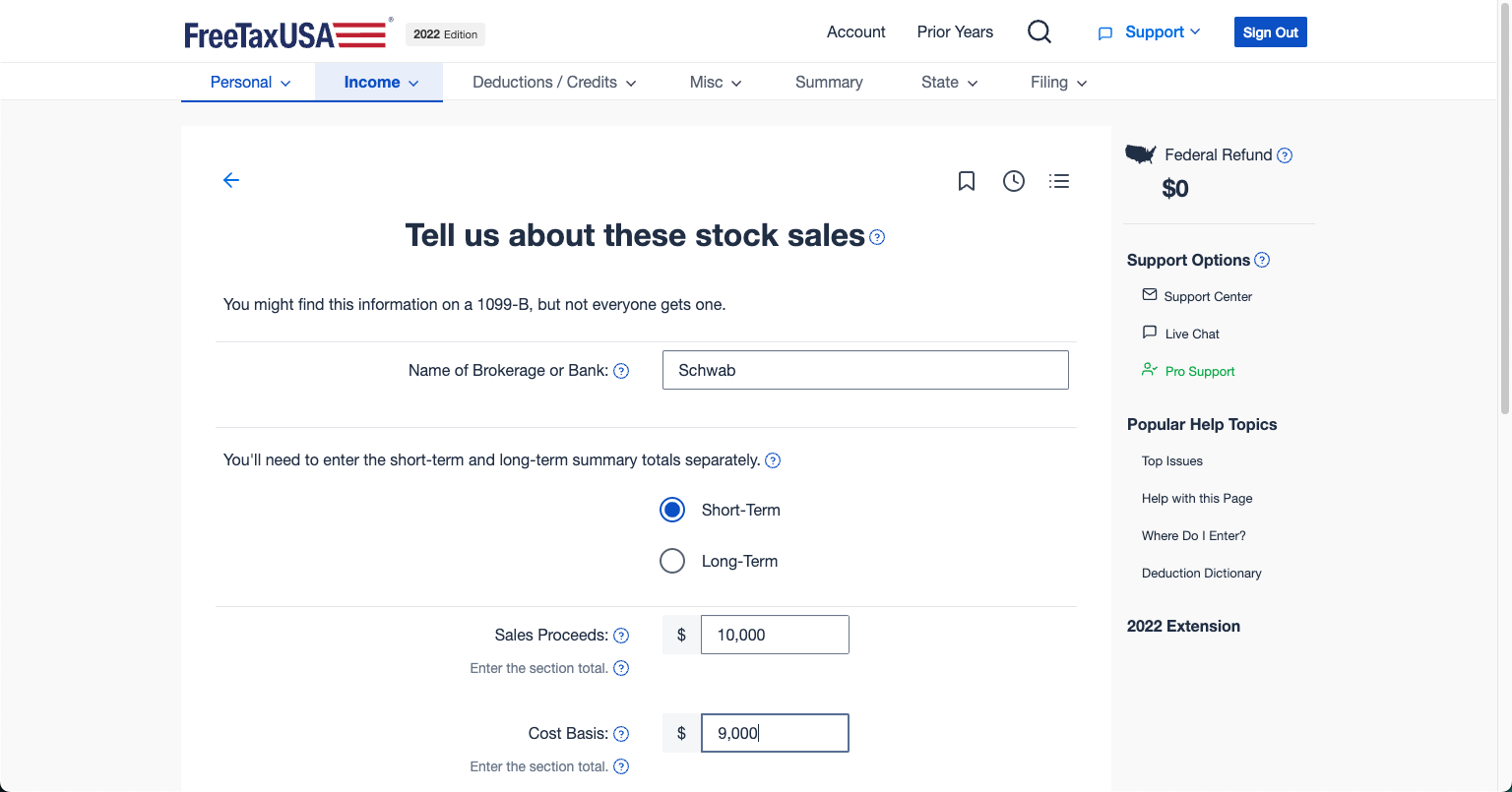

Enter the name of the 'Brokerage', 'Term', 'Proceeds', 'Cost'.

