Our Goal

At Form8949.com, our aim is to help you minimize the time and expense of complying with the tax reporting requirements related to your stock trading activity.

Try Then Buy

The Form8949.com app helps you self-prepare your 2020 or prior year Form 8949 and Schedule D.

You don't pay until after you review and approve our web application results.

Do you use TaxAct?

If you use one of over 30 brokers that do not participate in the TaxAct electronic import program, we can help.

- Use our app to retrieve and process your broker data.

- Then directly import your data into TaxAct from Form8949.com

See TaxAct Import Steps for TaxAct Import details.

If you have more than 2,000 transactions, use our site to generate Form 8949 Statements for attachment to your tax return.

Broker File Support

Our app supports processing of 5 types of data files from over 90 brokers.

See our broker support page for the matrix of broker and file support.

Tax Year 2020 App

The Tax Year 2020 app includes the following features:

- Processing of broker Forms 1099-B PDF files.

- 2019 and prior year Forms 8949 can be generated in the 2020 app. There is no need to go to a separate app.

- Support for all 4 Schedule D and Form 8949 reporting options:

- Traditional

- Exception 1

- Exception 2

- Exceptions 1 and 2 Combined

- Convenient email to forward to your Tax Pro with information and links to your forms generated by the app.

- "Summary" tax software data import if you have more transactions than can be imported by your tax software.

Email us with requests for additional program features and improvements.

Do you use a Tax Professional?

Save your tax preparer time and save tax preparation fees

Use our app to process your broker data file and generate schedules of your capital gains and losses in PDF format.

From the app, you can be sent an email to forward to your Tax Pro with information and links to your forms generated by the app.

Professional Tax Software Supported

Software

ATX

CCH Axcess Tax

CCH ProSystem fx Tax

Drake

Intuit Lacerte

Intuit ProConnect Tax Online

Intuit ProSeries

Tax Act Professional Edition

TaxWise

UltraTax CS

CSV Import

XLS Import

PDF Attach

Direct Import

Schedule D and Form 8949 Reporting Options

You have 4 options for reporting your broker transactions. All 4 are acceptable to the IRS. And all 4 are supported by our program. Option 1 is the most straight-forward. Options 2 - 4 can save you paper. You may use the option that works best for you.

1

Report all transactions on IRS Form 8949

2

Use Exception 1 . Aggregate qualifying transactions* and report them directly on either line 1a (for short-term transactions) or line 8a (for long-term transactions) of Schedule D. Report only nonqualifying transactions on Form 8949.

3

Use Exception 2 . Instead of reporting all transactions on Form 8949, report all transactions on an attached statement containing "all the same information as Form 8949 Parts I and II and in a similar format". The statements generated by our app satisfy this requirement and hold 49 transactions per page. While some suggest that you simply attach a copy of your consolidated brokerage statement (1099-B), it is our position that most broker statements do not satisfy the "same information and in a similar format" requirement.

4

Use Both Exceptions 1 and 2. This option minimizes the number of pages needed to report your broker transactions.

* For purposes of Exception 1, qualifying transactions are transactions for which all of the following statements are true :

- You received a Form 1099-B (or substitute statement)

- The 1099-B shows that basis WAS reported to the IRS

- Does NOT show an adjustment in box 1f for accrued market discount

- Does NOT show an adjustment in box 1g for wash sale loss disallowed

- The Ordinary box in box 2 is NOT checked

- Is NOT a sale of collectibles

- You are NOT electing to defer income due to an investment in a Qualified Opportunity Fund (QOF) and are NOT terminating deferral from an investment in a QOF

Do you prepare your income tax return by hand?

For many taxpayers with simple returns, money can be saved by preparing Form 1040, Schedule A, and Schedule B by hand.

However, if you have more than a few brokerage transactions, it doesn't make sense to prepare Schedules D and Form 8949 by hand.

For just $12, we can generate these schedules for you

and save you the time and tedium of transcribing broker transaction data.

Do you use TurboTax for Windows or TurboTax for Mac?

The Windows and Mac editions of TurboTax have some advantages over the online edition.

Unlike the online edition:

- You can use the deluxe edition and don't have to upgrade to premier edition just because you have stock trades.

- You can directly view and edit the forms, schedules, and worksheets that are used in your tax return.

Do you use TurboTax for Windows and have more than 1,000 transactions? See this article for more information.

Do you use TurboTax for Mac and have more than 1,000 transactions? See this article for more information.

Do you use TurboTax Online Edition?

Do you use TurboTax Online and have more transactions than can be imported into the program?

See this article for more information.

Form 8949 Statements

IRS Form 8949 only has room for 14 transactions per page. If you have many hundreds of transactions, this will result in a lot of pages.