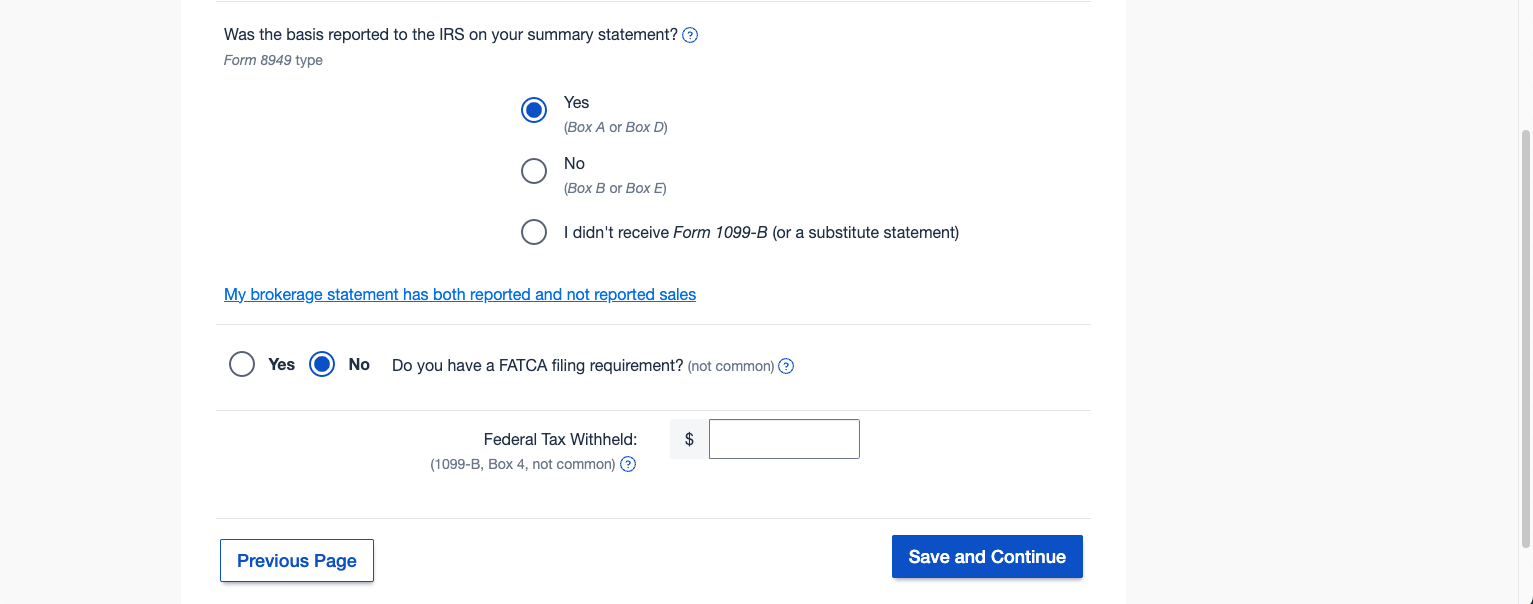

For 'Was the basis reported to the IRS', select the applicable value of: 'Yes', 'No', or 'I didn't receive Form 1099-B'

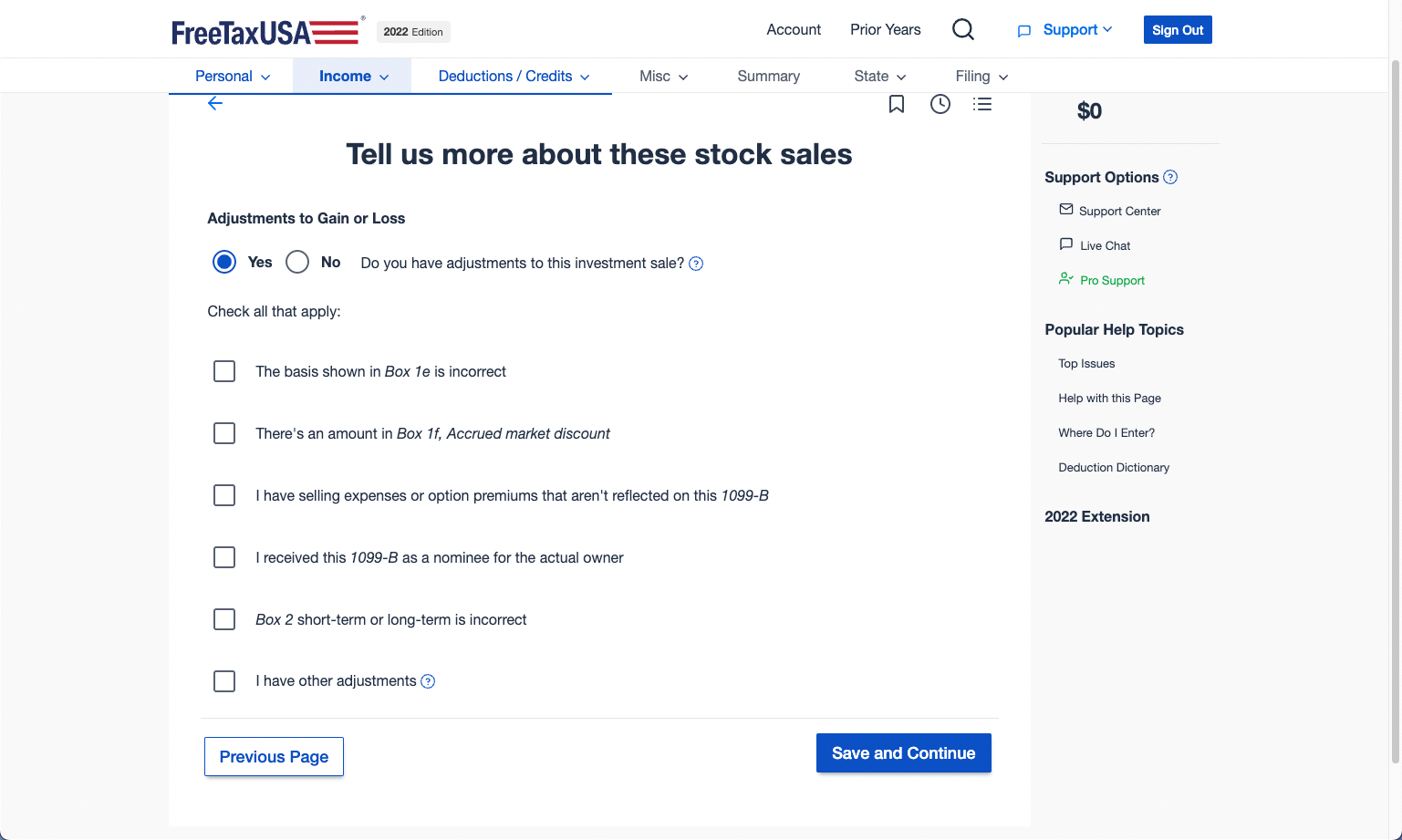

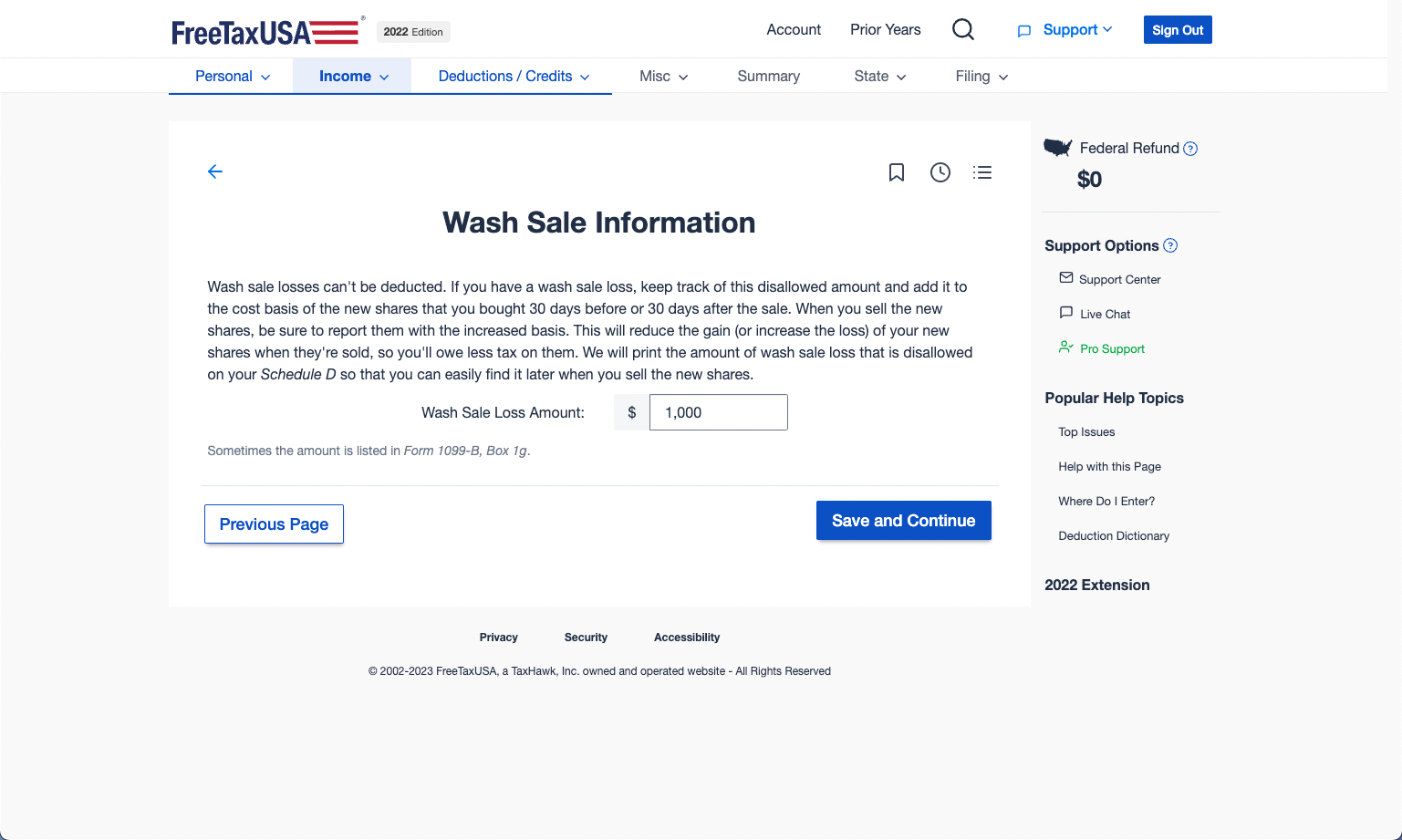

If you have wash sale adjustments, check the 'Yes' box.