Our programs will generate both the official IRS Form 8949 and "Form 8949 Statements". These statements are acceptable to the IRS and hold 49 transactions per page, reducing the number of pages generated.

There is no extra change for this conversion service and you can use whichever edition you prefer for your tax filing.

You may download a sample IRS Form 8949 and a sample Form 8949 Statements to compare the two.

Excel Spreadsheet Conversion

We can convert your Excel spreadsheet (.xls) of realized gain and loss information to IRS Schedule D and Form 8949.

See the spreadsheet requirements page for more information including templates.

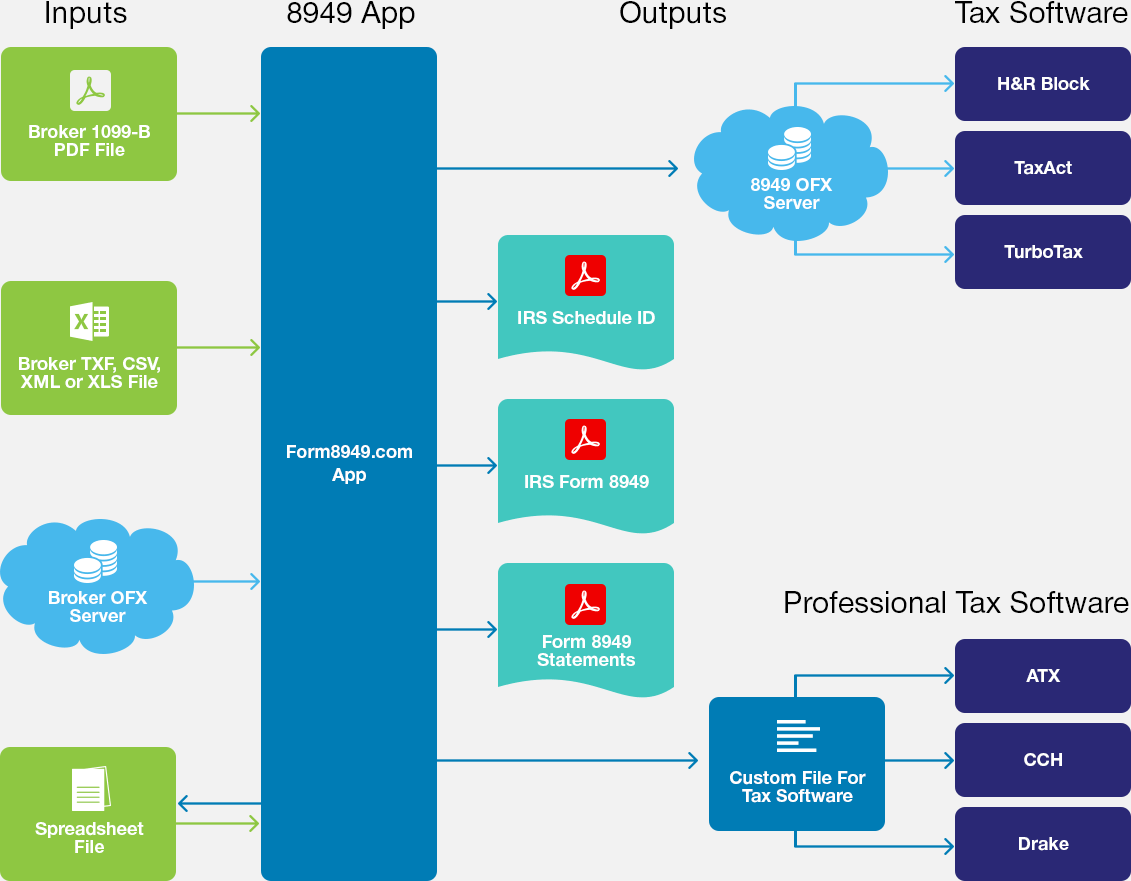

App Overview

Inputs

1. Our app retrieves data from openly-accessible broker OFX servers.

2. It also processes broker 1099-B data files in XML, JSON, TXF, or CSV files that you download from the broker web site.

3. If the above file types are not available, we can process broker 1099-B PDF files that you download from the broker web site.

4. We also process excel spreadsheet files that you create.

Outputs

5. The app generates IRS Form 1040 Schedule D and

6. Forms 8949 in PDF format for attachment to your tax return.

7. We also generate files you can deliver to your tax preparer for use in professional tax preparation software.

Tax Software Interfaces

8. Your data can also be imported directly into H&R Block, TurboTax, and TaxAct.

For tax year 2020, we will be supporting both the Open Financial Exchange (OFX) and Financial Data Exchange (FDX) standard interfaces. These servers are operated by our sibling website, Tax Doc Hub. See www.taxdochub.com to learn more.