But wash sale adjustments are entered on a subsequent screen

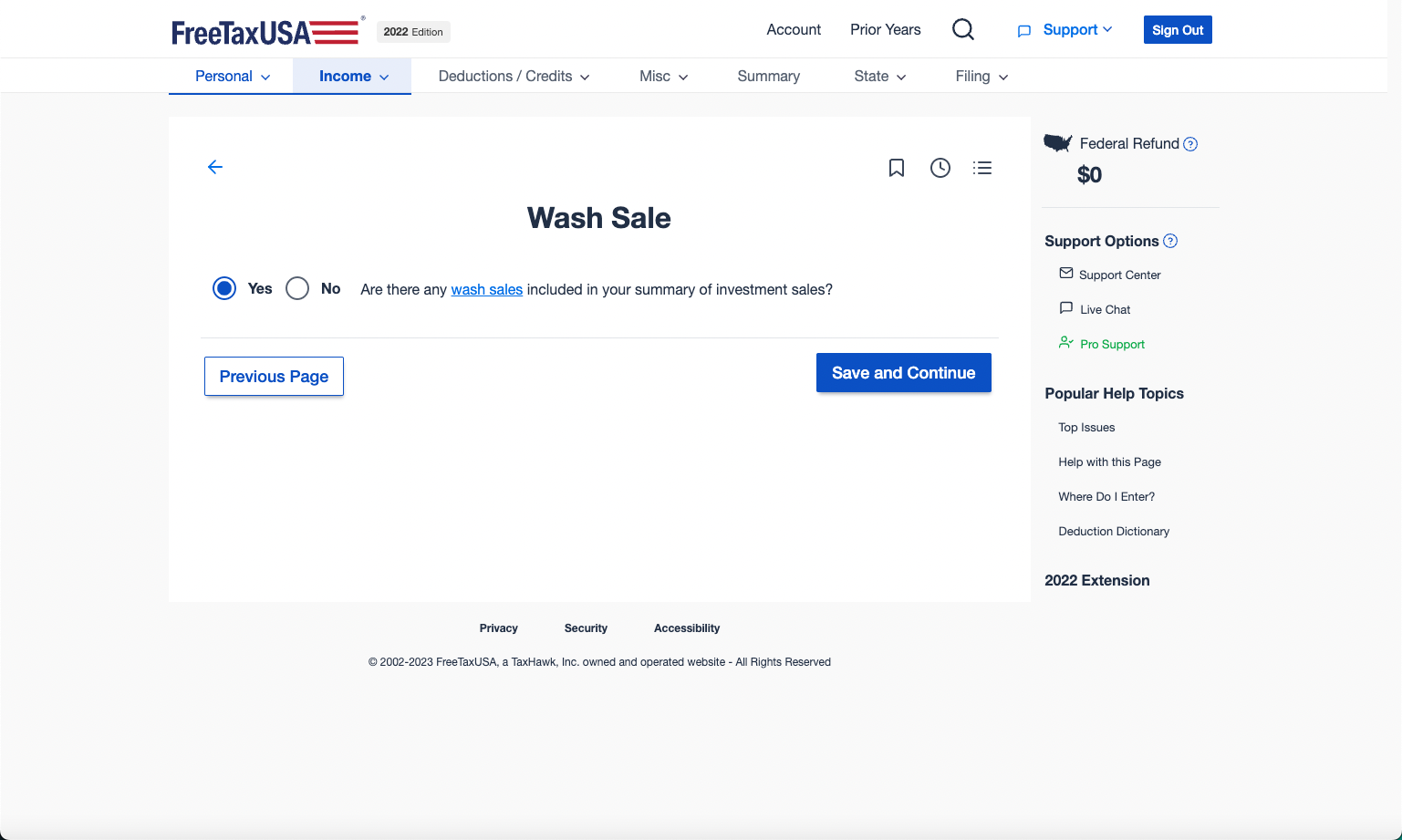

If you have wash sale adjustments, check the 'Yes' box.

If you have wash sale adjustments, enter the total amount.

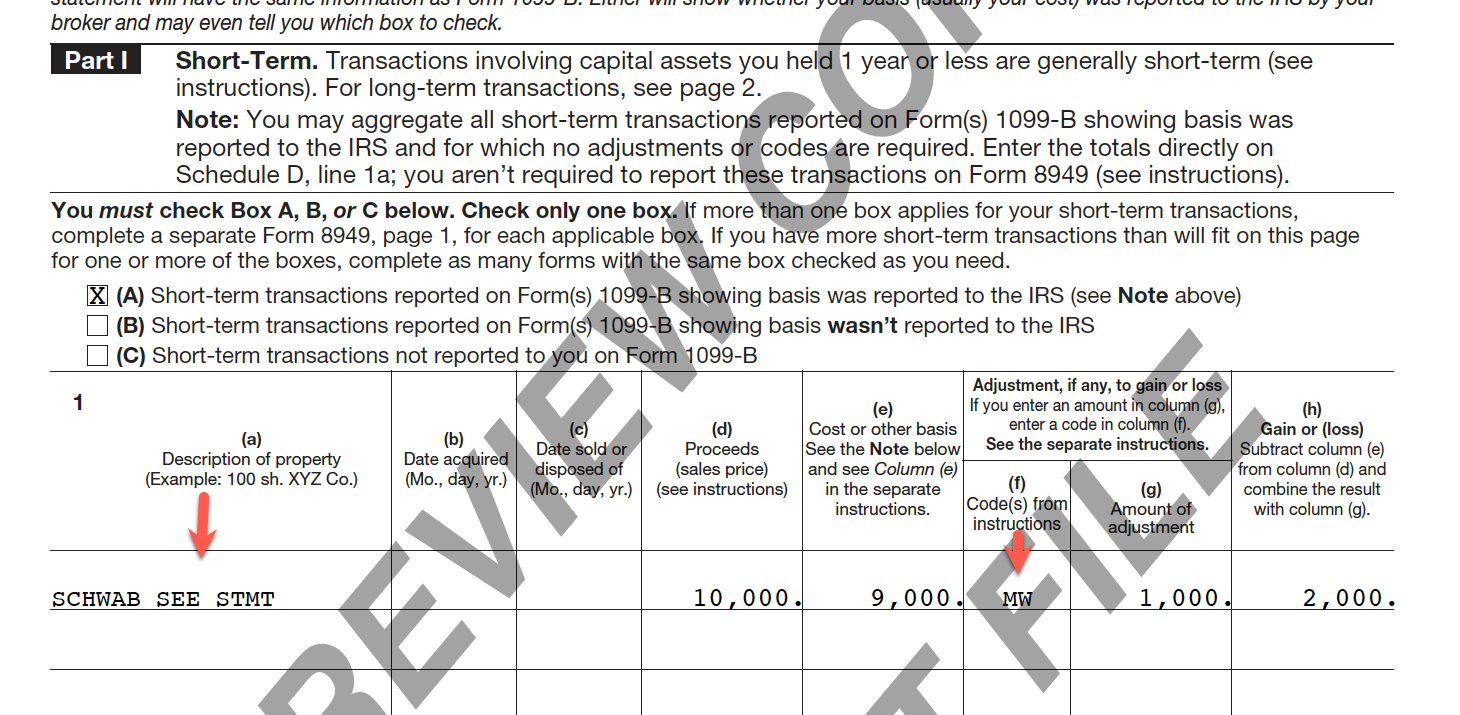

The Form 8949 generated by FreeTaxUSA will reference the statement.

3. Attach the PDF file to your FreeTaxUSA tax return

During the e-file step, the program will give you the opportunity to upload your PDF file.